An aggressive working capital policy would include – An aggressive working capital policy is a strategic approach that aims to optimize cash flow, reduce financing costs, and enhance profitability. By implementing key components such as efficient accounts receivable management, inventory optimization, and prudent accounts payable practices, companies can unlock the potential benefits of this strategy.

An aggressive working capital policy would include optimizing accounts receivable, accounts payable, and inventory. Implementing strict credit policies and offering discounts for early payments can improve accounts receivable. By negotiating extended payment terms with suppliers and delaying non-essential purchases, companies can improve accounts payable.

Inventory can be optimized by using just-in-time inventory management techniques. For example, a company offering 15 dollars an hour work can implement these policies to improve its working capital position.

Aggressive working capital policies have proven successful for companies like Apple and Amazon, who have consistently generated strong cash flows and maintained financial flexibility.

An aggressive working capital policy would include minimizing inventory, extending payables, and accelerating receivables. For example, a counselor working in an aids-related case may need to be aggressive in following up with clients who are behind on payments.

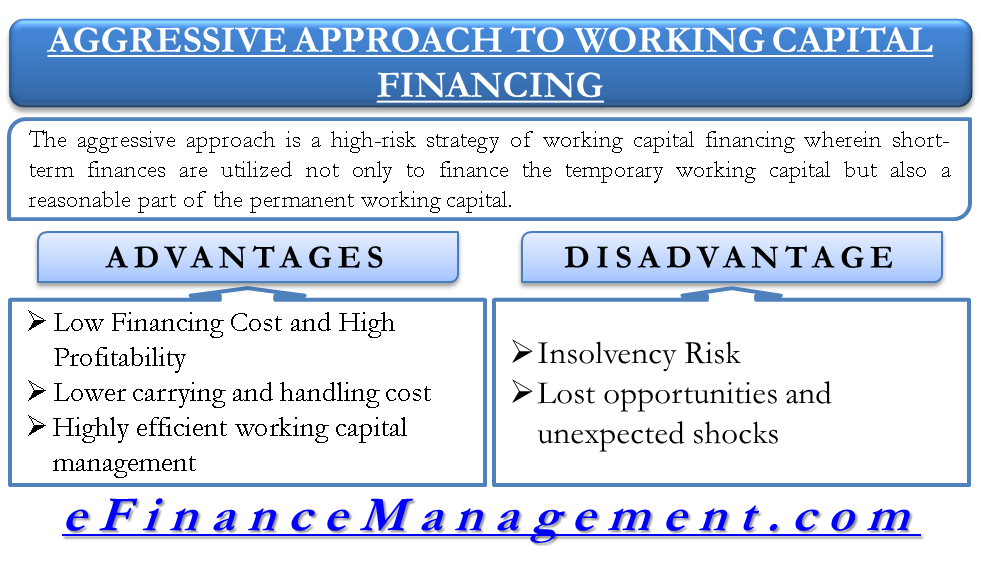

Definition and Purpose of an Aggressive Working Capital Policy

An aggressive working capital policy is a financial strategy that seeks to minimize the company’s working capital by reducing its current assets and increasing its current liabilities. The primary objective of this policy is to improve the company’s cash flow and profitability.Examples

of companies that have successfully implemented aggressive working capital policies include Walmart, Amazon, and Apple. These companies have been able to generate significant cash flow by managing their working capital efficiently.

An aggressive working capital policy would include minimizing inventory and receivables while maximizing payables. Flexible working arrangements, like those discussed in this article , can contribute to this by reducing the need for physical office space and equipment, which in turn reduces inventory and fixed asset requirements.

This can free up cash flow for other purposes, such as investing in new product development or expanding into new markets.

Components of an Aggressive Working Capital Policy

The key components of an aggressive working capital policy include:

Managing Accounts Receivable

Companies can reduce their accounts receivable by offering discounts for early payment, implementing stricter credit policies, and improving their billing and collection processes.

An aggressive working capital policy would include minimizing inventory levels to reduce carrying costs, like the electronics store adam works at . This helps businesses free up cash flow and improve profitability by optimizing the management of current assets and liabilities.

An aggressive working capital policy can also involve extending payment terms to customers and negotiating favorable terms with suppliers, further enhancing cash flow and reducing the need for external financing.

Managing Inventory

Companies can reduce their inventory by implementing just-in-time inventory management systems, negotiating better terms with suppliers, and reducing safety stock levels.

Managing Accounts Payable

Companies can increase their accounts payable by negotiating longer payment terms with suppliers and taking advantage of early payment discounts.

Benefits of an Aggressive Working Capital Policy

The potential benefits of implementing an aggressive working capital policy include:

Improved Cash Flow

By reducing current assets and increasing current liabilities, companies can improve their cash flow. This can be used to fund growth initiatives, reduce debt, or increase shareholder dividends.

An aggressive working capital policy would include minimizing current assets and maximizing current liabilities. This can be achieved by reducing inventory levels, shortening the collection period, and increasing accounts payable. The benefits of such a policy include improved liquidity, increased profitability, and reduced risk.

In contrast, salesmen enjoy greater flexibility, higher earning potential, and the opportunity to build strong relationships with customers. While an aggressive working capital policy can be beneficial for businesses, it is important to weigh the risks and benefits carefully.

Reduced Financing Costs

Companies with a lower working capital requirement can reduce their financing costs. This is because they need to borrow less money to finance their operations.

An aggressive working capital policy would include measures to minimize the firm’s investment in current assets, such as maintaining a low level of inventory and accounts receivable. To learn more about the end-of-fiscal-period work for a proprietorship, check out an accounting cycle for a proprietorship end-of-fiscal-period work answers . This resource provides a comprehensive guide to the accounting cycle, including the steps involved in recording transactions, preparing financial statements, and closing the books.

Increased Profitability

By improving cash flow and reducing financing costs, companies can increase their profitability. This can lead to higher stock prices and increased shareholder value.

An aggressive working capital policy would include minimizing inventory levels and extending payment terms. Like a 2-year-old with an internal working model would , it would focus on short-term cash flow and maximizing profitability. This policy can help companies improve their liquidity and reduce their risk of financial distress.

Risks of an Aggressive Working Capital Policy

The potential risks associated with an aggressive working capital policy include:

Increased Risk of Stockouts, An aggressive working capital policy would include

Companies that reduce their inventory levels too much may face the risk of stockouts. This can lead to lost sales and damage to customer relationships.

Damaged Relationships with Suppliers and Customers

Companies that implement aggressive credit policies or negotiate longer payment terms with suppliers may damage their relationships with these parties.

Difficulty Meeting Financial Obligations

Companies that have a high level of current liabilities may have difficulty meeting their financial obligations. This can lead to bankruptcy or other financial distress.

Implementation Considerations

When implementing an aggressive working capital policy, companies should consider the following:

Establishing Clear Goals and Objectives

Companies should establish clear goals and objectives for their working capital policy. These goals should be aligned with the company’s overall financial strategy.

Developing a Detailed Plan

Companies should develop a detailed plan for implementing their working capital policy. This plan should include specific actions and timelines.

Monitoring and Controlling the Policy

Companies should monitor and control their working capital policy on a regular basis. This will help to ensure that the policy is achieving its desired results.

Wrap-Up

Implementing an aggressive working capital policy requires careful planning, monitoring, and risk management. However, the potential rewards can be substantial, including improved cash flow, reduced costs, and increased profitability. By embracing this strategy, businesses can gain a competitive edge and position themselves for long-term success.

FAQ: An Aggressive Working Capital Policy Would Include

What is the primary goal of an aggressive working capital policy?

To optimize cash flow, reduce financing costs, and enhance profitability.

Can an aggressive working capital policy lead to increased risk?

Yes, it can increase the risk of stockouts, damage relationships with suppliers and customers, and make it more difficult to meet financial obligations.

How can companies implement an aggressive working capital policy effectively?

By establishing clear goals, developing a detailed plan, and monitoring and controlling the policy closely.