Apply for an australian business number – Get ready to unlock a world of business opportunities in Australia! Applying for an Australian Business Number (ABN) is your ticket to legitimacy, tax compliance, and a whole lot of benefits. Join us as we delve into the ins and outs of obtaining an ABN, from eligibility to application and everything in between.

Applying for an Australian Business Number (ABN) is a crucial step for businesses in Australia. It’s an essential identifier that enables you to interact with the government, banks, and other organizations. To learn more about the ethical implications of business decisions, consider reading an introduction to business ethics 4th edition . This comprehensive guide provides insights into the importance of ethical conduct in business and can help you make informed decisions as you navigate the complexities of running a business.

Understanding the ethical dimensions of business practices is equally important as obtaining an ABN, ensuring that your business operates with integrity and aligns with societal values.

Whether you’re a small business owner, a freelancer, or a multinational corporation, understanding the ABN is crucial. It’s the key to accessing essential services, managing your tax obligations, and building trust with customers.

Applying for an Australian Business Number (ABN) is a crucial step for any business operating in Australia. An ABN is a unique 11-digit number that identifies your business to the Australian Taxation Office (ATO). It’s like your business’s Social Security Number in the US.

Just as an international business is a firm that operates in multiple countries, an ABN is essential for businesses that conduct any type of activity in Australia.

Understanding the Australian Business Number (ABN)

An Australian Business Number (ABN) is a unique 11-digit number assigned to businesses and individuals operating in Australia. It’s like a social security number for your business, and it’s essential for conducting business activities.

To run a business in Australia, you’ll need to apply for an Australian Business Number (ABN). The ABN is a unique 11-digit number that identifies your business to the Australian government and other businesses. It’s important to understand the basics of business ethics before you apply for an ABN.

An overview of business ethics can help you make ethical decisions that will benefit your business in the long run. Once you have a clear understanding of business ethics, you can apply for an ABN online or through the mail.

Having an ABN provides several benefits, including the ability to register for the Goods and Services Tax (GST), claim business expenses, and open a business bank account. Businesses that are required to have an ABN include sole traders, partnerships, companies, and trusts.

Eligibility Requirements for an ABN: Apply For An Australian Business Number

To be eligible for an ABN, you must meet certain criteria, such as:

- Being a resident of Australia

- Carrying on a business in Australia

- Having an Australian bank account

You will also need to provide supporting documentation, such as:

- Australian Business Register (ABR) extract

- Tax file number (TFN)

- Proof of identity

Application Process for an ABN

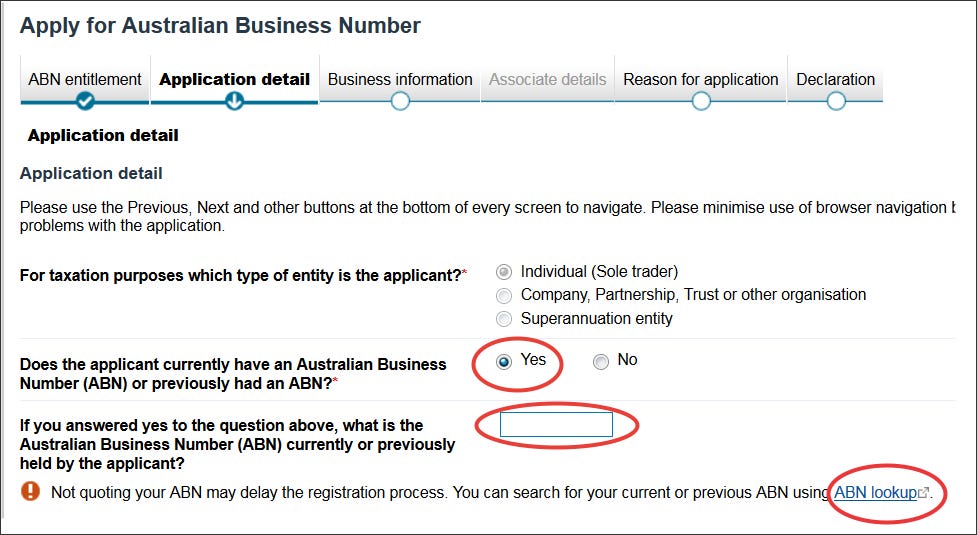

Applying for an ABN is a straightforward process that can be completed online through the Australian Business Register website. You will need to provide basic information about your business, such as its name, address, and industry.

Once you have submitted your application, it will be processed within a few days. You will receive a confirmation letter with your ABN and instructions on how to use it.

Applying for an Australian Business Number (ABN) is a must if you want to start a business down under. It’s like your company’s unique ID that you’ll need for everything from registering for taxes to opening a business account. If you’re serious about establishing an RTX business in Australia, getting an ABN is a crucial step.

It’ll help you stay compliant and avoid any unnecessary hassles when it comes to running your business.

ABN Structure and Verification

An ABN consists of 11 digits, which are arranged in the following format:

XX XXX XXX XXX

If you’re looking to apply for an Australian Business Number (ABN), it’s important to be aware of the potential implications of an increase in business taxes. As discussed in an increase in business taxes causes , higher taxes can lead to reduced profitability, increased operating costs, and a decrease in investment.

These factors can all impact the financial viability of your business, so it’s crucial to consider them when making decisions about your ABN application.

The first two digits represent the state or territory in which the business is registered. The next eight digits are randomly generated. The last digit is a check digit, which is used to verify the validity of the ABN.

Applying for an Australian Business Number (ABN) is a crucial step in establishing a business in Australia. It serves as a unique identifier for your business and is required for various legal and tax obligations. To gain a deeper understanding of the legal framework governing business organizations, I recommend checking out an introduction to the law of business organizations . This resource provides valuable insights into the different types of business structures and their legal implications.

Once you have a solid understanding of the legal landscape, you can proceed with the ABN application process confidently.

You can verify the validity of an ABN using the ABN Lookup tool on the Australian Business Register website.

Applying for an Australian Business Number (ABN) is a crucial step for businesses operating in Australia. Once you have your ABN, you can access various government services and benefits. To learn more about how business intelligence analytics and decision support can enhance your business operations, check out this overview . With an ABN, you can take advantage of these insights to make informed decisions that drive business growth and success.

ABN Obligations and Responsibilities

Holding an ABN comes with certain obligations and responsibilities, such as:

- Quoting your ABN on all business documents

- Filing an annual activity statement

- Keeping accurate business records

Failure to meet these obligations can result in penalties.

ABN Cancellation and Revocation

An ABN can be cancelled or revoked under certain circumstances, such as:

- If the business is no longer operating

- If the business has provided false or misleading information

- If the business has failed to meet its ABN obligations

You can cancel or revoke your ABN online through the Australian Business Register website.

Final Thoughts

With an ABN in your pocket, you’re not just a business – you’re a certified player in the Australian economy. Remember, it’s not just about the number; it’s about the responsibilities and obligations that come with it. Stay compliant, use your ABN wisely, and watch your business soar to new heights.

Popular Questions

Who needs an ABN?

Any business that carries out enterprise in Australia, including sole traders, companies, and non-profit organizations.

What documents do I need to apply for an ABN?

You’ll need proof of identity, such as a passport or driver’s license, and proof of your business, such as a business registration certificate or tax invoice.

If you’re starting a business in Australia, one of the first things you’ll need to do is apply for an Australian Business Number (ABN). An ABN is a unique 11-digit number that identifies your business to the Australian government. It’s used for tax, GST, and other business-related purposes.

You can apply for an ABN online through the Australian Business Register website. Once you have an ABN, you can start trading as a business in Australia. If you want to learn more about business ethics, I recommend reading An Introduction to Business Ethics by Joseph Desjardins.

It’s a great resource for understanding the ethical challenges that businesses face and how to make ethical decisions.

How long does it take to get an ABN?

If you apply online, you’ll usually get your ABN within a few minutes. By mail, it can take up to 28 days.