The brief job description of an accountant is a crucial document that Artikels the primary responsibilities, skills, and qualifications required for this essential role in the business world. Accountants play a vital role in ensuring the financial health and compliance of organizations, and this guide will delve into the intricacies of their multifaceted profession.

An accountant is responsible for recording, classifying, and summarizing financial transactions to provide information that is used to make business decisions. Accountants also prepare tax returns and provide financial advice. Accountants must have a strong understanding of accounting principles and practices.

Accountants work in a variety of settings, including businesses, government agencies, and non-profit organizations. In the past, accounting was considered an unsuitable job for a woman , but today, women make up a significant portion of the accounting workforce. Accountants must be able to work independently and as part of a team.

They must also be able to communicate effectively with clients and colleagues.

From financial reporting and analysis to tax compliance, auditing, and risk management, accountants are responsible for a wide range of tasks that contribute to the success of businesses. This guide will provide a comprehensive overview of the accountant’s role, highlighting the key aspects of their job and the impact they have on organizations.

Accountant: The Number Cruncher

If you’re a numbers whiz with a knack for making sense of financial chaos, becoming an accountant might be the perfect career for you. These financial superheroes play a crucial role in keeping businesses running smoothly, ensuring compliance with tax laws, and providing insights that help companies make informed decisions.

Role Overview

Accountants are responsible for a wide range of tasks, including:

- Preparing and analyzing financial statements

- Ensuring compliance with tax laws and regulations

- Conducting audits and providing assurance services

- Establishing and maintaining internal controls

- Communicating financial information to various stakeholders

To succeed in this role, you’ll need a strong foundation in accounting principles, as well as excellent analytical and communication skills.

When it comes to the daily grind, accountants are the superheroes of number crunching. They’re the ones who make sure the books balance and the taxes are filed on time. If you’re looking for an accounting gig in the Emerald Isle, check out an post jobs dublin . They’ve got a whole slew of opportunities for bean counters who are ready to show off their spreadsheet skills.

Financial Reporting and Analysis

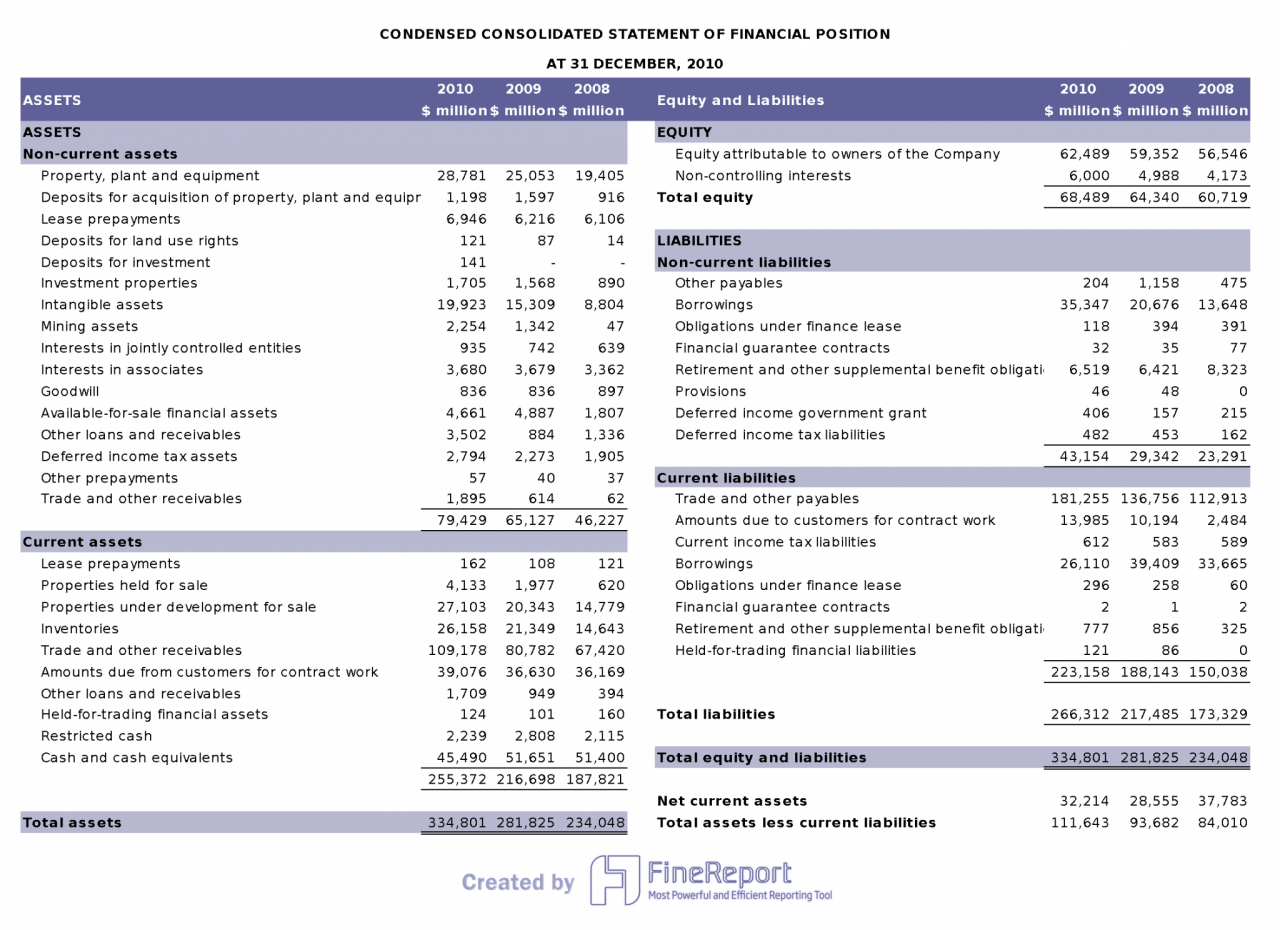

Accountants play a vital role in preparing financial statements, such as balance sheets and income statements, which provide a snapshot of a company’s financial health. They also analyze these statements to identify trends, assess risks, and make recommendations for improvement.

- Financial reporting: Accountants prepare financial statements that summarize a company’s financial transactions over a specific period.

- Financial analysis: Accountants use financial statements to analyze a company’s financial performance and make informed decisions.

Tax Compliance

Accountants are responsible for ensuring that businesses comply with tax laws and regulations. They prepare tax returns, advise clients on tax matters, and represent clients in tax audits.

Being an accountant is a role that can sometimes feel like an inside job, but that doesn’t mean it’s a secret. The phrase “inside job” means that something is done by people who are already in a position of trust or authority, and accountants often have access to sensitive financial information.

But don’t worry, accountants are also responsible for ensuring that financial records are accurate and that businesses are operating legally. So, while it may sometimes feel like an inside job, being an accountant is a vital role that helps businesses succeed.

- Tax return preparation: Accountants prepare tax returns for individuals and businesses.

- Tax consulting: Accountants provide tax advice to clients.

- Tax audit representation: Accountants represent clients in tax audits.

Auditing and Assurance

Accountants conduct audits to provide assurance that financial statements are accurate and reliable. They also provide other assurance services, such as reviewing internal controls and assessing compliance with laws and regulations.

- Auditing: Accountants conduct audits to provide assurance that financial statements are accurate and reliable.

- Assurance services: Accountants provide other assurance services, such as reviewing internal controls and assessing compliance with laws and regulations.

Internal Control and Risk Management, Brief job description of an accountant

Accountants play a key role in establishing and maintaining internal controls to prevent fraud and errors. They also assess risks and develop strategies to mitigate those risks.

Accountants are responsible for tracking and managing financial data, ensuring that financial statements are accurate and complete. They may also be involved in budgeting, forecasting, and auditing. Accountants typically need a bachelor’s degree in accounting or a related field. When asked why you left your last job, you can use the best answer for leaving a job on an application . Accountants also need strong analytical and problem-solving skills.

- Internal control: Accountants establish and maintain internal controls to prevent fraud and errors.

- Risk assessment: Accountants assess risks and develop strategies to mitigate those risks.

Communication and Reporting

Accountants communicate financial information to various stakeholders, including management, investors, and creditors. They use a variety of communication methods, including written reports, presentations, and financial statements.

The job of an accountant, which involves managing financial records and preparing financial statements, was once considered an unsuitable job for a woman, as depicted in the 1997 film An Unsuitable Job for a Woman . However, today, accountants are highly valued professionals who play a crucial role in businesses and organizations of all sizes.

- Financial reporting: Accountants communicate financial information to stakeholders.

- Communication methods: Accountants use a variety of communication methods, including written reports, presentations, and financial statements.

Closing Summary: Brief Job Description Of An Accountant

In conclusion, the brief job description of an accountant provides a detailed overview of the essential responsibilities, skills, and qualifications required for this critical role. Accountants are indispensable partners in the business world, ensuring financial accuracy, compliance, and risk mitigation.

If you’re an accountant, you know that being happy is an inside job. No matter how many spreadsheets you crunch or how many audits you complete, true happiness comes from within. As Gabriele Oettingen says, “Happiness is not something that happens to you.

It’s something you create.” So if you’re looking for a job that will make you happy, look no further than accounting. It’s a challenging and rewarding field that can give you the financial security and work-life balance you need to live a happy and fulfilling life.

Their expertise is vital for organizations of all sizes, and their contributions play a significant role in driving economic growth and stability.

FAQs

What are the primary responsibilities of an accountant?

Accountants are responsible for preparing and analyzing financial statements, ensuring compliance with tax laws and regulations, conducting audits and providing assurance services, establishing and maintaining internal controls, and communicating financial information to stakeholders.

What are the key skills and qualifications required for an accountant?

Accountants typically require a bachelor’s degree in accounting or a related field, along with strong analytical, communication, and problem-solving skills. They must also stay up-to-date on the latest accounting standards and regulations.

What are the different types of financial statements that accountants prepare?

Accountants are responsible for keeping track of a company’s financial transactions. They prepare financial statements, analyze financial data, and help companies make financial decisions. While accounting can be a challenging field, it can also be very rewarding. However, as an unsuitable job for a woman analysis suggests, the field of accounting has been historically dominated by men.

Despite this, there are many women who have succeeded in accounting and have made significant contributions to the field.

Accountants prepare various financial statements, including balance sheets, income statements, and cash flow statements. These statements provide a comprehensive overview of a company’s financial health and performance.

An accountant is responsible for managing financial records and preparing financial statements. They analyze financial data, prepare tax returns, and provide advice on financial matters. While this may seem like a straightforward job, it can be quite challenging, especially for a woman who is expected to be perfect and always in control.

As the article suggests, accounting is “an unsuitable job for a woman playing god.” However, despite these challenges, many women have found success in the field of accounting.

What are the different types of taxes that accountants deal with?

Accountants deal with various taxes, including income tax, sales tax, and property tax. They are responsible for ensuring that their clients comply with all applicable tax laws and regulations.

What are the different types of audits and assurance engagements that accountants conduct?

Accountants conduct various types of audits and assurance engagements, including financial statement audits, operational audits, and compliance audits. These engagements provide assurance to stakeholders about the accuracy and reliability of financial information.