In the realm of business, working capital is like the oxygen that keeps your company breathing. It’s the lifeblood that fuels your day-to-day operations and ensures your financial health. Let’s dive into an example of working capital and explore its importance, types, and management strategies.

An example of working capital is the money a company has on hand to pay its bills. This is important for any business, but especially for amanda works as an hr manager in a multinational corporation , who need to be able to pay their employees on time.

Working capital can also be used to invest in new projects or to expand the business.

Working Capital Definition

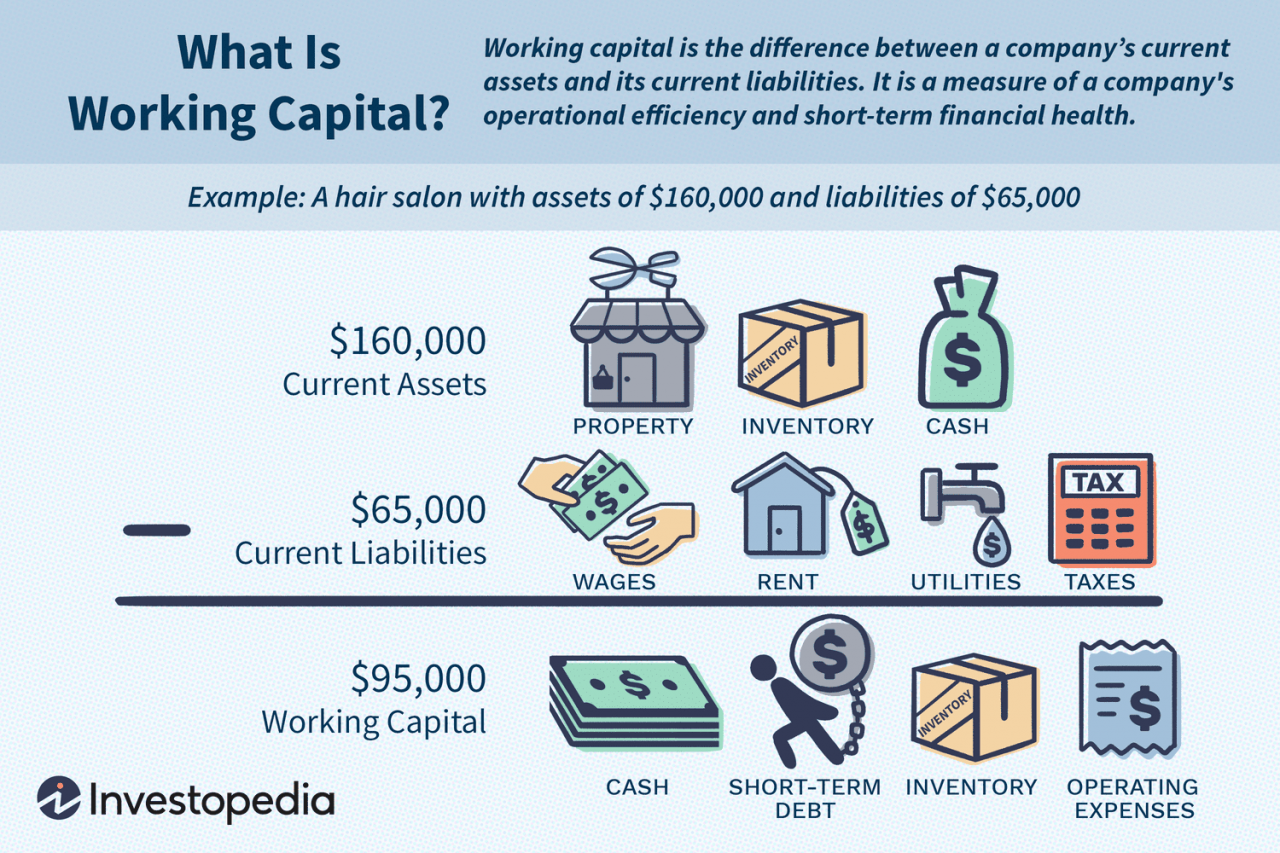

Working capital is the lifeblood of any business. It’s the difference between a company’s current assets and its current liabilities. A positive working capital means that a company has enough cash on hand to pay its bills and invest in growth.

An example of working capital is the money you have in the bank to cover your bills. When your AC stops working after an hour, you may need to use some of that working capital to pay for repairs. Click here for more info on how to fix an AC that stops working after an hour . That’s why it’s important to have a good amount of working capital on hand.

A negative working capital means that a company is struggling to meet its financial obligations.There are two main components of working capital:

-

-*Current assets

These are assets that can be easily converted into cash, such as cash, accounts receivable, and inventory.

-*Current liabilities

These are debts that are due within one year, such as accounts payable, short-term loans, and accrued expenses.

Importance of Working Capital

Working capital is essential for businesses for several reasons. First, it allows businesses to meet their financial obligations. A company with a positive working capital is less likely to default on its loans or miss payments to its suppliers. Second, working capital allows businesses to invest in growth.

A company with a positive working capital can use its excess cash to purchase new equipment, hire new employees, or expand into new markets. Third, working capital provides a cushion against unexpected events. A company with a positive working capital is better prepared to weather a downturn in the economy or a sudden increase in expenses.

One example of working capital is the amount of money a company has on hand to pay its bills. This includes cash, accounts receivable, and inventory. Working capital is important because it allows a company to meet its short-term obligations, such as paying its employees the amount of money paid to an employee for work performed . Without sufficient working capital, a company may not be able to pay its bills on time, which can lead to financial problems.

Types of Working Capital: An Example Of Working Capital

There are two main types of working capital:

-

-*Gross working capital

This is the total amount of a company’s current assets.

-*Net working capital

This is the difference between a company’s current assets and its current liabilities.

Gross working capital is a measure of a company’s overall liquidity. Net working capital is a measure of a company’s ability to meet its financial obligations.

Working Capital Management

Effective working capital management is essential for businesses. A company that can effectively manage its working capital will be more profitable and less likely to fail. There are several methods and strategies that businesses can use to optimize their working capital, including:

-

-*Managing inventory

Businesses can reduce their inventory levels to free up cash.

-*Collecting accounts receivable

Businesses can collect their accounts receivable more quickly to improve their cash flow.

-*Paying accounts payable

An example of working capital is when you have cash on hand to pay for unexpected expenses. Just like how an aneroid barometer works on the principle that changes in air pressure cause the metal box to expand or contract, resulting in the movement of the needle.

In business, working capital helps you stay afloat and respond to changes in the market.

Businesses can pay their accounts payable more slowly to conserve cash.

-*Negotiating with suppliers

Working capital, the difference between a company’s current assets and current liabilities, is a crucial indicator of its financial health. An evidence-based model of work engagement suggests that engaged employees are more productive and contribute to a positive work environment, ultimately boosting a company’s working capital.

Businesses can negotiate with their suppliers to get better payment terms.

-*Using a line of credit

Businesses can use a line of credit to borrow money to cover short-term cash flow needs.

Measuring Working Capital

There are several key metrics and ratios that businesses can use to measure their working capital, including:

-

-*Current ratio

Working capital is crucial for a business’s daily operations, like paying for raw materials. It’s like the cash in your wallet that keeps your business running smoothly. And just like having a financial advisor can help you manage your personal finances, working with an independent insurance agent offers similar advantages . They can help you find the right coverage for your business needs and ensure you have the working capital to keep your business afloat.

This is a measure of a company’s ability to meet its short-term financial obligations. The current ratio is calculated by dividing a company’s current assets by its current liabilities.

-*Quick ratio

This is a more conservative measure of a company’s ability to meet its short-term financial obligations. The quick ratio is calculated by dividing a company’s liquid assets (cash, accounts receivable, and marketable securities) by its current liabilities.

Inventory is one example of working capital. The raw materials that a company uses to make its products are also part of its working capital. Air hockey tables, for example, require a constant supply of air to keep the puck floating.

An air hockey table works by pumping air through tiny holes in the playing surface. This creates a cushion of air that allows the puck to glide smoothly across the table. Without a constant supply of air, the puck would quickly slow down and stop moving.

The company that manufactures air hockey tables must therefore maintain a sufficient inventory of air pumps to meet the demand for its products.

-*Working capital turnover ratio

This is a measure of how efficiently a company is using its working capital. The working capital turnover ratio is calculated by dividing a company’s net sales by its average working capital.

Case Studies

There are many examples of companies that have successfully managed their working capital. One example is Apple. Apple has a very efficient working capital management system. The company has a high inventory turnover ratio and a low accounts receivable turnover ratio.

This means that Apple is able to generate a lot of cash from its operations. Apple also uses a line of credit to cover its short-term cash flow needs.Another example of a company that has successfully managed its working capital is Walmart.

Walmart has a very low inventory turnover ratio. This means that Walmart is able to keep its inventory levels low. Walmart also has a very efficient accounts receivable collection system. This means that Walmart is able to collect its accounts receivable quickly.

Walmart’s efficient working capital management system has helped the company to become one of the most profitable retailers in the world.

Last Recap

Effective working capital management is a balancing act, but it’s essential for businesses of all sizes. By understanding the concept, implementing sound strategies, and monitoring key metrics, you can optimize your working capital and set your company up for long-term success.

Q&A

What’s the difference between working capital and profit?

Profit is the income your business earns after subtracting expenses, while working capital is the difference between your current assets and current liabilities.

How can I improve my working capital?

Implement strategies like reducing inventory levels, improving receivables collection, and optimizing payment terms.