Understanding Invoice Basics

How do i make an invoice for a small business – An invoice is a document that itemizes the products or services provided by a business to a customer, along with the amounts owed for each item and the total amount due. It serves as a record of the transaction and provides the customer with detailed information about the purchase.

When creating an invoice for a small business, it’s important to address potential issues that may arise. For example, understanding the scope of the project and defining clear payment terms can help avoid misunderstandings and ensure smooth transactions. By addressing such business problems, small businesses can streamline their invoicing process and maintain positive relationships with their clients.

Essential elements of an invoice include:

- Invoice number

- Invoice date

- Business name and contact information

- Customer name and contact information

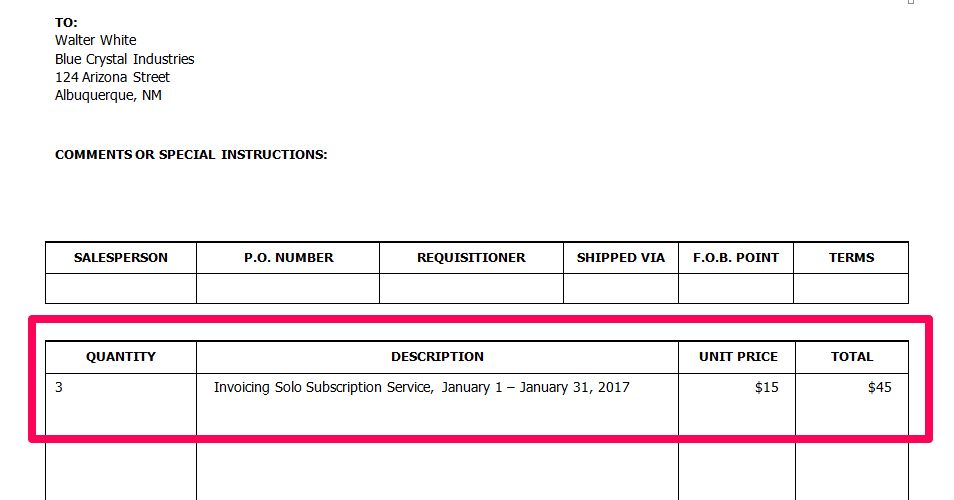

- Description of products or services provided

- Quantity and unit price of each item

- Subtotal

- Taxes (if applicable)

- Total amount due

Invoice Design and Format

A standard invoice template typically includes the following sections:

- Header: Contains the business name, contact information, and invoice number.

- Customer information: Includes the customer’s name, address, and contact details.

- Invoice details: Lists the products or services provided, along with the quantity, unit price, and total amount for each item.

- Subtotal: The total amount before taxes.

- Taxes: The amount of taxes applicable to the invoice.

- Total amount due: The final amount the customer owes.

For visually appealing invoices, consider using a clean and professional design, clear fonts, and ample white space. Highlight important information, such as the total amount due, using bold or contrasting colors.

For small business owners looking to create invoices, it’s crucial to have a professional email address. A dedicated business email address, like the ones you can create following the tips in this guide , adds credibility to your business and helps you appear more established.

This is especially important when sending invoices, as a professional email address can instill confidence in your clients and make them more likely to pay promptly.

Invoice Content

Essential invoice information includes:

- Accurate description of products or services

- Quantity and unit price for each item

- Clear itemization to avoid confusion

- Taxes, if applicable, and the tax rate

- Total amount due, including taxes

To calculate taxes, determine the applicable tax rate and multiply it by the subtotal. For example, if the subtotal is $100 and the tax rate is 10%, the tax amount would be $10.

To succeed in today’s business landscape, small businesses must prioritize both profitability and ethical conduct. By integrating ethical principles into their operations, companies can foster trust, attract customers, and drive long-term growth. Creating an ethical culture, as outlined in this article , is crucial for building a strong foundation.

Simultaneously, streamlining invoice processes is essential for efficient cash flow management and customer satisfaction. Understanding how to create an invoice effectively will ensure accurate billing and timely payments, contributing to the overall financial health of your small business.

Invoice Delivery and Payment

Invoices can be delivered via email, mail, or other methods agreed upon by the business and customer.

Crafting invoices is essential for small businesses. To streamline this process, consider using an invoicing software or template. Additionally, individuals may explore claiming Social Security benefits based on an ex-spouse’s work record. By following these steps, small business owners can create professional invoices and manage their finances efficiently.

Payment terms and conditions should be clearly stated on the invoice, including:

- Due date

- Accepted payment methods

- Late payment penalties (if applicable)

Businesses can use invoice tracking software to monitor the status of invoices and receive notifications when payments are received.

Understanding how to make an invoice for a small business is crucial for tracking expenses and ensuring timely payments. An effective business model, as outlined in developing an effective business model , plays a vital role in streamlining this process.

By implementing clear invoicing procedures, small businesses can optimize their cash flow and maintain financial stability.

Using Invoice Software

Invoice software streamlines the invoice process by automating tasks such as invoice creation, sending, and tracking.

Creating an invoice for your small business is a crucial task for tracking income and managing finances. However, if your business is more of a hobby, you may wonder if you need an Australian Business Number (ABN). For guidance on this matter, refer to this article.

Returning to the topic of invoicing, ensuring accurate and professional invoices is essential for smooth business operations.

Popular invoice software options include:

- FreshBooks

- Zoho Invoice

- Invoice Ninja

When selecting invoice software, consider features such as:

- Ease of use

- Customization options

- Integration with other business software

Invoice Best Practices: How Do I Make An Invoice For A Small Business

Effective invoice management includes:

- Sending invoices promptly after completing work

- Following up on unpaid invoices

- Maintaining accurate records

To reduce invoice errors:

- Proofread invoices carefully before sending them

- Use clear and concise language

- Ensure that all essential information is included

Legal considerations and compliance may include:

- Including all required information on invoices

- Complying with tax laws

- Retaining invoices for the required period

Specific Considerations for Small Businesses

Small businesses face unique challenges and opportunities when it comes to invoicing:

- Limited resources

- Need for flexibility

- Importance of building strong customer relationships

Adapting invoice practices for small businesses includes:

- Using simple and straightforward invoice templates

- Offering flexible payment options

- Providing excellent customer service

Using American English

Using American English for invoices ensures clarity and professionalism.

Crafting an invoice for your small business can be a daunting task, but it’s essential for ensuring timely payments and maintaining accurate records. For guidance on creating professional invoices, consider referring to “From the Egg Business Lays an Egg Answers” here , which provides practical tips and templates to help you get started.

By following these guidelines, you can create clear and effective invoices that will streamline your billing process.

Common mistakes to avoid include:

- Using British English spelling and grammar

- Using slang or informal language

- Making grammatical errors

Resources for American English usage include:

- The American Heritage Dictionary

- The Chicago Manual of Style

- Grammarly

Last Word

By following these best practices, you can create professional and accurate invoices that will help you get paid faster, streamline your financial processes, and ultimately grow your small business.

Question & Answer Hub

What are the essential elements of an invoice?

An invoice should include the following: business name and contact information, invoice number, invoice date, due date, payment terms, description of goods or services, quantity, unit price, total amount, and any applicable taxes.

How can I create a visually appealing invoice?

Use a professional invoice template, choose a clear and easy-to-read font, and keep the design simple and organized. You can also add your business logo and branding elements to make your invoices more recognizable.

What are the benefits of using invoice software?

Invoice software can save you time and effort by automating many of the tasks involved in invoicing, such as generating invoices, tracking payments, and sending reminders. It can also help you create professional-looking invoices and reduce errors.

Understanding how to make an invoice is essential for small businesses. However, managing your finances can be overwhelming, especially if you lack accounting knowledge. Consider finding an accountant for small business to assist with tasks like invoice creation, ensuring accuracy and compliance.

This can free up your time to focus on core business operations, ultimately boosting efficiency and profitability.