A budget is an informal plan for future business activities. – Dive into the world of budgeting, the informal roadmap for your future business endeavors. In this guide, we’ll navigate the ins and outs of creating a budget that will steer your business towards financial success.

A budget is not just a spreadsheet filled with numbers; it’s a dynamic tool that empowers you to make informed decisions, track your progress, and stay on top of your financial game. Let’s get started on building a budget that will transform your business aspirations into tangible realities.

Definition of a Budget

A budget is a plan for managing your finances. It’s a way to track your income and expenses so that you can make informed decisions about how to spend your money. There are many different types of budgets, but they all share the same basic principles:

- Track your income and expenses.

- Set financial goals.

- Make a plan for how to reach your goals.

Components of a Budget

A budget is a financial plan that Artikels your income and expenses over a specific period of time. It helps you track your cash flow, make informed financial decisions, and achieve your financial goals. There are several essential components of a budget, each of which plays a crucial role in its effectiveness.

Income, A budget is an informal plan for future business activities.

Your income is the money you earn from all sources, including your job, investments, and any other sources of revenue. It’s important to accurately track your income to ensure that your budget is realistic and sustainable.

Expenses

Expenses are the costs associated with running your household or business. They can be divided into two main categories: fixed expenses and variable expenses. Fixed expenses are those that remain relatively constant from month to month, such as rent or mortgage payments, car payments, and insurance premiums.

Variable expenses are those that can fluctuate from month to month, such as groceries, entertainment, and gas.

Savings

Savings are the portion of your income that you set aside for future use. It’s important to include a savings goal in your budget to ensure that you’re making progress towards your financial objectives.

A budget is an informal plan for future business activities. For instance, a budget will help you stay on track and achieve your business goals. You can even find out can you see deleted messages on an android and uncover hidden information that can be valuable for your business.

In short, a budget is an essential tool for any business that wants to succeed.

Debt Repayment

If you have any outstanding debts, it’s important to include debt repayment in your budget. This will help you pay down your debt faster and save money on interest charges.

Emergency Fund

An emergency fund is a savings account that you can use to cover unexpected expenses, such as a medical emergency or a car repair. It’s important to have an emergency fund in place to avoid going into debt or using your savings for unexpected expenses.

A budget is an informal plan for future business activities. For example, if you’re wondering can you record a phone call on an android , it’s a good idea to budget for the cost of a recording app. This will help you stay on track and make sure that your business is successful.

Budgeting Methods

Budgeting methods are various approaches used to create a financial plan for an individual or organization. These methods differ in their complexity, flexibility, and suitability for different situations.There are several commonly used budgeting methods, each with its own advantages and disadvantages:

Traditional Budgeting

Traditional budgeting involves creating a detailed plan for a specific period, typically a year. This method requires careful estimation of income and expenses, and it allocates funds to different categories based on the organization’s goals and priorities. Traditional budgeting is often used by large organizations with complex financial operations.Advantages:

- Provides a comprehensive and structured approach to financial planning.

- Helps organizations track and control their expenses.

- Facilitates long-term planning and decision-making.

Disadvantages:

- Can be time-consuming and inflexible.

- May not be suitable for organizations with rapidly changing circumstances.

- Requires a high level of accuracy in forecasting income and expenses.

Incremental Budgeting

Incremental budgeting is based on the previous year’s budget, with adjustments made for expected changes in income and expenses. This method is relatively simple and easy to implement, making it suitable for small businesses and organizations with stable financial operations.Advantages:

- Simple and straightforward to use.

- Requires less time and effort to prepare.

- Can be used to quickly adjust to changes in financial circumstances.

Disadvantages:

- May not encourage innovation or strategic planning.

- Can perpetuate inefficiencies and outdated practices from the previous year’s budget.

- Does not provide a comprehensive analysis of financial needs.

Zero-Based Budgeting

Zero-based budgeting requires that every dollar of income be allocated to a specific expense category. This method ensures that all expenses are justified and that there is no surplus at the end of the budgeting period. Zero-based budgeting is often used by individuals and organizations seeking to optimize their financial resources.Advantages:

- Forces a thorough review of all expenses.

- Promotes financial discipline and cost-effectiveness.

- Helps identify areas for potential savings.

Disadvantages:

- Can be time-consuming and complex to implement.

- May not be suitable for organizations with fluctuating income or expenses.

- Requires a high level of financial literacy and discipline.

Rolling Forecast Budgeting

Rolling forecast budgeting involves creating a financial plan that is continuously updated as new information becomes available. This method is particularly useful for organizations operating in rapidly changing environments or with highly uncertain financial conditions.Advantages:

- Provides a flexible and adaptive approach to financial planning.

- Allows organizations to respond quickly to changes in the market or economic conditions.

- Facilitates ongoing monitoring and adjustment of financial strategies.

Disadvantages:

- Can be more complex and resource-intensive than other budgeting methods.

- Requires regular updating and analysis of financial data.

- May not be suitable for organizations with stable financial operations.

Creating a Budget

Budgeting is a crucial step in managing your finances effectively. It involves creating a plan for how you will allocate your income to various expenses and savings goals.

To create a budget, follow these steps:

- Track your income and expenses:Start by tracking all your income sources and expenses for a month or two. This will give you a clear picture of where your money is going.

- Categorize your expenses:Once you have tracked your expenses, categorize them into different groups, such as housing, food, transportation, and entertainment.

- Set realistic goals:Determine how much you want to save each month and how much you can afford to spend on different categories. Be realistic with your goals, as overly ambitious budgets can be difficult to stick to.

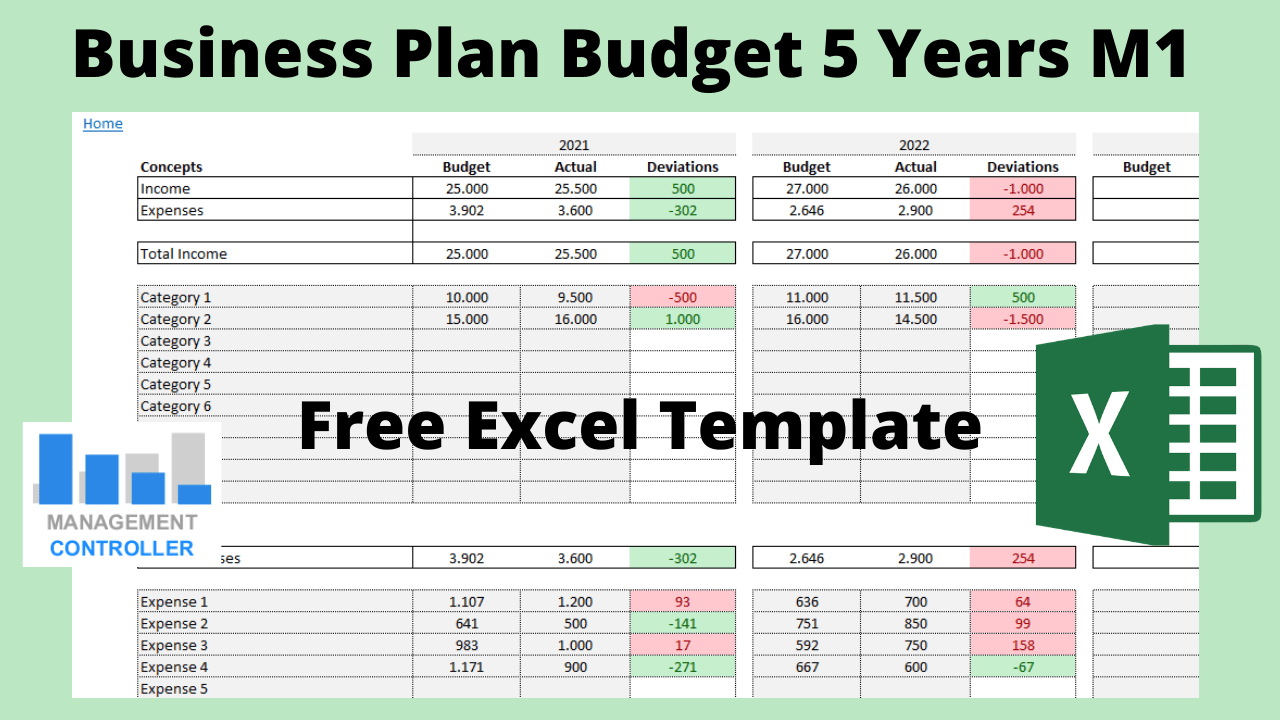

- Create a budget template:Use a spreadsheet, budgeting app, or even a simple notebook to create a budget template. This template should include your income, expenses, and savings goals.

- Review and adjust your budget regularly:Your budget should not be set in stone. As your income and expenses change, you will need to review and adjust your budget accordingly.

Remember, the key to successful budgeting is to create a plan that is realistic and achievable. If you set unrealistic goals, you will likely become discouraged and give up. By following these steps and being mindful of your spending habits, you can create a budget that will help you reach your financial goals.

A budget is an informal plan for future business activities. These activities can be as simple as deciding whether to buy a new computer or as complex as planning a marketing campaign. In today’s business world, it’s more important than ever to have a budget in place.

Can you switch contacts from an android to an iphone ? A budget can help you track your income and expenses, make informed decisions about how to allocate your resources, and stay on track to achieve your business goals.

Tracking and Monitoring a Budget

Tracking and monitoring a budget is crucial for ensuring that your financial plan remains on track. Regular reviews and adjustments are essential for maintaining financial discipline and achieving your financial goals.

Methods for Tracking and Monitoring a Budget

There are several methods for tracking and monitoring a budget:

- Spreadsheets:Using a spreadsheet program like Microsoft Excel or Google Sheets allows you to create a detailed budget and track expenses and income over time.

- Budgeting apps:Numerous budgeting apps are available, both free and paid, that provide features for tracking expenses, setting financial goals, and creating reports.

- Online banking tools:Many banks offer online tools that allow you to track your transactions and monitor your account balances in real-time.

- Physical receipts and notes:While less convenient than digital methods, keeping physical receipts and notes can help you track your expenses and stay within your budget.

Significance of Regular Reviews and Adjustments

Regular reviews of your budget are essential for identifying areas where you may be overspending or undersaving. Adjustments may be necessary to ensure that your budget remains realistic and aligned with your financial goals.By tracking and monitoring your budget, you can identify patterns in your spending and make informed decisions about your financial future.

It allows you to stay accountable and make necessary adjustments to achieve your financial objectives.

Benefits of Budgeting

Creating and adhering to a budget offers numerous advantages that can significantly improve financial well-being. A budget serves as a roadmap, guiding individuals and businesses in managing their income and expenses effectively.

One of the primary benefits of budgeting is that it promotes financial discipline. By tracking income and expenses, individuals gain a clear understanding of their cash flow and can make informed decisions about spending. This helps curb impulsive purchases and promotes a more responsible approach to money management.

Improved Financial Planning

A budget provides a solid foundation for financial planning. It allows individuals to forecast future income and expenses, enabling them to set realistic financial goals and make informed decisions about saving, investing, and debt repayment.

In the realm of business, a budget serves as a blueprint for financial planning, guiding future activities. Just like a traveler might consult a map before embarking on a journey, a business owner relies on a budget to chart their financial course.

Whether it’s a question as specific as can you use an android charger for iphone 15 , or the broader concerns of financial planning, a budget provides a framework for making informed decisions. It’s an essential tool for navigating the complexities of business and ensuring financial stability.

Reduced Financial Stress

Budgeting helps alleviate financial stress by providing a sense of control over finances. Knowing exactly where money is going and how much is available can reduce anxiety and promote peace of mind.

A budget is an informal plan for future business activities. It helps you track your income and expenses, and make informed decisions about how to allocate your resources. Can you get iMessage on an Android ? No, you can’t get iMessage on an Android.

iMessage is a proprietary messaging service developed by Apple Inc. for its iOS and macOS operating systems. It is not available on Android devices. A budget is an informal plan for future business activities.

Increased Savings

By identifying areas where expenses can be reduced, a budget can help individuals increase their savings. This can lead to financial security, the ability to handle unexpected expenses, and the achievement of long-term financial goals.

When it comes to managing your finances, a budget is an informal plan for future business activities. It’s a roadmap that helps you stay on track and reach your financial goals. So, if you’re wondering can you take screenshots on an android phone , the answer is yes! Just hold down the power button and volume down button at the same time.

And there you have it – a screenshot! This simple trick can be super helpful when you need to capture something on your screen, whether it’s a receipt, a map, or a funny meme. So, next time you need to take a screenshot, remember this handy tip.

Back to budgeting, it’s all about planning and making informed decisions about how you spend your money.

Better Credit Score

Responsible budgeting practices, such as paying bills on time and maintaining low credit utilization, can positively impact credit scores. A higher credit score can lead to lower interest rates on loans and credit cards, further enhancing financial well-being.

Challenges of Budgeting

Budgeting is an essential part of financial planning, but it can also be challenging. There are a number of common obstacles that people face when creating and maintaining a budget. However, by understanding these challenges and developing strategies to overcome them, you can increase your chances of budgeting success.

One of the most common challenges of budgeting is tracking expenses. It can be difficult to keep track of every dollar you spend, especially if you are not used to doing so. However, there are a number of tools available to help you track your expenses, such as budgeting apps and spreadsheets.

Once you have a system in place for tracking your expenses, you will be able to see where your money is going and make adjustments as needed.

Another challenge of budgeting is sticking to your budget. Once you have created a budget, it is important to stick to it as closely as possible. However, there will be times when you need to make adjustments. For example, if you have an unexpected expense, you may need to adjust your budget to accommodate it.

The key is to be flexible and to make adjustments as needed while still staying within your overall financial goals.

Finally, lack of motivationcan be a challenge to budgeting. It can be difficult to stay motivated to budget when you are not seeing immediate results. However, it is important to remember that budgeting is a long-term process. It takes time to see the benefits of budgeting, but it is worth it in the end.

Overcoming Challenges

There are a number of strategies that you can use to overcome the challenges of budgeting. Here are a few tips:

- Set realistic goals. Don’t try to budget every dollar you earn. Start by setting small, achievable goals. As you become more comfortable with budgeting, you can gradually increase your goals.

- Make budgeting a habit. The more you budget, the easier it will become. Set aside a specific time each week to review your budget and make adjustments as needed.

- Find a budgeting method that works for you. There are many different budgeting methods available. Experiment with different methods until you find one that you are comfortable with and that you can stick to.

- Be flexible. There will be times when you need to make adjustments to your budget. Don’t be afraid to make changes as needed. The key is to stay within your overall financial goals.

- Get help if you need it. If you are struggling to budget, don’t be afraid to get help from a financial advisor or credit counselor.

By following these tips, you can overcome the challenges of budgeting and achieve your financial goals.

Budgeting Tools and Resources

Navigating the financial landscape can be daunting, but fear not! A plethora of budgeting tools and resources are at your disposal, each offering unique advantages and potential drawbacks. Embark on a journey of financial empowerment as we delve into the world of budgeting tools.

A budget is an informal plan for future business activities. It’s important to have a budget so that you can track your income and expenses, and make sure that you’re not spending more money than you’re making. If you’re not sure how to create a budget, there are many resources available online.

You can also get help from a financial advisor. Can you connect an android to a tv ? If so, you can use your phone to control your TV, watch movies, and play games. This can be a great way to save money on cable or satellite TV.

A budget is an informal plan for future business activities. It’s important to have a budget so that you can track your income and expenses, and make sure that you’re not spending more money than you’re making.

The advent of technology has ushered in a new era of budgeting, with a myriad of apps, software, and online platforms vying for your attention. These tools offer a range of features, from expense tracking to cash flow forecasting, designed to simplify and streamline your financial management.

Mobile Budgeting Apps

- Convenience: Carry your budget in your pocket, accessible anytime, anywhere.

- Automated tracking: Many apps seamlessly integrate with your bank accounts, automatically categorizing transactions.

- Customization: Tailor your budget to your specific needs and preferences.

However, some mobile budgeting apps may have limited features compared to desktop software, and subscription fees can be a consideration.

Desktop Budgeting Software

- Comprehensive features: Robust software offers advanced budgeting capabilities, such as detailed reports and investment tracking.

- Data security: Desktop software often provides enhanced data security measures.

- Offline access: Work on your budget without an internet connection.

On the downside, desktop software can be more expensive than mobile apps and may require a learning curve.

Online Budgeting Platforms

- Accessibility: Access your budget from any device with an internet connection.

- Collaboration: Share your budget with others, such as a spouse or financial advisor.

- Community support: Connect with other users for tips and advice.

Keep in mind that online platforms may have limited customization options compared to desktop software, and data privacy concerns should be considered.

Financial Advisors

- Personalized guidance: Receive tailored advice from a financial professional.

- Expertise: Benefit from the knowledge and experience of a certified advisor.

- Objectivity: An outside perspective can provide valuable insights.

Financial advisors typically charge fees for their services, and their availability may be limited.

Books and Workbooks

- Tangible resource: Physical books and workbooks provide a hands-on approach to budgeting.

- Step-by-step guidance: Structured materials offer clear instructions and exercises.

- Affordable: Books and workbooks are generally more affordable than other budgeting tools.

However, physical resources may not offer the same level of automation and customization as digital tools.

Budgeting for Different Situations

Budgeting is a versatile tool that can be tailored to meet the specific needs of different financial situations. Whether you’re an individual managing your personal finances, a family planning for the future, or a business looking to optimize its operations, there’s a budgeting method that can help you achieve your financial goals.

Individuals

For individuals, budgeting can help track income and expenses, set financial goals, and make informed decisions about spending. By creating a budget, individuals can identify areas where they can save money, prioritize their expenses, and avoid overspending.

Families

Budgeting is equally important for families, as it allows them to coordinate their financial resources and plan for their future. Family budgets can help cover expenses such as housing, food, transportation, education, and healthcare. By working together to create a budget, families can ensure that their financial needs are met and that they are saving for the future.

Businesses

Businesses of all sizes can benefit from budgeting. A budget can help businesses track their revenue and expenses, forecast future cash flow, and make informed decisions about investments and operations. By creating a budget, businesses can ensure that they are operating efficiently and that they are making the most of their financial resources.

Advanced Budgeting Techniques

Advanced budgeting techniques are designed for complex financial scenarios that require a more sophisticated approach. These techniques allow for greater flexibility, accuracy, and control over financial planning and decision-making.

Some of the most common advanced budgeting techniques include:

Zero-Based Budgeting

Zero-based budgeting is a method where every dollar of income is allocated to a specific expense category. This ensures that all income is accounted for and that there is no overspending. Zero-based budgeting is particularly effective for individuals or businesses with limited financial resources.

Envelope Budgeting

Envelope budgeting is a physical method of budgeting where cash is allocated into different envelopes, each representing a specific expense category. This technique helps individuals stay within their budget by limiting spending to the amount of cash available in each envelope.

Rolling Budget

A rolling budget is a dynamic budget that is updated on a regular basis, typically monthly or quarterly. This technique allows businesses to adjust their budget as needed to reflect changing financial conditions and priorities.

Scenario Planning

Scenario planning is a technique that involves creating multiple budgets based on different assumptions about future events. This allows businesses to prepare for a range of possible outcomes and make more informed decisions.

Cash Flow Forecasting

Cash flow forecasting is a technique that helps businesses predict their future cash flow. This information can be used to make informed decisions about investments, expenses, and borrowing.

Behavioral Aspects of Budgeting

Budgeting is not just about numbers and spreadsheets; it also involves psychological and behavioral aspects. Our emotions, habits, and biases can significantly influence our budgeting decisions.

One common behavioral aspect of budgeting is the tendency to overspend when we have more money available. This is known as the “windfall effect.” When we receive a bonus or unexpected income, we may be more likely to spend it on non-essential items rather than saving or investing it.

Emotional Spending

Emotions can also play a significant role in budgeting. When we are stressed, anxious, or depressed, we may be more likely to make impulsive purchases as a way to cope. This can lead to overspending and debt.

Habitual Spending

Habits can also influence our budgeting. If we are accustomed to spending a certain amount of money each month on entertainment or dining out, it can be difficult to break that habit, even if we know we need to save more money.

Epilogue

Remember, budgeting is an ongoing journey, not a one-time event. Regularly review and adjust your budget to ensure it aligns with your evolving business goals. Embrace the power of budgeting, and watch your business soar to new heights of financial success.

Question Bank: A Budget Is An Informal Plan For Future Business Activities.

What’s the difference between a budget and a financial plan?

A budget is a short-term plan that focuses on allocating funds for specific activities within a defined period, typically a month or a year. A financial plan, on the other hand, is a comprehensive roadmap that Artikels your long-term financial goals and strategies to achieve them.

How often should I review my budget?

Regularly reviewing your budget is crucial. Aim to review it at least monthly to track your progress, identify areas for improvement, and make necessary adjustments to stay on track.

What are some common budgeting challenges?

Sticking to your budget can be challenging. Common obstacles include unexpected expenses, changes in income, and emotional spending. To overcome these challenges, be realistic with your goals, track your expenses diligently, and seek support if needed.