Cost of an Accountant for a Small Business in the UK: How Much Is An Accountant For A Small Business Uk

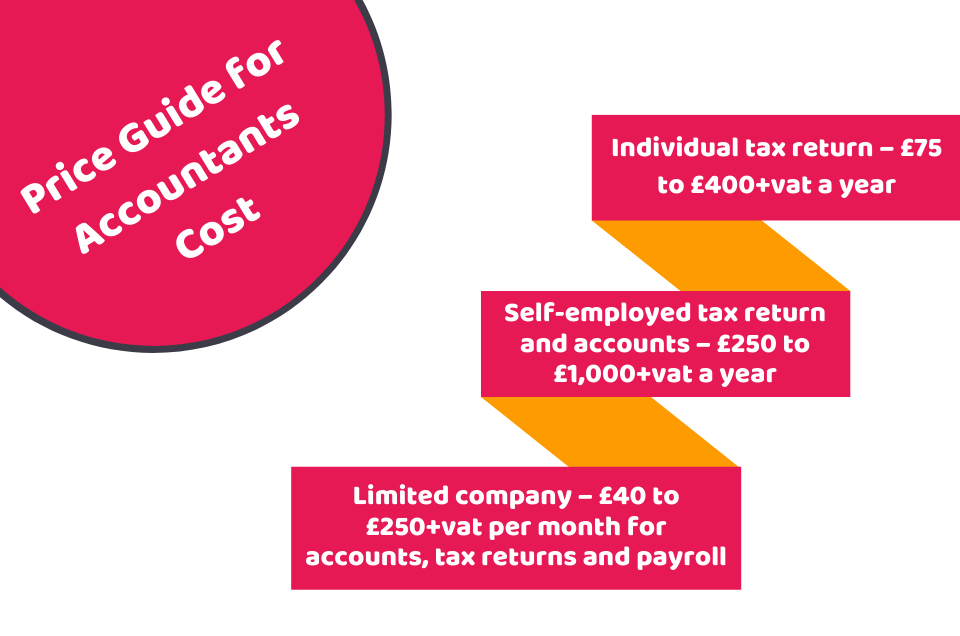

How much is an accountant for a small business uk – The cost of hiring an accountant for a small business in the UK can vary depending on a number of factors, including the size of the business, the industry it operates in, and its location. However, there are some general costs that you can expect to pay:

Hourly rate:Accountants typically charge an hourly rate for their services. This rate can range from £50 to £200 per hour, depending on the accountant’s experience and expertise.

In the UK, the cost of hiring an accountant for a small business typically ranges from £500 to £2,000 per year. However, the exact amount you’ll pay will depend on the size and complexity of your business. If you’re looking to file an extension for your business, you may need to pay an additional fee.

For more information on how to file an extension, visit file an extension for my business.

Monthly retainer:Some accountants offer a monthly retainer fee for their services. This fee typically covers a set number of hours of accounting work each month. The cost of a monthly retainer can range from £200 to £1,000 per month.

For a small business in the UK, the cost of hiring an accountant can vary depending on the size and complexity of the business. However, on average, you can expect to pay around £1,000 to £2,000 per year for basic accounting services.

If you are looking to develop an online business, it is important to factor in the cost of accounting into your budget. An accountant can help you with tasks such as setting up your business, managing your finances, and filing your taxes.

By working with an accountant, you can ensure that your business is compliant with all legal requirements and that you are making the most of your financial resources. Developing an online business can be a great way to reach new customers and grow your business, but it is important to make sure that you have the right financial foundation in place.

Project-based fees:Some accountants charge a project-based fee for their services. This fee is typically based on the scope of the project and the time it is expected to take.

The cost of hiring an accountant for a small business in the UK can vary, but typically ranges from £50 to £200 per month. While having an accountant can help you manage your finances and stay compliant with regulations, it’s important to weigh the costs against the potential benefits.

It’s also worth considering the disadvantages of having an online business , such as the lack of face-to-face interaction with customers and the increased risk of fraud. If you decide that hiring an accountant is the right move for your business, be sure to shop around and compare quotes from different providers.

Factors that Influence the Cost of an Accountant, How much is an accountant for a small business uk

- Size of the business:The size of your business will have a significant impact on the cost of your accountant. A larger business will typically have more complex accounting needs, which will require more time and expertise from the accountant.

- Industry:The industry in which your business operates can also affect the cost of your accountant. Some industries, such as healthcare and finance, have more complex accounting requirements than others.

- Location:The location of your business can also affect the cost of your accountant. Accountants in large cities typically charge higher rates than accountants in smaller towns.

Types of Accounting Services for Small Businesses

There are a variety of accounting services that small businesses may require, including:

- Bookkeeping:Bookkeeping is the process of recording and organizing financial transactions. This includes recording income, expenses, assets, and liabilities.

- Tax preparation:Tax preparation is the process of preparing and filing tax returns. This includes calculating taxes owed and ensuring that all required forms are filed.

- Financial reporting:Financial reporting is the process of creating financial statements, such as balance sheets and income statements. These statements provide a snapshot of a business’s financial health.

- Payroll processing:Payroll processing is the process of calculating and paying employee wages. This includes withholding taxes and other deductions.

- Auditing:Auditing is the process of examining a business’s financial records to ensure that they are accurate and complete.

Benefits of Hiring an Accountant

There are many benefits to hiring an accountant for your small business, including:

- Save time:Accountants can save you time by taking care of your accounting needs, so you can focus on running your business.

- Save money:Accountants can help you save money by identifying tax deductions and other ways to reduce your expenses.

- Improve financial performance:Accountants can help you improve your financial performance by providing you with financial advice and guidance.

- Peace of mind:Accountants can give you peace of mind by ensuring that your accounting is accurate and complete.

Finding the Right Accountant

Finding the right accountant for your small business is important. Here are a few tips:

- Interview several accountants:Before hiring an accountant, interview several candidates to find the one who is the best fit for your business.

- Check references:Ask each accountant for references from previous clients.

- Assess their qualifications:Make sure that the accountant you hire is qualified and experienced.

Last Point

Ultimately, the cost of an accountant for a small business in the UK will vary depending on your specific needs and circumstances. However, by understanding the factors that influence the price, you can make an informed decision about whether or not hiring an accountant is right for your business.

The cost of hiring an accountant for a small business in the UK can vary depending on factors such as the size and complexity of the business, as well as the level of experience and qualifications of the accountant. Given the business rule that an employee may have many degrees , it is important to consider the specific needs of the business when determining the appropriate level of accounting support.

FAQ Section

What are the benefits of hiring an accountant for a small business?

There are many benefits to hiring an accountant for a small business, including:

- Saving time and money

- Improving financial performance

- Reducing the risk of errors

- Gaining access to expert advice

How do I find the right accountant for my small business?

There are a few things to consider when looking for an accountant for your small business, including:

- Experience

- Qualifications

- Cost

- Location

What are the different types of accounting services available for small businesses?

Depending on the complexity of the business, an accountant for a small business in the UK can cost between £1,000 and £3,000 per year. For those considering starting an event planning business, this cost should be factored into the budget.

Learn more about starting an event planning business. With careful planning, small businesses can find affordable accounting solutions that meet their needs.

There are a variety of accounting services available for small businesses, including:

- Bookkeeping

- Tax preparation

- Financial reporting

- Payroll

- Auditing

The cost of hiring an accountant for a small business in the UK can vary depending on the size and complexity of the business. For example , a small business with simple accounting needs may only need to pay a few hundred pounds per year for basic bookkeeping services, while a larger business with more complex accounting requirements may need to pay several thousand pounds per year for a full-service accountant.

To optimize profitability, small businesses in the UK should consider hiring an accountant. The cost of their services varies, so it’s essential to assess your needs and budget. An effective business model can also enhance financial performance. As outlined in eight components of an effective business model , a well-defined business model can streamline operations, reduce costs, and increase revenue.

By aligning your accounting practices with a solid business model, you can maximize the impact of an accountant’s expertise and drive financial success.

In the UK, accounting fees for small businesses can vary significantly. It’s important to factor in these costs when starting a business. Additionally, understanding whether a permit is required for an online business is crucial. For more information on this topic, refer to the article: Do I Need a Permit to Start an Online Business?

. Returning to the topic of accounting fees, it’s essential to research and compare quotes from different providers to ensure you get the best value for your money.