A strategic plan must identify expected returns from an investment. This is a critical step in the planning process, as it helps to ensure that the investment is aligned with the organization’s goals and objectives. By identifying the expected returns, the organization can make informed decisions about whether or not to proceed with the investment.

Just like a strategic plan must identify expected returns from an investment, estate planning for unmarried couples is crucial to protect their assets and ensure their wishes are met. Unmarried couples often overlook the importance of an estate plan, but it’s essential to address potential legal and financial challenges.

4 tips why unmarried couples need an estate plan provides valuable insights into why estate planning is vital for unmarried couples, ensuring they navigate legal complexities and secure their future.

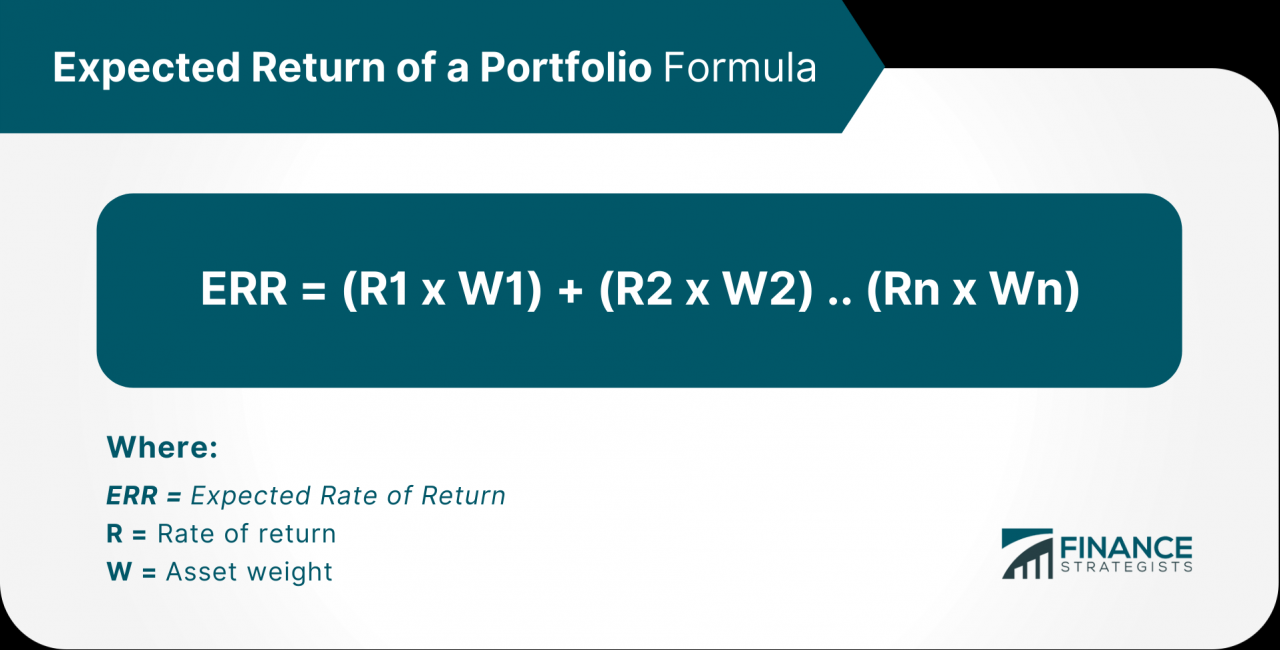

There are a number of methods that can be used to identify expected returns. One common method is to use financial models. These models can be used to forecast the future cash flows of the investment and to calculate the expected return.

Yo, check it. A strategic plan is like a boss move, it’s all about knowing what you’re gonna get out of it. It’s like when a science class is planning an investigation about gravity . They gotta figure out what they’re gonna learn and how they’re gonna measure it.

Same goes for investments, you gotta know what you’re gonna get back before you drop the dough.

Another method is to use sensitivity analysis. This analysis can be used to assess the impact of different factors on the expected return.

A strategic plan should clearly outline the anticipated returns on investment. This is especially important when considering retirement plans offered by employers, which are a retirement plan offered by an employer is a an . By understanding the potential returns, individuals can make informed decisions about their financial future and ensure that their retirement savings are working hard for them.

1. Introduction

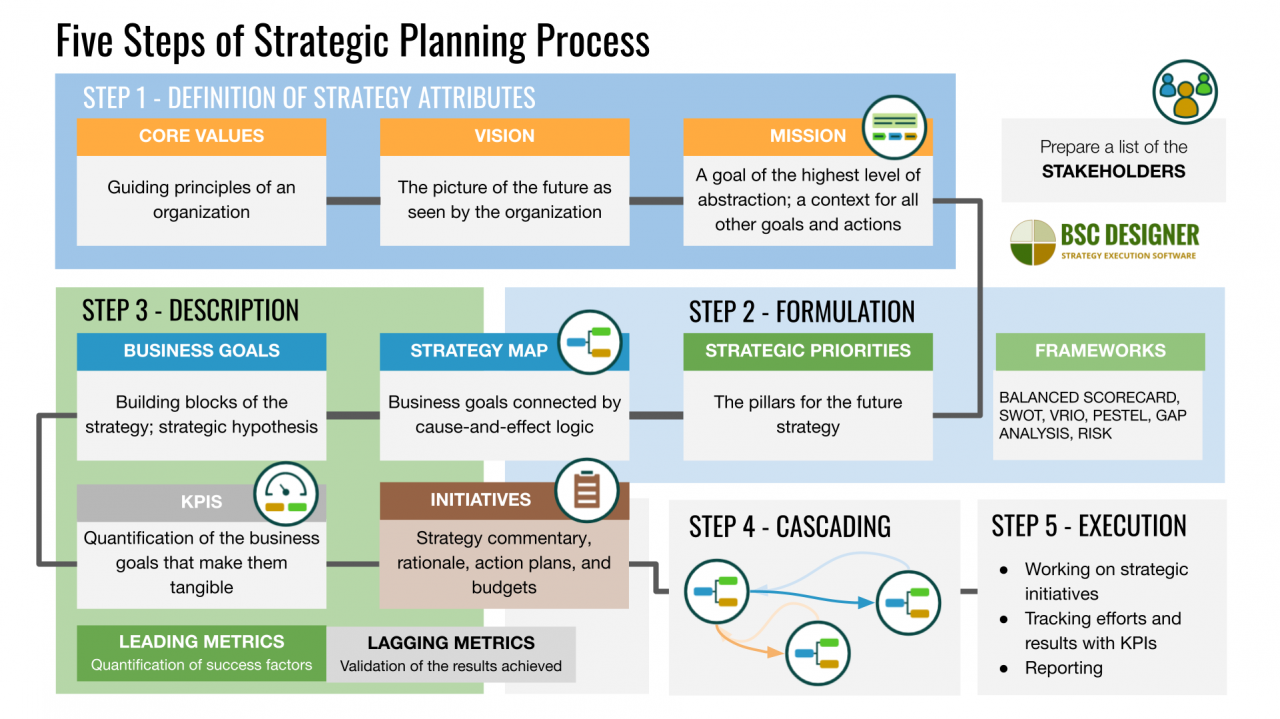

A strategic plan serves as a roadmap for an organization’s future, outlining its goals, objectives, and the actions necessary to achieve them. At the core of any strategic plan is the identification of expected returns from investments. This process is crucial because it allows organizations to assess the potential benefits and risks associated with their investment decisions.

2. Methods for Identifying Expected Returns

There are various methods for quantifying expected returns from investments. One common approach is the use of financial models. These models take into account historical data, market conditions, and other relevant factors to project future cash flows and returns. Sensitivity analysis can also be employed to assess the impact of different scenarios and assumptions on expected returns.

Assumptions and Estimates

It’s important to note that expected returns are based on assumptions and estimates. These assumptions should be carefully considered and documented to ensure the reliability of the projections.

3. Factors to Consider When Identifying Expected Returns

Market Conditions, A strategic plan must identify expected returns from an investment.

The prevailing market conditions play a significant role in determining expected returns. Factors such as economic growth, interest rates, and inflation can impact the performance of investments.

Competition

The level of competition in the market can affect expected returns. High levels of competition can reduce profit margins and make it more challenging to achieve high returns.

Just like how a strategic plan must identify expected returns from an investment, the 7-2 project submission: create an academic success plan will help you identify the expected returns from your academic investment. It will help you set goals, create a timeline, and identify the resources you need to achieve your academic success.

Technological Advancements

Technological advancements can disrupt industries and create new opportunities for investment. Organizations need to consider the potential impact of technology on their expected returns.

4. Communicating Expected Returns

Importance of Clarity

Clearly communicating expected returns to stakeholders is essential for building trust and ensuring alignment. Investors, shareholders, and other stakeholders need to understand the potential returns and risks associated with the organization’s investments.

Effective Presentation

Expected returns should be presented in a clear and concise manner. Visual aids, such as charts and graphs, can be effective in communicating complex financial information.

Transparency and Disclosure

Organizations should strive for transparency and disclosure in communicating expected returns. This involves providing stakeholders with all relevant information, including assumptions and estimates, to enable informed decision-making.

5. Monitoring and Evaluating Expected Returns

Performance Metrics and Benchmarks

Organizations should establish performance metrics and benchmarks to monitor and evaluate the actual returns achieved compared to the expected returns. This allows for timely adjustments to the strategic plan if necessary.

Yo, if you’re all about making your investments count, you need a strategic plan that’s got your expected returns on lock. And when it comes to crushing it on social media, check out these 7 steps for an effective social media marketing plan . They’ll guide you like a pro, from setting goals to tracking your progress.

So, whether you’re a newbie or a social media ninja, this plan will help you slay the competition and reap the rewards you deserve.

Adjusting the Strategic Plan

Based on the evaluation of actual returns, the strategic plan should be adjusted to ensure it remains aligned with the organization’s goals and objectives. This may involve revising investment strategies, reallocating resources, or reassessing market conditions.

End of Discussion

Once the expected returns have been identified, it is important to communicate them clearly to stakeholders. This can be done through a variety of methods, such as presentations, reports, and financial statements. It is also important to be transparent about the assumptions and estimates that were used to determine the expected returns.

By following these steps, organizations can ensure that their strategic plans are aligned with their goals and objectives. This will help to increase the likelihood of success for the organization.

FAQ Corner: A Strategic Plan Must Identify Expected Returns From An Investment.

What is the purpose of a strategic plan?

A strategic plan is a roadmap for an organization’s future. It Artikels the organization’s goals and objectives, and identifies the steps that need to be taken to achieve them.

Why is it important to identify expected returns from an investment?

Identifying expected returns from an investment is critical because it helps to ensure that the investment is aligned with the organization’s goals and objectives. By identifying the expected returns, the organization can make informed decisions about whether or not to proceed with the investment.

What are some methods that can be used to identify expected returns?

There are a number of methods that can be used to identify expected returns. One common method is to use financial models. These models can be used to forecast the future cash flows of the investment and to calculate the expected return.

Another method is to use sensitivity analysis. This analysis can be used to assess the impact of different factors on the expected return.