An audit plan – Get ready to dive into the thrilling world of audit plans, where risk assessment and compliance take the spotlight. This guide will be your trusty sidekick, arming you with the knowledge and tools to navigate the complexities of auditing with confidence and finesse.

When it comes to your financial future, having an audit plan is crucial. It’s like a roadmap that keeps you on track and ensures you’re making the right moves. But hey, let’s not forget about the rainy days. Consider a savings plan bought through an insurance company . It’s like an umbrella for your finances, protecting you from unexpected storms.

With an audit plan and a savings plan, you’ll be cruising through the financial highway with confidence.

Buckle up and prepare to uncover the secrets of planning, risk evaluation, and reporting. Let’s embark on an adventure that will transform you into an audit rockstar!

Creating an audit plan is essential for ensuring your finances are in order. If you’re looking to upgrade your tech, consider adding an iPad to your AT&T plan . It’s a great way to stay connected and entertained. Remember, an audit plan is crucial for keeping your financial goals on track.

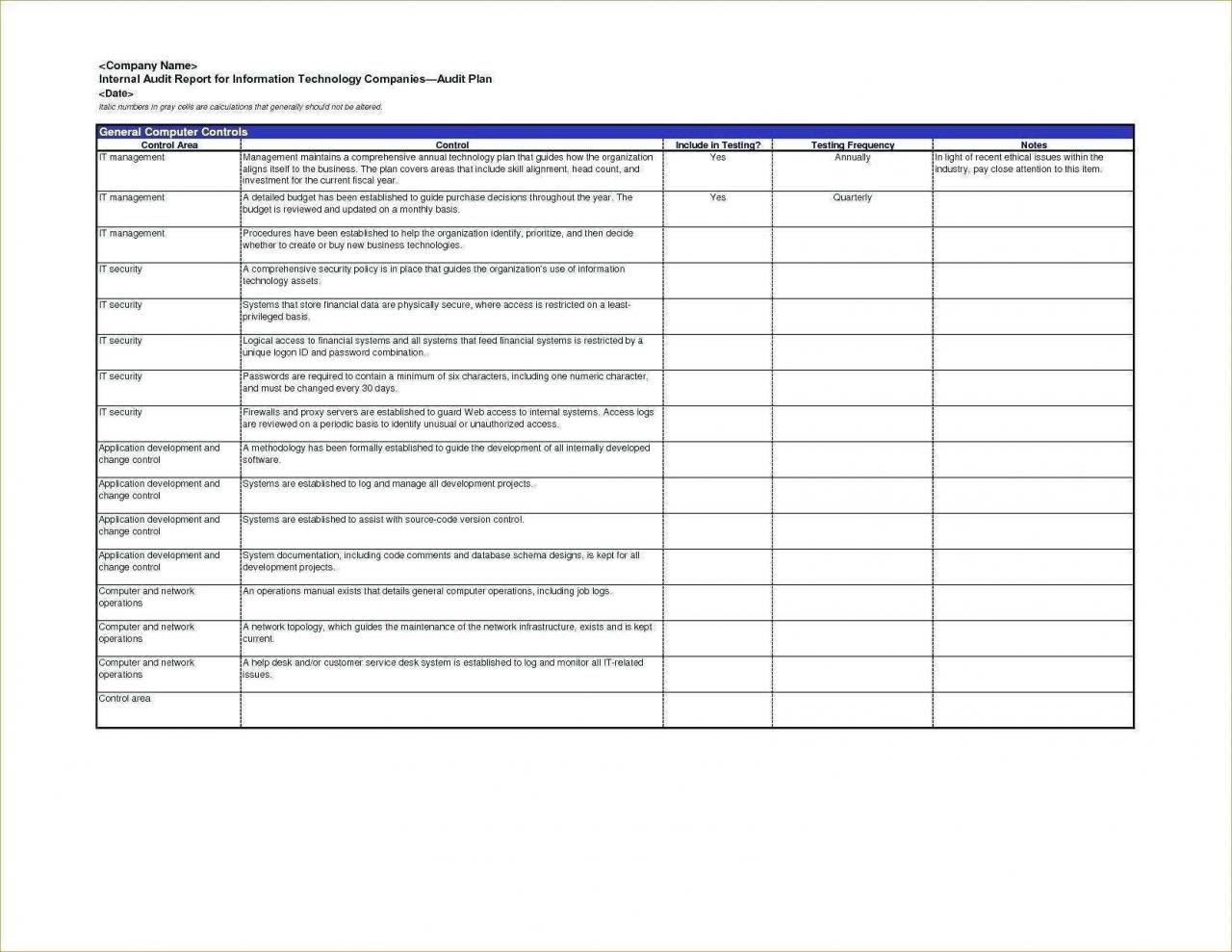

Audit Plan Overview: An Audit Plan

An audit plan serves as a roadmap for the audit process, outlining the purpose, scope, and approach for conducting audits within an organization. It provides a framework for auditors to follow, ensuring a systematic and comprehensive review of an organization’s financial and operational activities.

Dude, if you’re looking to crush it with an audit plan that’s lit, you gotta check out this lesson plan from Miss Keller . It’s like the ultimate cheat sheet for nailing your audit, no sweat. Trust me, it’s the bomb!

Types of Audits Covered by the Plan

- Financial audits: Assess the accuracy and reliability of financial statements.

- Operational audits: Evaluate the efficiency and effectiveness of internal controls and business processes.

- Compliance audits: Determine whether an organization is adhering to laws, regulations, and internal policies.

Benefits of Having an Audit Plan

- Improved audit quality and consistency.

- Reduced risk of audit failures.

- Enhanced communication and coordination among audit team members.

Planning and Preparation

Effective audit planning involves identifying the resources needed, developing a timeline, and establishing communication channels with stakeholders. These steps ensure that the audit process is well-organized and executed efficiently.

Yo, check it! When it comes to gettin’ your biz on track, an audit plan is like your GPS, showin’ you where you’re at and where you need to go. Now, let’s say an advertising company wishes to plan their next campaign, an audit plan can help ’em scope out the competition, find their target audience, and figure out the best way to reach ’em.

It’s like havin’ a roadmap for success, baby!

Identify the Resources Needed for the Audit

- Audit team members with the necessary skills and experience.

- Access to financial records, operational data, and other relevant documentation.

- Audit software and tools to facilitate data analysis and reporting.

Develop a Timeline for the Audit Process

- Establish a start and end date for the audit.

- Break down the audit process into manageable phases.

- Allocate time for planning, fieldwork, reporting, and follow-up.

Establish Communication Channels with Stakeholders

- Identify key stakeholders, including management, internal audit, and external auditors.

- Establish clear lines of communication for reporting progress, findings, and recommendations.

- Schedule regular meetings to update stakeholders on the audit’s status.

Risk Assessment

Risk assessment is a critical step in the audit process, as it helps auditors identify and evaluate potential risks that could impact the organization’s financial or operational performance. By understanding these risks, auditors can design appropriate audit procedures to address them.

Conduct a Risk Assessment to Identify Potential Risks

- Review industry trends and best practices.

- Analyze historical data and internal control assessments.

- Conduct interviews with key personnel.

Evaluate the Likelihood and Impact of Identified Risks

- Assign a likelihood and impact rating to each identified risk.

- Prioritize risks based on their potential severity and likelihood of occurrence.

- Focus audit efforts on the most significant risks.

Design Audit Procedures to Address Identified Risks

- Develop specific audit procedures to test the effectiveness of internal controls.

- Determine the sample size and selection criteria for testing.

- Identify the evidence needed to support audit findings.

Audit Procedures

Audit procedures are the specific steps that auditors perform to gather evidence and evaluate the accuracy and reliability of financial and operational information. These procedures provide the basis for audit findings and recommendations.

If you’re creating an audit plan for your business, you should make sure to include a disaster recovery plan. A company needs to design an aws disaster recovery plan that will help you recover your data and systems in the event of a disaster.

An audit plan is an important part of any business, and it can help you protect your company from financial loss and reputational damage.

Design Audit Procedures to Gather Evidence

- Use a variety of audit techniques, such as inspection, observation, and inquiry.

- Test the completeness, accuracy, and validity of financial transactions.

- Review supporting documentation to corroborate evidence.

Describe the Methods and Techniques to be Used

- Explain the sampling methods and sample sizes to be used.

- Describe the techniques for testing internal controls.

- Provide examples of the evidence that will be collected.

Determine the Sample Size and Selection Criteria

- Consider the risk assessment and materiality level.

- Use statistical sampling techniques to determine the appropriate sample size.

- Establish clear criteria for selecting items for testing.

Reporting and Follow-Up

The audit report is the culmination of the audit process, providing stakeholders with the results of the audit and any recommendations for improvement. Effective reporting and follow-up ensure that audit findings are communicated clearly and acted upon appropriately.

An audit plan is like a roadmap for checking the health of your business. It helps you stay on track and make sure everything is running smoothly. Just like a strategic plan should identify expected returns from an investment, an audit plan helps you identify areas where you can improve efficiency and profitability.

Describe the Format and Content of the Audit Report, An audit plan

- Follow generally accepted auditing standards.

- Include an executive summary, audit findings, and recommendations.

- Provide clear and concise language.

Describe the Process for Communicating Audit Findings

- Present the audit report to management and the audit committee.

- Hold follow-up meetings to discuss findings and recommendations.

- Distribute the audit report to other stakeholders as appropriate.

Establish a Plan for Monitoring and Following Up on Audit Recommendations

- Track the implementation of audit recommendations.

- Monitor the effectiveness of corrective actions.

- Conduct follow-up audits to assess progress and ensure compliance.

Wrap-Up

As we wrap up our audit plan extravaganza, remember that a well-executed audit is like a finely tuned symphony—every element working in harmony to deliver valuable insights and drive continuous improvement. Embrace the power of planning, risk assessment, and reporting to ensure your organization stays on the path to success and compliance.

FAQs

What’s the secret sauce of a successful audit plan?

A well-defined purpose, thorough planning, and a collaborative approach are the magic ingredients.

How can I make risk assessment less daunting?

An audit plan is a key component of any business’s risk management strategy. By identifying potential risks and developing a plan to mitigate them, businesses can protect themselves from financial losses, reputational damage, and other negative consequences. As a first step in planning for an emergency includes identifying potential risks, an audit plan can help businesses prepare for a variety of scenarios and ensure that they are able to continue operating in the event of an emergency.

Break it down into manageable steps, prioritize risks based on impact, and involve experts to gain valuable insights.

What’s the key to effective audit reporting?

Clarity, conciseness, and actionable recommendations are the holy trinity of successful audit reports.