Benefits of an LLC for small business? Oh, there’s a treasure trove! From shielding you from legal hassles to saving you a pretty penny on taxes, an LLC has got your back. Let’s dive into the details and discover how this business structure can empower your entrepreneurial journey.

If you’re a small business owner, you may be wondering if an LLC is right for you. LLCs offer a number of benefits, including limited liability, pass-through taxation, and flexibility. If you’re considering starting an RTX business , an LLC can be a great option.

RTX businesses are typically small businesses that are focused on research and development. They often receive funding from government grants or venture capitalists. If you’re interested in starting an RTX business, an LLC can help you protect your personal assets and give you the flexibility you need to grow your business.

Benefits of an LLC for Small Businesses

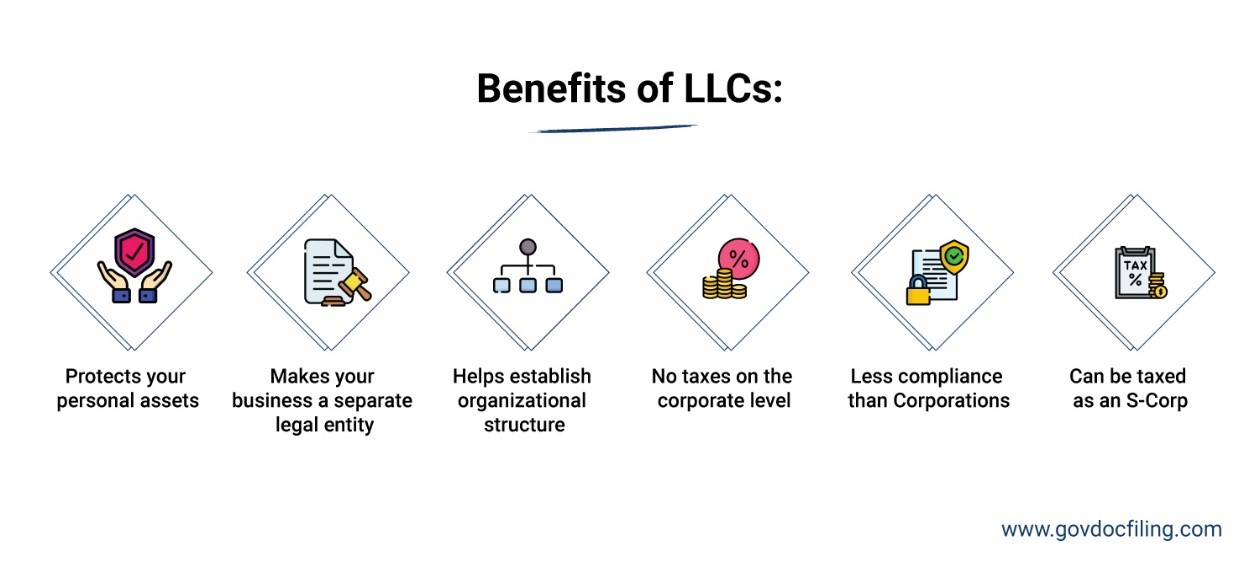

Limited liability companies (LLCs) offer a wide range of benefits to small businesses, including legal protection, tax advantages, flexibility, credibility and professionalism, asset protection, and easy transferability of ownership.

One major advantage of forming an LLC for your small business is the flexibility it offers. Whether you’re wondering are hotels an essential business or if your venture falls under a different category, an LLC structure allows for a wide range of business activities and provides liability protection for its owners.

Legal Protection, Benefits of an llc for small business

LLCs shield owners from personal liability for business debts and obligations. This means that if the business is sued, the owners’ personal assets, such as their homes and savings, are not at risk.

LLCs offer a ton of benefits for small businesses, like liability protection and tax flexibility. If you’re starting a new venture, you should definitely consider forming an LLC. For more info on the latest business trends, check out an introduction to business v 2.0 . Once you’ve got the basics down, you can focus on the specific benefits of an LLC for your business.

For example, if a small business owner is sued for negligence and the business is found liable, the owner’s personal assets would be protected if the business is an LLC. This can provide peace of mind and financial security for small business owners.

LLCs provide several benefits for small businesses, including liability protection, tax flexibility, and ease of management. If you’re considering starting an online business idea , forming an LLC can be a smart move. An LLC can help protect your personal assets from business debts and lawsuits.

It also allows you to choose how your business is taxed, which can save you money. Additionally, LLCs are relatively easy to manage, making them a good option for small business owners who don’t have a lot of time or resources.

Tax Advantages

LLCs offer pass-through taxation, which means that the business’s profits and losses are passed through to the owners and reported on their individual tax returns.

One of the key benefits of forming an LLC for your small business is that it provides liability protection for its owners. This means that if the business is sued, the owners’ personal assets are not at risk. Another benefit of an LLC is that it can help you save on taxes.

In addition, an LLC can help you build credibility with customers and clients. Just as you would want to put your best foot forward when meeting with potential customers or clients, it’s important to dress appropriately for an interview. Appropriate business attire can help you make a good impression and increase your chances of getting the job.

When choosing what to wear for an interview, it’s important to consider the company culture and the position you’re applying for. For example, if you’re applying for a job at a law firm, you’ll want to dress more formally than if you’re applying for a job at a tech startup.

Additionally, an LLC can provide you with flexibility and control over your business. This can be a major benefit for small business owners who want to have the freedom to make their own decisions.

This can save small businesses money on taxes because they are not subject to corporate income tax. In addition, LLCs can elect to be taxed as S corporations, which can provide even more tax savings.

An LLC can provide numerous advantages for small businesses, including limited liability protection and tax flexibility. International businesses, defined as firms that operate across national borders (an international business is a firm that) , can also benefit from forming an LLC to protect their assets and minimize their tax liability.

Additionally, LLCs can facilitate international expansion and provide a clear legal structure for cross-border transactions.

Flexibility

LLCs offer a great deal of flexibility in terms of management structure and profit distribution.

If you’re thinking about starting a small business, forming an LLC can provide numerous benefits, such as liability protection and tax flexibility. If you’re interested in learning more about becoming an entrepreneur and the steps involved in starting a small business, check out this guide: becoming an entrepreneur how to start a small business . Forming an LLC can also simplify the process of managing your business and its finances.

- Management structure:LLCs can be managed by their owners, by a board of managers, or by a combination of the two.

- Profit distribution:LLCs can distribute profits to their owners in any way they choose.

This flexibility allows small businesses to tailor their LLCs to their specific needs.

Concluding Remarks: Benefits Of An Llc For Small Business

So, there you have it! An LLC is like a superhero for your small business, protecting your assets, giving you tax breaks, and making you look like a pro. If you’re serious about growing your venture, forming an LLC is a no-brainer.

Embrace the benefits, and watch your business soar to new heights!

Question Bank

Is forming an LLC expensive?

The cost varies by state, but it’s typically a few hundred dollars to file the paperwork.

Can I form an LLC on my own?

Yes, but it’s recommended to consult with an attorney to ensure everything is done correctly.

Does an LLC protect my personal assets?

Yes, LLCs provide a layer of protection between your business and personal assets.

Can I have multiple owners in an LLC?

Yes, LLCs can have multiple owners, known as members.

LLCs offer several advantages to small businesses, including limited liability protection for owners, pass-through taxation, and flexibility in management structure. These benefits make LLCs an attractive option for entrepreneurs and small business owners alike. To learn more about the ethical considerations involved in business, I recommend reading An Introduction to Business Ethics by Joseph DesJardins , 5th Edition.

This comprehensive guide provides valuable insights into the principles and practices of ethical business conduct. Understanding business ethics is crucial for LLC owners as it helps them navigate the complex legal and regulatory landscape while maintaining a strong reputation and building trust with customers and stakeholders.