A firm following an aggressive working capital strategy would embark on a thrilling journey, navigating the delicate balance between financial prudence and audacious growth. This strategy, employed by bold companies seeking to maximize their liquidity and profitability, presents a captivating tale of calculated risks and potential rewards.

From the outset, this narrative immerses readers in the intricacies of working capital management, shedding light on the innovative approaches that have propelled countless businesses to remarkable heights. We will explore the triumphs and tribulations of companies that have dared to venture down this path, unraveling the secrets behind their success and the lessons learned from their setbacks.

Definition of Aggressive Working Capital Strategy

An aggressive working capital strategy involves actively managing current assets and liabilities to maximize the company’s liquidity and profitability. It aims to minimize the conversion cycle by reducing inventory levels, extending payment terms to customers, and negotiating shorter payment terms with suppliers.

Companies that have successfully implemented an aggressive working capital strategy include Walmart, Amazon, and Apple. These companies have been able to generate significant cash flow and improve their overall financial performance by effectively managing their working capital.

Benefits of an Aggressive Working Capital Strategy

There are several potential benefits to pursuing an aggressive working capital strategy:

- Improved cash flow: By reducing inventory levels and extending payment terms, companies can free up cash that can be used for other purposes, such as investing in growth initiatives or paying down debt.

- Increased profitability: An aggressive working capital strategy can lead to increased profitability by reducing the cost of goods sold and improving the company’s operating efficiency.

- Enhanced financial flexibility: Companies with a strong working capital position are better able to withstand unexpected events, such as economic downturns or supply chain disruptions.

Case studies have shown that companies that have implemented an aggressive working capital strategy have experienced positive outcomes, such as increased sales, improved profitability, and reduced debt.

A firm following an aggressive working capital strategy would prioritize maximizing short-term liquidity. To gain insights into implementing such a strategy, check out An Example of a Business Plan: A Blueprint for Success . It offers a comprehensive guide on developing a solid financial plan, including strategies for optimizing working capital management.

By adopting these principles, firms can enhance their cash flow and maintain financial stability.

Risks of an Aggressive Working Capital Strategy

While an aggressive working capital strategy can have many benefits, there are also some potential risks to consider:

- Stockouts: Reducing inventory levels too aggressively can lead to stockouts, which can result in lost sales and damage to the company’s reputation.

- Strained relationships with suppliers: Extending payment terms to suppliers can strain relationships and make it more difficult to negotiate favorable terms in the future.

- Increased risk of default: Companies with a very aggressive working capital strategy may have difficulty meeting their financial obligations, which can lead to default.

Companies that have faced challenges due to an aggressive working capital strategy include Toys “R” Us, Circuit City, and Blockbuster. These companies were unable to manage their working capital effectively and eventually filed for bankruptcy.

A firm following an aggressive working capital strategy would be wise to heed the advice laid out in An Example of an Action Plan: A Blueprint for Success . This guide provides a step-by-step roadmap for achieving your goals, whether it’s increasing cash flow or improving profitability.

By following the principles outlined in this plan, a firm can ensure that its working capital strategy is both effective and sustainable.

Key Considerations for Implementing an Aggressive Working Capital Strategy

Before implementing an aggressive working capital strategy, companies should consider the following factors:

- The company’s financial position: Companies with a strong financial position are better able to withstand the risks associated with an aggressive working capital strategy.

- The industry in which the company operates: Some industries, such as retail, have higher working capital requirements than others.

- The company’s competitive landscape: Companies that operate in competitive markets may need to be more aggressive with their working capital strategy in order to gain market share.

It is important for companies to conduct a thorough analysis of their financial position and industry before implementing an aggressive working capital strategy.

Methods for Implementing an Aggressive Working Capital Strategy

There are several methods that companies can use to implement an aggressive working capital strategy:

- Reducing inventory levels: Companies can reduce inventory levels by implementing just-in-time inventory management systems or by negotiating with suppliers to reduce lead times.

- Extending payment terms to customers: Companies can extend payment terms to customers by offering discounts for early payment or by negotiating longer payment terms with key customers.

- Negotiating shorter payment terms with suppliers: Companies can negotiate shorter payment terms with suppliers by offering to pay early or by consolidating purchases with multiple suppliers.

Companies can also use a combination of these methods to implement an aggressive working capital strategy.

Monitoring and Control of an Aggressive Working Capital Strategy

It is important for companies to monitor and control their working capital strategy on an ongoing basis. Key metrics that companies should track include:

- Days sales outstanding (DSO): DSO measures the average number of days it takes a company to collect its receivables.

- Days inventory outstanding (DIO): DIO measures the average number of days it takes a company to sell its inventory.

- Days payable outstanding (DPO): DPO measures the average number of days it takes a company to pay its suppliers.

Companies should also regularly review their working capital strategy and make adjustments as needed.

Alternative Working Capital Strategies: A Firm Following An Aggressive Working Capital Strategy Would

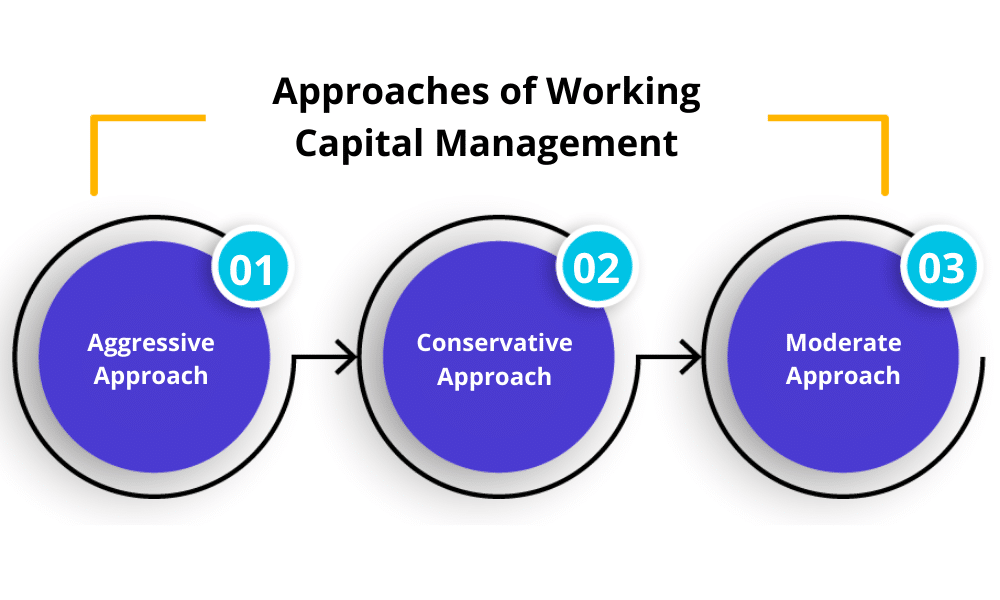

An aggressive working capital strategy is not the only option for companies. Other working capital strategies include:

- Conservative working capital strategy: A conservative working capital strategy involves maintaining higher levels of inventory and receivables, and shorter payment terms with suppliers. This strategy is less risky than an aggressive strategy, but it can also lead to lower profitability.

- Moderate working capital strategy: A moderate working capital strategy falls somewhere between an aggressive and conservative strategy. Companies that use this strategy typically maintain moderate levels of inventory and receivables, and payment terms that are in line with industry norms.

The best working capital strategy for a particular company will depend on its financial position, industry, and competitive landscape.

A firm following an aggressive working capital strategy would need to carefully manage its cash flow and working capital. For a detailed guide on how to write a business plan that outlines such a strategy, refer to An Example of a Written Business Plan: A Comprehensive Guide . This resource provides insights into developing a comprehensive business plan that addresses working capital management and other key aspects of business planning.

Wrap-Up

As we reach the culmination of our exploration, a clear understanding of aggressive working capital strategies emerges. We have witnessed the transformative power of this approach, capable of unlocking significant growth and profitability. Yet, we have also acknowledged the inherent risks that accompany such boldness.

A firm following an aggressive working capital strategy would seek to optimize its cash flow and minimize its financial risks. An Example of Strategic Planning: A Comprehensive Guide to Achieving Success provides a detailed framework for developing and implementing a strategic plan that aligns with a firm’s overall business objectives, including its working capital management strategy.

The key lies in striking a delicate balance, carefully considering the unique circumstances of each company and its risk appetite.

A firm following an aggressive working capital strategy would benefit from a comprehensive marketing plan. As outlined in An Example of a Marketing Plan: A Comprehensive Guide to Success , a well-crafted marketing plan can help businesses identify and target their audience, develop effective marketing campaigns, and track their progress.

By implementing the strategies outlined in this guide, a firm can optimize its working capital management and achieve its business objectives.

Whether a company chooses to embrace an aggressive working capital strategy or opt for a more conservative approach, the insights gained from this journey will prove invaluable. The lessons learned and the strategies unveiled will empower businesses to make informed decisions, navigate the complexities of financial management, and ultimately achieve their long-term goals.

Q&A

What are the key benefits of an aggressive working capital strategy?

Aggressive working capital strategies can lead to increased profitability, improved cash flow, and enhanced operational efficiency.

What are the potential risks associated with an aggressive working capital strategy?

Risks include increased financial leverage, liquidity constraints, and potential damage to supplier relationships.

How can companies mitigate the risks of an aggressive working capital strategy?

Companies can mitigate risks by conducting thorough financial analysis, maintaining strong relationships with suppliers, and implementing robust risk management practices.