A retirement plan offered by an employer is a an – When it comes to planning for your future, a retirement plan offered by an employer is a crucial tool that can help you achieve financial security. These plans offer a range of benefits and investment options, making them an essential part of any comprehensive retirement strategy.

In this guide, we’ll dive into the world of employer-sponsored retirement plans, exploring their advantages, eligibility requirements, investment options, and more. Whether you’re just starting out in your career or nearing retirement, understanding these plans is key to securing your financial future.

Definition of a Retirement Plan Offered by an Employer

An employer-sponsored retirement plan is a financial savings vehicle offered by employers to help their employees prepare for retirement. These plans allow employees to set aside a portion of their income on a pre-tax basis, which can significantly reduce their current tax liability.

Yo, check this out! A retirement plan offered by an employer is a total game-changer. It’s like having a secret stash of cash for your future self. And guess what? It’s one of the key components of an effective employee compensation plan.

If you’re not sure what else makes a great compensation plan, hit up this link: 8 components of an effective employee compensation plan . You’ll find everything you need to know about perks, bonuses, and all the other cool stuff that makes working worth it.

Plus, it’ll help you plan for the future like a total boss.

The money invested in these plans grows tax-deferred until it is withdrawn in retirement, at which point it is subject to income tax.

A retirement plan offered by an employer is a golden ticket to financial security in your golden years. Just like an involver follows 4 steps for planning , you can secure your retirement by planning early, saving consistently, investing wisely, and seeking professional advice.

An employer-sponsored retirement plan is a crucial step towards a comfortable and worry-free retirement.

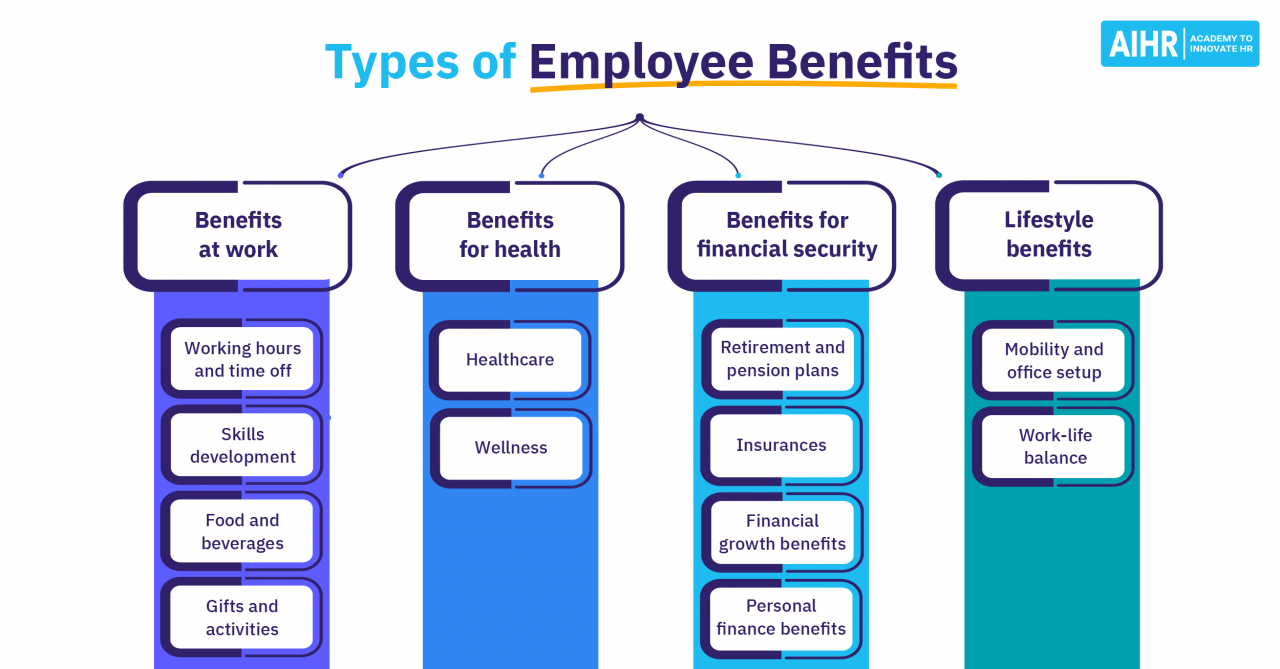

There are several different types of employer-sponsored retirement plans, each with its own unique features and benefits. The most common types of plans include 401(k) plans, 403(b) plans, and defined benefit plans.

Benefits of an Employer-Sponsored Retirement Plan

Participating in an employer-sponsored retirement plan offers several benefits, including:

- Tax savings: Contributions to employer-sponsored retirement plans are made on a pre-tax basis, which reduces the employee’s current tax liability. The money invested in these plans grows tax-deferred until it is withdrawn in retirement, at which point it is subject to income tax.

- Potential for employer contributions: Many employers make matching contributions to their employees’ retirement plans, which can significantly increase the amount of money saved for retirement.

- Investment options: Employer-sponsored retirement plans typically offer a variety of investment options, allowing employees to choose the investments that best meet their individual risk tolerance and investment goals.

Eligibility and Participation Requirements, A retirement plan offered by an employer is a an

Eligibility for participating in an employer-sponsored retirement plan varies depending on the plan and the employer. Generally, employees must meet certain criteria, such as being at least 21 years old and working a minimum number of hours per week.

The enrollment process for employer-sponsored retirement plans also varies depending on the plan and the employer. Some plans require employees to enroll主動積極地主動積極地 actively, while others automatically enroll employees unless they opt out. Vesting schedules, which determine when employees have ownership of their employer contributions, also vary depending on the plan.

Employees can typically change their contribution levels at any time, but they may be subject to certain limits.

Investment Options

Employer-sponsored retirement plans typically offer a variety of investment options, including:

- Mutual funds: Mutual funds are professionally managed investment funds that pool money from multiple investors and invest it in a variety of assets, such as stocks, bonds, and real estate.

- Exchange-traded funds (ETFs): ETFs are similar to mutual funds, but they are traded on stock exchanges like stocks.

- Target-date funds: Target-date funds are mutual funds that automatically adjust their asset allocation based on the investor’s age and retirement date.

It is important for employees to diversify their investments by investing in a mix of asset classes, such as stocks, bonds, and real estate. This can help to reduce risk and improve the chances of achieving their retirement goals.

Withdrawal and Distribution Rules

There are rules and restrictions on withdrawing funds from an employer-sponsored retirement plan. Generally, employees cannot withdraw funds from their retirement plan until they reach age 59½. Withdrawals made before age 59½ may be subject to a 10% early withdrawal penalty, in addition to income tax.

There are several different distribution options available to employees when they retire. These options include:

- Taking a lump sum distribution: Employees can take a lump sum distribution of their retirement savings when they retire. This option can provide employees with a large sum of money to use in retirement, but it can also result in a large tax bill.

A retirement plan offered by an employer is an essential tool for financial security in your golden years. But what if you’re not married? Unmarried couples face unique challenges when it comes to estate planning. Check out 4 tips why unmarried couples need an estate plan to learn more about the importance of having a plan in place.

Just like a retirement plan offered by an employer, an estate plan can provide peace of mind and ensure that your wishes are respected after you’re gone.

- Taking periodic payments: Employees can also take periodic payments from their retirement savings when they retire. This option can provide employees with a steady stream of income in retirement, but it may not provide as much money as a lump sum distribution.

- Rolling over to an IRA: Employees can also roll over their retirement savings to an IRA when they retire. This option allows employees to continue to defer taxes on their retirement savings until they withdraw the money from the IRA.

Like a retirement plan offered by an employer is a sweet bonus, 7-2 project submission: create an academic success plan is a surefire way to plan for academic achievement. It helps you set goals, track progress, and stay motivated, just like a retirement plan secures your financial future.

So, dive into creating your academic success plan today, and watch your academic dreams take flight!

It is important for employees to carefully consider their distribution options when they retire. The decision of which option to choose will depend on their individual circumstances and financial needs.

A retirement plan offered by an employer is a way to save for the future. Like 5g for europe an action plan , it’s a plan that helps you reach your goals. Retirement plans can be a great way to save money and build a nest egg for the future.

Closure

Remember, retirement planning is an ongoing process. Regularly review your plan and make adjustments as needed to ensure it remains aligned with your financial goals. With careful planning and a commitment to saving, you can harness the power of an employer-sponsored retirement plan to build a secure and fulfilling retirement.

FAQ Overview: A Retirement Plan Offered By An Employer Is A An

Who is eligible to participate in an employer-sponsored retirement plan?

Eligibility requirements vary depending on the plan and employer, but typically include factors such as age, length of service, and employment status.

What are the different types of employer-sponsored retirement plans?

Common types include 401(k) plans, 403(b) plans, and profit-sharing plans.

How do I choose the best investment options for my retirement plan?

Consider your age, risk tolerance, and investment goals. Diversification and asset allocation are key to managing risk and maximizing returns.