What is an ABN?: Do I Need An Abn For A Hobby Business

Do i need an abn for a hobby business – An Australian Business Number (ABN) is a unique 11-digit identifier assigned to businesses and individuals in Australia for the purposes of tax and other government interactions.

Determining the need for an ABN for a hobby business requires an assessment of income and business activities. Just as relationships can face challenges after an affair ( can relationships work after an affair ), understanding ABN requirements for hobby businesses can prevent future complications.

It serves as a way to identify and track businesses for tax purposes, streamline interactions with government agencies, and reduce the risk of fraud.

If you’re wondering if you need an ABN for your hobby business, you’re not alone. Many people are unsure of the rules surrounding ABNs and hobby businesses. However, before you can determine if you need an ABN, you should first consider whether you need to create an LLC.

If you’re planning on starting a business, you may want to consider creating an LLC to protect yourself from personal liability. To learn more about LLCs, click here. Once you’ve determined whether or not you need an LLC, you can then determine if you need an ABN.

All businesses in Australia, regardless of their size or structure, are required to have an ABN if they are registered for GST or have an annual turnover of $75,000 or more.

Determining the necessity of an ABN for a hobby business requires an understanding of business structures. Similarly, selecting an appropriate structure for an equine business in West Virginia necessitates consideration of factors outlined in choosing an equine business structure in wv.

These factors include liability protection, tax implications, and business size. Evaluating these elements will assist in determining whether an ABN is required for the hobby business.

Do I need an ABN for a hobby business?

Whether or not you need an ABN for a hobby business depends on several factors:

- Are you registered for GST?

- Do you have an annual turnover of $75,000 or more?

- Do you intend to make a profit from your hobby business?

- Do you have employees?

If you answer yes to any of these questions, you are likely required to have an ABN.

If you’re thinking about starting a hobby business, you may be wondering if you need an ABN. The answer is yes, if you’re planning to make a profit. However, if you’re not sure whether your business will be profitable, you can apply for an ABN later.

In the meantime, you can learn more about ABNs and how they can benefit your business.

There are several benefits to having an ABN for a hobby business, including:

- It can help you to track your income and expenses more easily.

- It can make it easier to open a business bank account.

- It can help you to build a business credit history.

- It can reduce your risk of being audited by the ATO.

There are also some consequences to not having an ABN if you are required to have one, including:

- You may have to pay penalties.

- You may not be able to claim certain tax deductions.

- You may be at a disadvantage when competing with businesses that have an ABN.

How to apply for an ABN

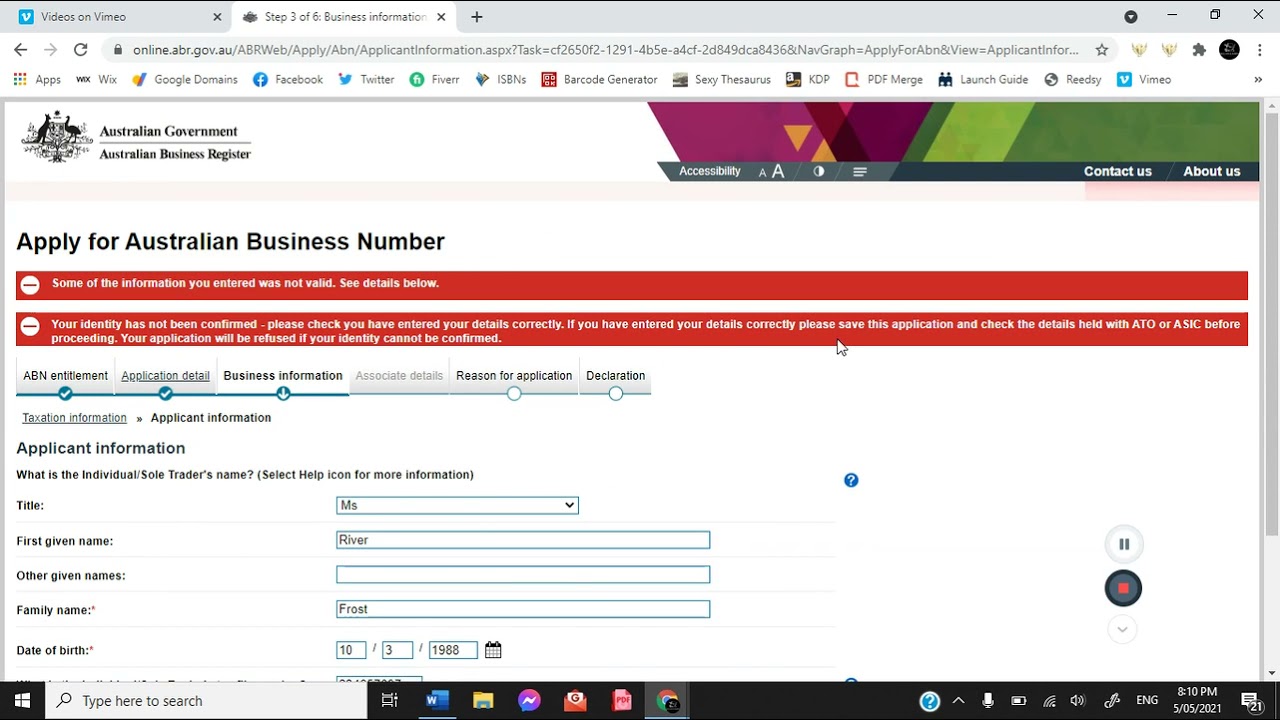

You can apply for an ABN online through the Australian Business Register (ABR) website.

If you’re wondering whether you need an ABN for a hobby business, you’re not alone. Many people start out with a hobby that they eventually turn into a business. However, there are some key differences between a hobby and a business, and one of the most important is whether or not you need an ABN.

Can you take an emotional support animal to work ? The answer may depend on your specific situation and the policies of your employer. However, in general, you should be able to bring your emotional support animal to work if it is properly trained and does not pose a threat to others.

If you’re not sure whether or not you need an ABN for your hobby business, it’s always best to consult with an accountant or lawyer.

To apply, you will need to provide some basic information about your business, including:

- Your business name

- Your business address

- Your contact details

- Your tax file number (TFN)

Once you have submitted your application, it will be processed by the ABR and you will be issued with an ABN.

An ABN (Australian Business Number) is not required for a hobby business that does not earn an income. However, if the hobby business starts to generate income, then an ABN will be required. If you are unsure whether or not your hobby business requires an ABN, you can check with the Australian Taxation Office (ATO).

Can an iPhone 6 work without a SIM card ? The answer is yes, but there are some limitations. Without a SIM card, you will not be able to make phone calls or send text messages. However, you will still be able to use the iPhone’s other features, such as Wi-Fi, Bluetooth, and GPS.

Additionally, you can still use the iPhone to make calls and send text messages over Wi-Fi using apps like WhatsApp or Skype.

Here are some tips for completing the ABN application form:

- Make sure that you have all of the required information before you start.

- Answer all of the questions on the form carefully and completely.

- If you are not sure about something, contact the ABR for help.

Using American English

It is important to use American English when completing ABN-related forms and correspondence.

While determining the need for an ABN for a hobby business, individuals may also explore opportunities to work remotely for Australian companies. For those based overseas, working for an Australian company from overseas can provide flexibility and access to a global job market.

Returning to the topic of ABNs, it’s crucial to assess whether the hobby business generates income or has the potential to do so, as this may trigger the requirement for an ABN.

The ATO uses American English in all of its official communications, and using the correct language will help to ensure that your application is processed smoothly.

There are a number of resources available to help you convert Australian English to American English, including:

- The Australian Government Style Manual

- The Macquarie Dictionary

- The Oxford English Dictionary

Using incorrect English can lead to delays in the processing of your ABN application or other correspondence with the ATO.

Wrap-Up

Ultimately, whether or not you need an ABN for your hobby business depends on a number of factors, including the nature of your business, your income, and your plans for the future. If you’re unsure whether or not you need an ABN, it’s always best to err on the side of caution and apply for one.

That way, you can avoid any potential penalties or complications down the road.

Q&A

What is the difference between an ABN and an ACN?

An ABN is an Australian Business Number, while an ACN is an Australian Company Number. An ABN is used to identify a business for tax purposes, while an ACN is used to identify a company. All companies must have an ACN, but not all businesses need an ABN.

Do I need to charge GST if I have an ABN?

Yes, if you have an ABN and your business has a turnover of $75,000 or more, you are required to charge GST on your sales.

How do I apply for an ABN?

You can apply for an ABN online through the Australian Business Register website.

Whether you need an ABN for a hobby business depends on a few factors, including the frequency of your sales and your income. If you’re not sure whether you need an ABN, it’s best to consult with an accountant. In other news, do airpods work on an iphone 6 ?

The answer is yes, but there are some caveats. AirPods will work with any iPhone that has Bluetooth 4.0 or later, which includes the iPhone 6 and later models. However, some features, such as hands-free Siri access, may not be available on older iPhone models.