Define an Australian Business Number (ABN)

How do i get an australian business number – An Australian Business Number (ABN) is a unique 11-digit identifier assigned to businesses and individuals in Australia. It serves as a means of identifying businesses for taxation and other official purposes. An ABN is essential for businesses that engage in commercial activities, including:

- Registering for Goods and Services Tax (GST)

- Claiming business expenses

- Applying for government grants and assistance

- Opening a business bank account

The ABN consists of two parts: the Entity Identifier (EI) and the Reference Number (RN). The EI identifies the type of entity, such as a company, partnership, or individual, while the RN is a unique number assigned to each business.

Getting an Australian Business Number (ABN) is essential for businesses operating in Australia. It serves as a unique identifier for tax and other regulatory purposes. If you’re wondering about the effectiveness of Epsom salts in an ice bath, research suggests they may aid in muscle recovery and reduce inflammation.

Returning to the topic of obtaining an ABN, the process involves registering with the Australian Business Register (ABR) and meeting specific eligibility criteria.

Eligibility for an ABN: How Do I Get An Australian Business Number

To be eligible for an ABN, you must meet the following criteria:

- Carry out business in Australia

- Have an Australian address

- Be either an Australian resident or a foreign resident with an Australian presence

The following individuals and entities are eligible for an ABN:

- Individuals

- Companies

- Partnerships

- Trusts

- Non-profit organizations

- Government entities

Steps to Apply for an ABN

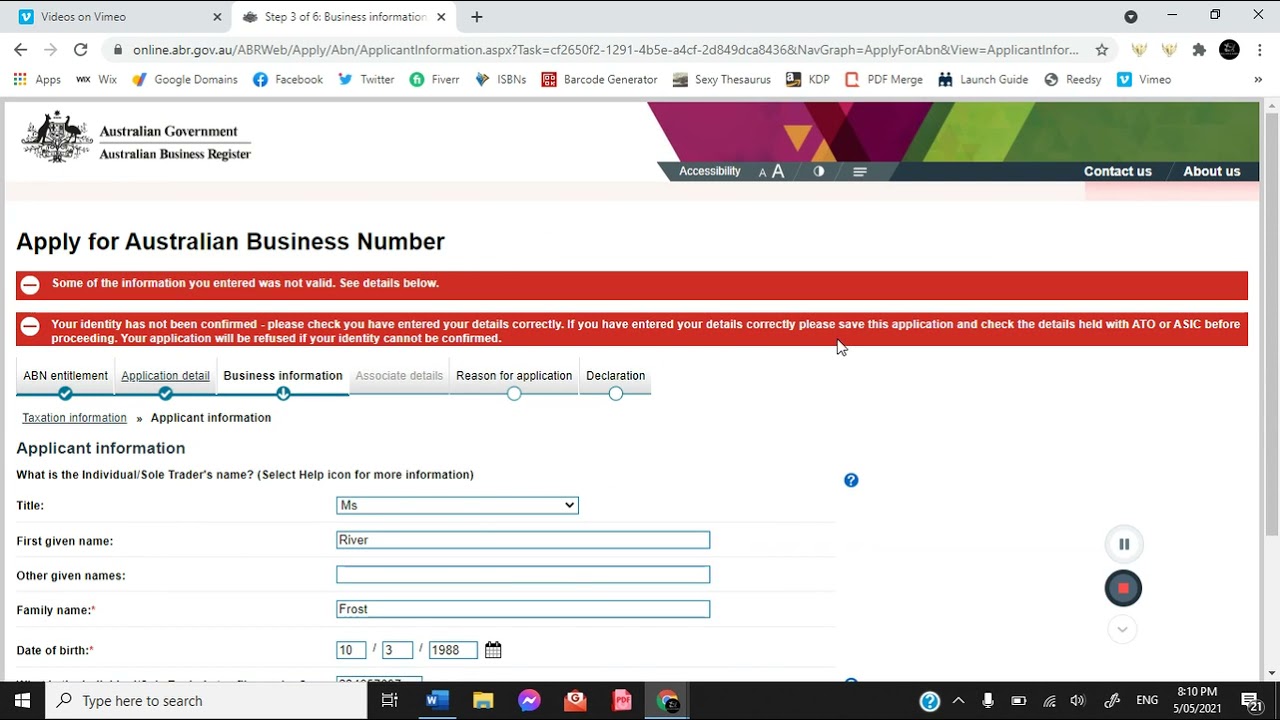

To apply for an ABN, you can follow these steps:

- Visit the Australian Business Register (ABR) website

- Click on the “Apply for an ABN” button

- Select the type of entity you are applying for

- Provide your personal or business details

- Submit your application

You will need to provide supporting documentation, such as:

- Proof of identity

- Proof of address

- Business registration documents (if applicable)

Benefits of Having an ABN

There are many benefits to having an ABN, including:

- Improved business credibility

- Simplified tax reporting

- Access to government grants and assistance

- Easier to open a business bank account

- Ability to claim business expenses

An ABN is an essential tool for businesses operating in Australia. It provides a range of benefits and makes it easier to conduct business.

To obtain an Australian Business Number (ABN), you must first determine if you are eligible. Sole proprietors are not required to have an ABN, but it is recommended for businesses that have employees or are registered for GST. If you are changing your business from a sole proprietorship to an LLC, you will need to apply for an ABN as part of the process.

Changing a business from sole proprietor to an LLC involves several steps, including registering your business with the Australian Securities and Investments Commission (ASIC) and obtaining an ABN.

ABN Registration and Maintenance

Once you have applied for an ABN, it will be processed by the ABR. You will be notified by mail when your ABN has been issued.

Obtaining an Australian Business Number (ABN) is a crucial step for businesses operating in Australia. The process involves registering with the Australian Taxation Office (ATO) and meeting specific eligibility criteria. Once an ABN is obtained, it allows businesses to engage in various activities, such as opening bank accounts, registering for taxes, and applying for government grants.

It also facilitates interactions with customers, suppliers, and other stakeholders. However, for a deeper understanding of the artistic realm, consider exploring the fascinating world of abstract expressionist artists, whose bold and expressive works describe the life and work of an abstract expressionist artist.

Their innovative techniques and unconventional styles have left an indelible mark on the art world. Returning to the topic of obtaining an ABN, businesses should consult the ATO’s website or seek professional advice to ensure a smooth and efficient application process.

It is important to keep your ABN information up to date. You can do this by logging into the ABR website and updating your details.

To obtain an Australian Business Number (ABN), businesses can apply through the Australian Taxation Office (ATO). The ABN is crucial for various business operations, including registering for taxes and opening business accounts. Ideas for improving work processes can enhance efficiency and streamline operations.

For example, implementing a centralized communication platform or automating certain tasks can save time and improve collaboration. These improvements can contribute to a more efficient and productive work environment while facilitating compliance with the ATO’s ABN requirements.

If you cease trading, you must cancel your ABN. You can do this by contacting the ABR.

Securing an Australian Business Number (ABN) is a crucial step for businesses operating in Australia. By registering for an ABN, you gain access to various business services and fulfill legal obligations. To learn more about how an electric generator works, click here.

Once you have acquired an ABN, you can proceed with other essential business processes, such as opening a business bank account and registering for goods and services tax (GST).

Use American English

When applying for an ABN, it is important to use American English. This is because the ABN system is based on the American English language.

Using American English will ensure that your application is processed correctly and that you receive the correct ABN.

Final Conclusion

Obtaining an ABN is an essential step for any business operating in Australia. By following the steps Artikeld in this guide, you can ensure a smooth and successful application process. Remember, an ABN is more than just a number; it’s a vital tool that will support your business growth and empower you to navigate the Australian business landscape with confidence.

To obtain an Australian Business Number (ABN), businesses must register with the Australian Taxation Office (ATO). This unique identifier is crucial for conducting business in Australia. If you’re considering establishing an online business, you may also need an Employer Identification Number (EIN).

For more information on EINs, refer to this guide. Returning to the topic of obtaining an ABN, the ATO provides comprehensive guidelines and resources to assist businesses through the registration process.

FAQ Insights

What is the purpose of an ABN?

An ABN is a unique identifier for your business, used for various transactions and interactions with government agencies, including GST registration and business banking.

Who is eligible for an ABN?

Individuals, companies, partnerships, trusts, and other entities carrying on a business in Australia are generally eligible for an ABN.

How do I apply for an ABN?

You can apply for an ABN online through the Australian Business Register website or by completing a paper application form.

What are the benefits of having an ABN?

An ABN provides a range of benefits, including the ability to register for GST, open business bank accounts, and enhance your business’s credibility.

To obtain an Australian Business Number (ABN), businesses must meet specific eligibility criteria and follow the application process. The ABN serves as a unique identifier for tax and business purposes. While an MBA can provide valuable knowledge and skills for running a business, it’s not a requirement.

Many successful entrepreneurs have built thriving enterprises without an MBA. However, if you’re considering an MBA, explore this article for insights into whether it aligns with your goals. Nevertheless, obtaining an ABN remains crucial for businesses operating in Australia.

Complimenting others for good work is an example of positive reinforcement, a technique used to encourage desired behaviors. Similarly, obtaining an Australian Business Number (ABN) is a crucial step for businesses operating in Australia. The ABN is a unique identifier that simplifies tax and business dealings.

If you’re unsure how to get an ABN, refer to the Australian Business Register website for guidance.