With an aggressive working capital policy at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american pop culture language filled with unexpected twists and insights.

An aggressive working capital policy can free up cash flow, but it’s important to understand the risks involved. Consider the advantages of working with an independent insurance agent who can help you assess your risks and find the right coverage for your business.

An aggressive working capital policy can be a smart move, but it’s important to do your research and make sure you’re comfortable with the risks involved.

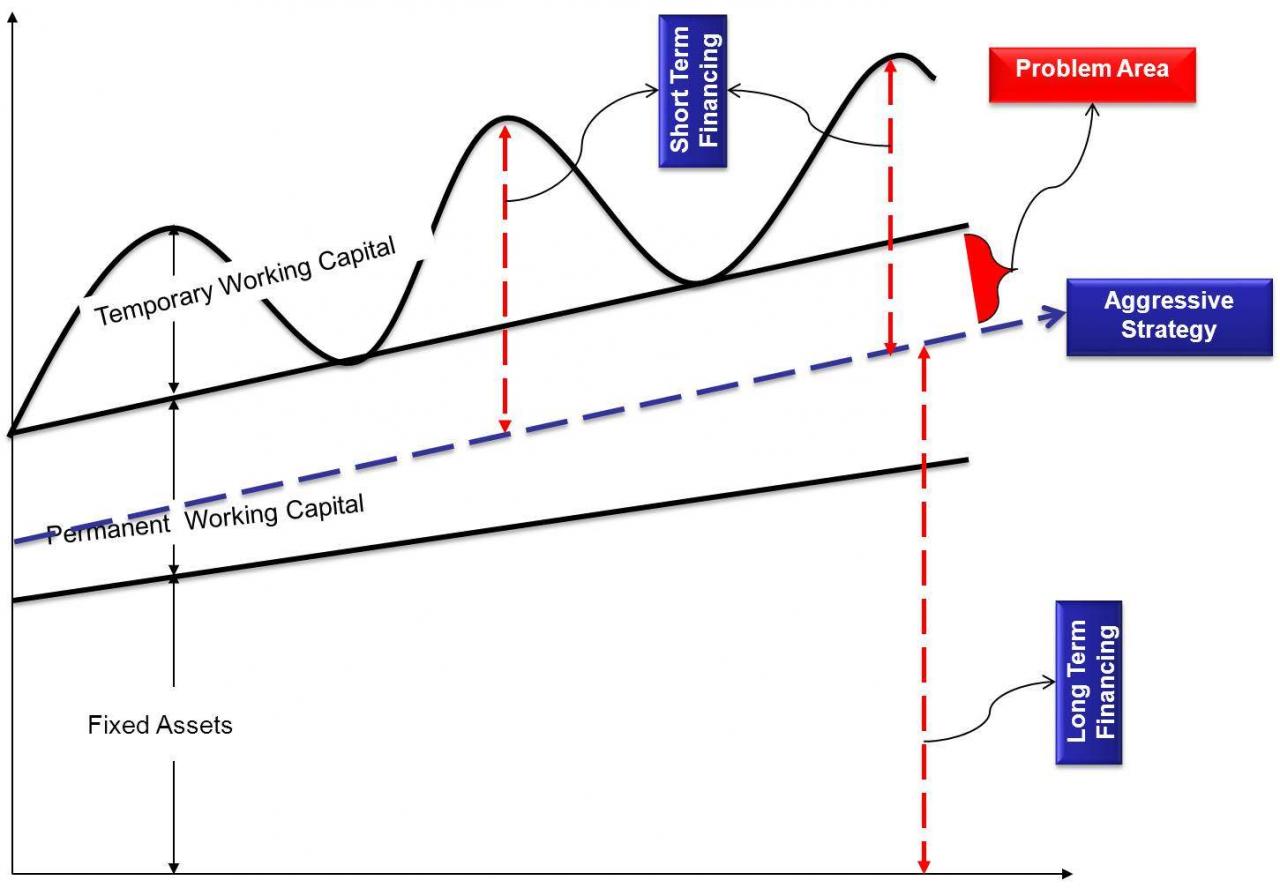

An aggressive working capital policy is a strategy that seeks to minimize the amount of working capital a company holds. This can be done by reducing inventory levels, collecting accounts receivable more quickly, and delaying the payment of accounts payable.

An aggressive working capital policy can be a great way to improve your cash flow. But before you implement one, you need to make sure you’re authorized to work as an independent contractor. Am I authorized to work as an independent contractor ? If you’re not sure, check with your state’s labor department.

Once you’ve confirmed that you’re authorized to work as an independent contractor, you can start implementing an aggressive working capital policy.

The goal of an aggressive working capital policy is to free up cash that can be used to invest in other areas of the business.

An aggressive working capital policy can be a risky move, but it can also pay off big time. Just like a charge nurse is working with an assistive personnel , an aggressive working capital policy requires careful planning and execution.

If done correctly, it can free up cash flow and boost profits. But if done incorrectly, it can lead to financial disaster.

Aggressive Working Capital Policy

An aggressive working capital policy involves managing a company’s assets and liabilities to maximize liquidity and minimize the cash conversion cycle. It aims to improve financial performance by reducing the time it takes to convert inventory into cash.

An aggressive working capital policy can lead to increased profits and improved cash flow, but it can also increase the risk of financial distress. A body of work: an anthology of poetry and medicine explores the complex relationship between work and health, and the ways in which poetry can help us to understand and cope with the challenges of illness and recovery.

An aggressive working capital policy can be a powerful tool for businesses, but it should be used with caution.

Primary Goals and Objectives

- Improve liquidity and cash flow

- Reduce the cash conversion cycle

- Increase profitability and return on assets

Benefits of an Aggressive Working Capital Policy

Implementing an aggressive working capital policy can lead to several benefits, including:

- Improved financial flexibility

- Increased profitability

- Reduced risk of financial distress

Risks of an Aggressive Working Capital Policy

While an aggressive working capital policy can provide benefits, it also carries risks, such as:

- Operational challenges

- Financial distress

- Increased risk of stockouts

Key Components of an Aggressive Working Capital Policy

| Component | Description |

|---|---|

| Inventory Management | Optimizing inventory levels to minimize carrying costs and reduce the risk of obsolescence. |

| Accounts Receivable Management | Effectively managing accounts receivable to minimize days sales outstanding (DSO). |

| Accounts Payable Management | Delaying payments to suppliers to extend the cash conversion cycle. |

Implementation and Management of an Aggressive Working Capital Policy

Implementing and managing an aggressive working capital policy involves:

- Establishing clear goals and objectives

- Developing and implementing a comprehensive plan

- Monitoring and adjusting the policy as needed

Conclusive Thoughts

An aggressive working capital policy can be a powerful tool for improving a company’s financial performance. However, it is important to carefully consider the risks and benefits before implementing such a policy. By understanding the key components of an aggressive working capital policy and following best practices for implementation and management, companies can maximize the benefits of this strategy while minimizing the risks.

Key Questions Answered: An Aggressive Working Capital Policy

What are the benefits of an aggressive working capital policy?

An aggressive working capital policy can be a double-edged sword. While it can free up cash for an advertiser who works for a large company to invest in growth opportunities, it can also increase the risk of financial distress if the company is unable to meet its short-term obligations.

Therefore, it is important for companies to carefully consider the risks and benefits of an aggressive working capital policy before implementing it.

An aggressive working capital policy can improve a company’s financial performance in several ways. First, it can free up cash that can be used to invest in other areas of the business. This can lead to increased sales, profits, and shareholder value.

Second, an aggressive working capital policy can improve a company’s liquidity. This means that the company will have more cash on hand to meet its short-term obligations.

What are the risks of an aggressive working capital policy?

To implement an aggressive working capital policy, organisations must foster a cohesive work environment. Just like a well-oiled machine, teams that collaborate effectively can streamline operations, reduce waste, and improve efficiency. As outlined in advantages and disadvantages of team working in an organisation , teamwork can enhance problem-solving, boost morale, and increase productivity.

By harnessing the collective knowledge and skills of a team, organisations can effectively manage their working capital and achieve their financial goals.

There are also some risks associated with implementing an aggressive working capital policy. First, it can lead to operational challenges. For example, a company may have difficulty meeting customer demand if it does not have enough inventory on hand. Second, an aggressive working capital policy can increase the risk of financial distress.

This is because the company may not have enough cash on hand to meet its short-term obligations.

How can I implement an aggressive working capital policy?

An aggressive working capital policy aims to minimize cash on hand, which can reduce interest expenses. This strategy can also free up cash for other uses, such as amount of money paid to an employee for work performed . By carefully managing working capital, companies can improve their financial flexibility and profitability, which ultimately benefits shareholders and other stakeholders.

There are several steps that companies can take to implement an aggressive working capital policy. First, they should develop a clear understanding of their working capital needs. This includes identifying the company’s current working capital position and its target working capital position.

Second, companies should develop a plan for reducing their working capital. This plan should include specific strategies for reducing inventory levels, collecting accounts receivable more quickly, and delaying the payment of accounts payable. Third, companies should implement their plan and monitor its progress.

This includes tracking key metrics such as inventory turnover, days sales outstanding, and days payable outstanding.