An advantage of effective personal financial planning is: empowering individuals to take control of their financial lives and work towards their financial goals. It provides a roadmap for managing finances, making informed decisions, and achieving long-term financial well-being.

An advantage of effective personal financial planning is that it helps you set financial goals and create a plan to achieve them. Like in the 7-2 project submission: create an academic success plan , you can outline your goals, identify obstacles, and develop strategies to overcome them.

This can help you stay on track and make progress towards your financial objectives.

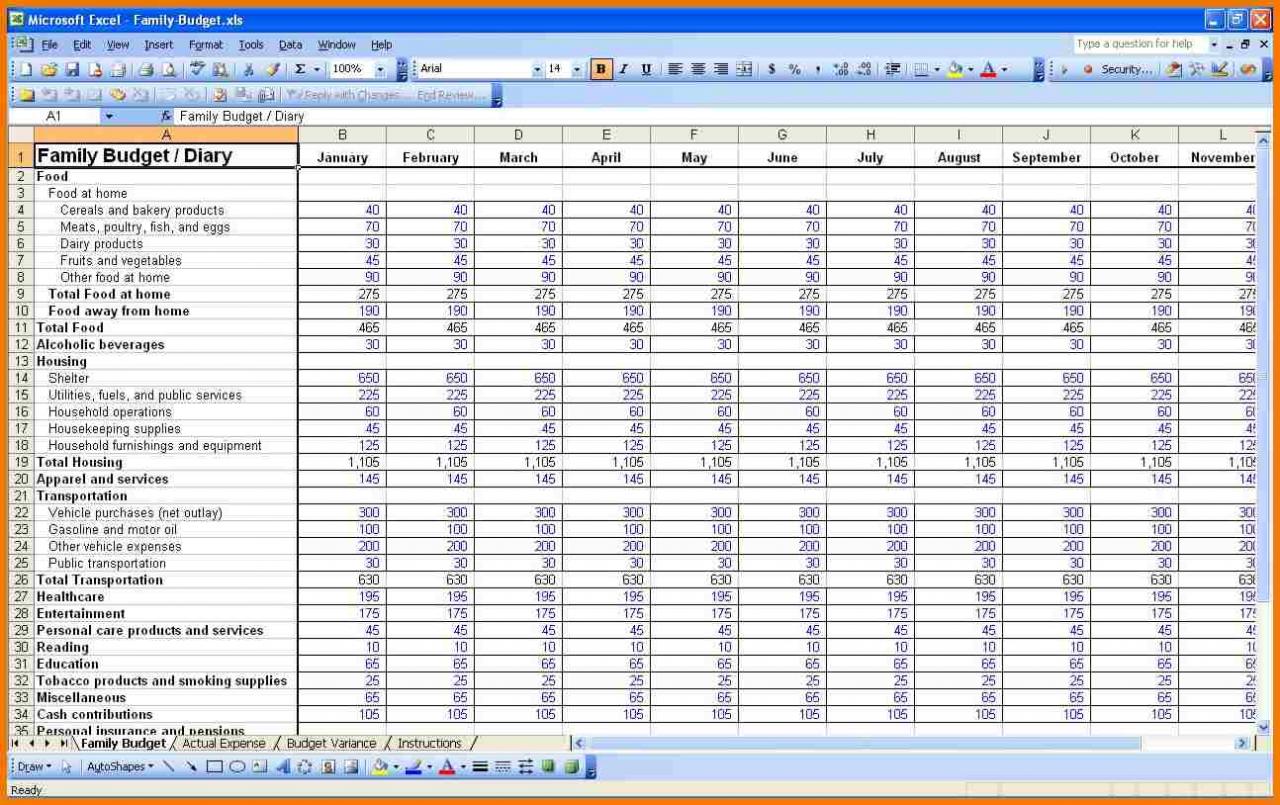

Effective personal financial planning encompasses various aspects, including budgeting, saving, investing, debt management, and retirement planning. By adopting sound financial planning practices, individuals can enhance their financial stability, achieve their goals, and secure their financial future.

Yo, check it! An advantage of effective personal financial planning is that it can help you set realistic financial goals. And guess what? Just like a strategic plan must identify expected returns from an investment, a strategic financial plan should outline the expected outcomes of your financial decisions.

That’s the key to making smart money moves!

Financial Stability: An Advantage Of Effective Personal Financial Planning Is:

Effective personal financial planning is the cornerstone of financial stability. It empowers individuals to manage their finances prudently, ensuring they have a secure financial foundation. By creating a comprehensive plan, individuals can navigate unexpected expenses, emergencies, and financial setbacks with confidence.

Unexpected Expenses and Emergencies

- Financial planning helps individuals establish an emergency fund, a crucial buffer against unexpected expenses like medical bills or car repairs.

- It enables them to anticipate potential financial emergencies and develop contingency plans, minimizing the impact of unforeseen events.

Debt Management

Effective personal financial planning is instrumental in managing debt effectively. It provides a roadmap for creating a debt repayment plan, prioritizing high-interest debts, and exploring debt consolidation options.

An advantage of effective personal financial planning is the ability to prepare for retirement. One option for self-employed individuals is a retirement plan offered for the self-employers . This type of plan allows individuals to set aside money for retirement and take advantage of tax benefits.

By planning ahead, individuals can ensure they have a secure financial future.

Risk Mitigation

Financial planning helps individuals identify potential financial risks, such as job loss or market volatility. By creating contingency plans and securing appropriate insurance, they can mitigate these risks and protect their financial well-being.

An advantage of effective personal financial planning is that it can help you prepare for unexpected events. Just like a disaster recovery plan drp for an organization should , effective personal financial planning can provide a roadmap for how to respond to a financial crisis.

By creating a budget, setting financial goals, and building an emergency fund, you can increase your financial resilience and ensure that you’re prepared for whatever life throws your way.

Tax Optimization

Personal financial planning plays a vital role in tax optimization. It empowers individuals to understand tax laws, take advantage of deductions and credits, and minimize their tax liability. This maximizes their after-tax income, increasing their financial resources.

An advantage of effective personal financial planning is that it can help you achieve your financial goals. For example, if you want to buy a house, you can create a savings plan to help you save for a down payment.

If you want to retire early, you can create an investment plan to help you grow your retirement savings. 8 components of an effective employee compensation plan can also help you reach your financial goals. By understanding how these plans work, you can make the most of your money and achieve your financial dreams.

Estate Planning, An advantage of effective personal financial planning is:

Effective financial planning extends beyond the individual’s lifetime. It involves creating a will, establishing trusts, and distributing assets according to their wishes. This ensures their legacy and provides for their loved ones after their passing.

Closure

In conclusion, effective personal financial planning is a crucial aspect of financial well-being. It empowers individuals to make informed financial decisions, achieve their goals, and navigate financial challenges. By embracing the principles of financial planning, individuals can gain control of their finances, secure their financial future, and live a life free from financial worries.

Answers to Common Questions

What are the benefits of effective personal financial planning?

Effective personal financial planning offers numerous benefits, including financial stability, goal achievement, debt management, risk mitigation, retirement planning, tax optimization, and estate planning.

How can I create an effective personal financial plan?

Creating an effective personal financial plan involves assessing your financial situation, setting financial goals, creating a budget, managing debt, investing for the future, and planning for retirement.

What are some common financial planning mistakes?

Common financial planning mistakes include not having a budget, spending more than you earn, taking on too much debt, not saving for retirement, and not having adequate insurance coverage.