Apis improve an insurance agent’s business – In the ever-evolving insurance landscape, APIs (Application Programming Interfaces) have emerged as a game-changer, empowering agents to streamline operations, personalize customer interactions, and drive business growth. Join us as we delve into the transformative power of APIs and explore how they are revolutionizing the insurance industry.

APIs can significantly enhance an insurance agent’s business by streamlining processes and improving efficiency. For a comprehensive understanding of business ethics, refer to “An Introduction to Business Ethics: Joseph Desjardins, 6th Edition” here . With the knowledge gained from this book, agents can navigate ethical dilemmas and maintain high standards in their interactions with clients and colleagues, ultimately benefiting their business growth.

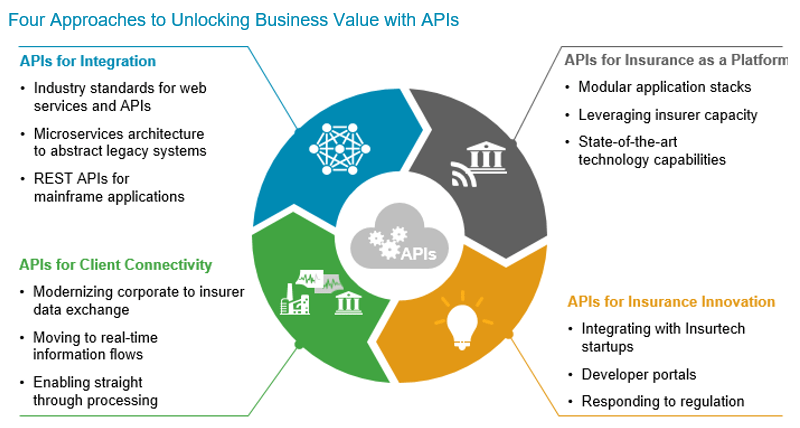

By seamlessly connecting systems and automating processes, APIs empower agents to work smarter, not harder. Real-time data access, personalized recommendations, and expanded product offerings are just a few of the benefits that APIs bring to the table. Get ready to witness how APIs are transforming the way insurance agents do business and elevate customer experiences.

APIs empower insurance agents to streamline processes, enhance customer service, and access real-time data. By leveraging APIs, agents can connect with a wider network of partners and data sources, which increases their perceived business opportunities . This expanded network allows agents to identify new prospects, cross-sell products, and provide personalized recommendations, ultimately driving business growth and profitability.

APIs Improve an Insurance Agent’s Business

Insurance agents can significantly enhance their business operations and customer service by leveraging application programming interfaces (APIs). APIs enable seamless integration between different software systems, streamlining communication, automating workflows, and providing personalized customer experiences.

APIs can help insurance agents streamline their processes, automate tasks, and improve customer service. By integrating APIs into their business, agents can access a wealth of data and tools that can help them grow their business. An introduction to business v 2.0 provides a comprehensive overview of the latest trends and technologies that are shaping the future of business.

By staying up-to-date on the latest developments, insurance agents can ensure that they are using the most effective tools and strategies to grow their business.

Streamlined Communication

APIs facilitate real-time communication between agents and clients, improving responsiveness and efficiency. They enable:

- Automated messaging for policy updates, reminders, and personalized notifications

- Appointment scheduling and management through integrated calendars

- Seamless policy delivery and document sharing via email or secure portals

Automated Workflows

APIs automate repetitive and time-consuming tasks, allowing agents to focus on more strategic initiatives. This includes:

- Automated data entry from forms and applications

- Streamlined policy generation and underwriting processes

- Automated renewal reminders and premium billing

Personalized Customer Experiences

APIs provide agents with access to real-time customer data, enabling them to tailor their services. This allows for:

- Personalized recommendations based on customer preferences and history

- Proactive outreach for cross-selling and up-selling opportunities

- Targeted marketing campaigns tailored to specific customer segments

Expanded Product Offerings

APIs enable agents to integrate third-party services into their offerings, expanding their value proposition. This includes:

- Financial planning tools for retirement and investment planning

- Health screenings and wellness programs

- Home security and monitoring services

Data Analytics and Insights, Apis improve an insurance agent’s business

APIs provide access to valuable data and analytics, empowering agents to make informed decisions. This enables:

- Tracking customer behavior and identifying trends

- Optimizing marketing strategies based on data-driven insights

- Identifying opportunities for growth and improvement

Collaboration and Integration

APIs facilitate collaboration between agents, insurers, and other stakeholders. This allows for:

- Seamless data sharing between agents and insurers

- Automated underwriting processes with real-time access to risk data

- Streamlined claims processing through automated communication and document exchange

Final Summary

In conclusion, APIs have become an indispensable tool for insurance agents, unlocking a world of possibilities. From streamlined communication to personalized customer experiences, APIs are driving efficiency, enhancing customer satisfaction, and opening doors to new revenue streams. As the insurance industry continues to embrace digital transformation, APIs will undoubtedly play an even more pivotal role in shaping the future of insurance.

APIs can revolutionize the insurance industry, streamlining processes and enhancing customer experiences. For insurance agents, this means increased efficiency, better decision-making, and improved profitability. By understanding an introduction to business management , agents can leverage APIs to optimize their operations and stay ahead in a competitive market.

APIs empower insurance agents to provide personalized policies, automate underwriting processes, and enhance risk assessment, ultimately improving their business outcomes and driving growth.

FAQ Corner: Apis Improve An Insurance Agent’s Business

How do APIs improve communication between agents and clients?

APIs facilitate automated messaging, appointment scheduling, and policy updates, enhancing communication efficiency and keeping clients informed.

APIs can streamline insurance agents’ operations by automating tasks, integrating data, and enhancing customer experiences. However, understanding the legal implications of using APIs is crucial. For a comprehensive overview of business law, refer to an introduction to business law . This resource provides valuable insights into contracts, torts, property law, and other essential concepts that impact insurance agents’ API usage and overall business practices.

Can APIs automate repetitive tasks for insurance agents?

By integrating APIs into their workflow, insurance agents can streamline their operations and provide better service to their clients. This can include automating tasks such as policy issuance, claims processing, and underwriting. In addition, APIs can help agents connect with other businesses, such as banks and financial institutions, to offer complementary services.

This can help agents build stronger relationships with their clients and grow their businesses. An LLP is a type of business structure that can be well-suited for insurance agents who want to take advantage of the benefits of APIs. LLPs offer limited liability protection, which means that the owners are not personally liable for the debts and liabilities of the business.

This can be a valuable benefit for insurance agents who are concerned about the potential risks of their business.

Yes, APIs can automate data entry, policy generation, and other repetitive tasks, freeing up agents to focus on more value-added activities.

How do APIs enable personalized customer experiences?

APIs provide agents with access to real-time customer data, enabling them to tailor recommendations, proactively reach out, and deliver personalized marketing campaigns.

APIs empower insurance agents to automate tasks and streamline processes, enhancing efficiency and productivity. Similarly, investing in equipment like laptops and software can also boost productivity by automating tasks, improving communication, and facilitating data analysis . By leveraging both APIs and cutting-edge equipment, insurance agents can optimize their workflows, increase customer satisfaction, and ultimately grow their businesses.

What are the benefits of expanded product offerings through APIs?

APIs allow agents to integrate third-party services, such as financial planning tools and health screenings, into their offerings, providing additional value to clients.

How do APIs contribute to data analytics and insights?

APIs provide access to valuable data and analytics, enabling agents to track customer behavior, identify trends, and optimize marketing strategies.

APIs can help insurance agents automate tasks, improve customer service, and increase sales. By integrating APIs into their business systems, agents can gain access to real-time data and insights that can help them make better decisions. An introduction to business systems analysis can provide agents with the knowledge and skills they need to implement and manage APIs effectively.

This can help them improve their business operations and provide better service to their customers.