An iou from a business or government – In the realm of finance, IOUs—short for “I owe you”—play a significant role. IOUs issued by businesses and governments have unique characteristics and implications that demand our attention. This comprehensive guide delves into the intricate world of IOUs, exploring their legal enforceability, accounting treatment, practical applications, and real-world examples.

An IOU from a business or government can be a valuable asset, representing a promise to repay a debt. An internet service provider , for example, may issue an IOU to a customer who has overpaid their bill. This IOU can then be used to offset future charges or request a refund.

As we embark on this journey, we’ll unravel the complexities of IOUs, empowering you with a deeper understanding of these financial instruments.

An IOU from a business or government is a legally binding document that acknowledges a debt. If you’re interested in learning more about business law, an introduction to business law can provide you with a comprehensive overview of the legal principles that govern business transactions.

Understanding these principles can help you navigate the complexities of business relationships and protect your interests. Additionally, an IOU from a business or government can be used as evidence in court to enforce payment of the debt.

Understanding IOUs

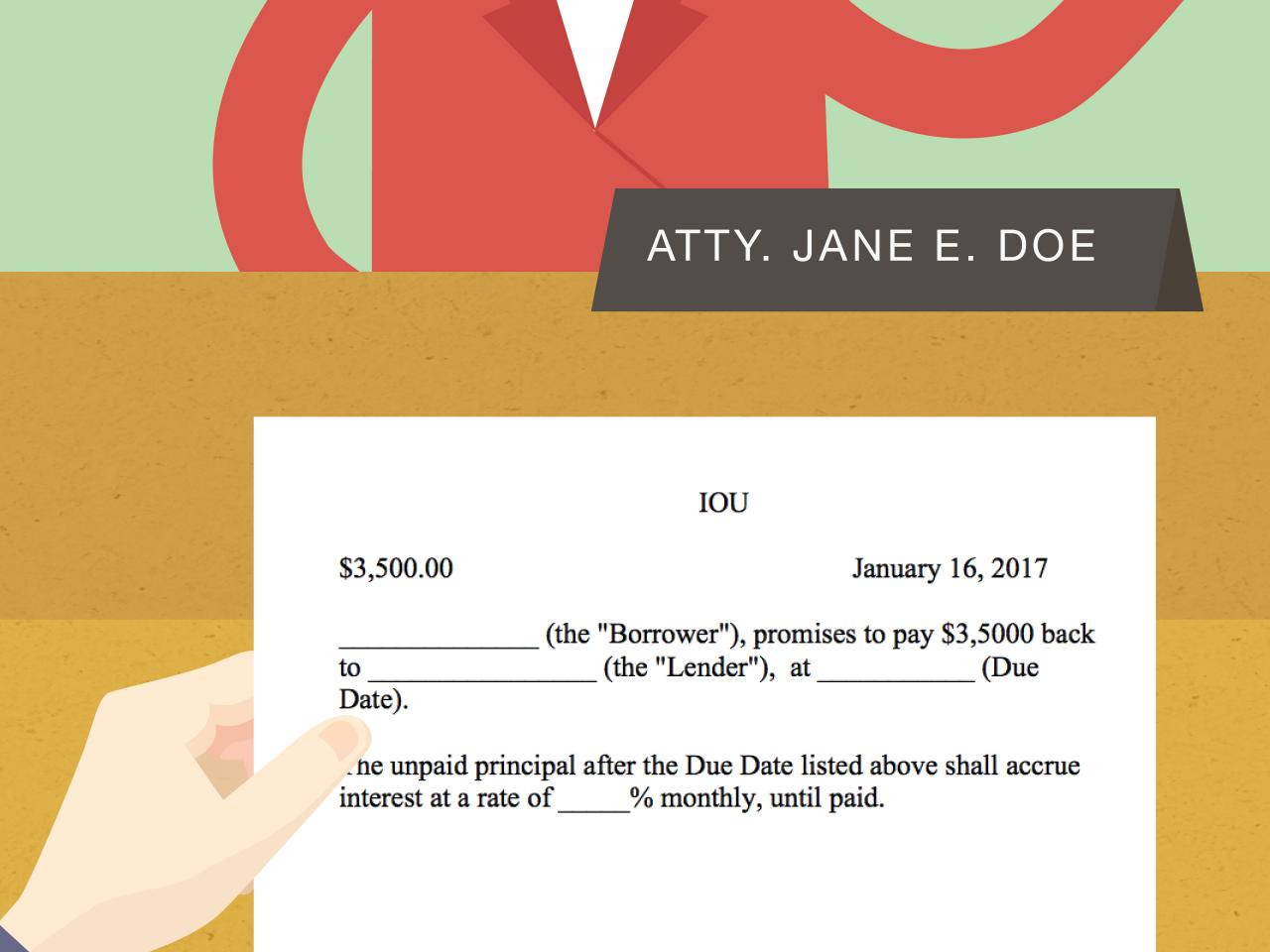

An IOU, short for “I owe you,” is a written or verbal acknowledgment of a debt. It typically includes the amount owed, the date it is due, and the names of the debtor and creditor. IOUs can be issued by individuals, businesses, or governments.

If you’re dealing with an IOU from a business or government, it’s best to avoid bringing it up in an important business meeting. While it’s important to address financial obligations, such matters are typically not appropriate for the agenda of a formal business meeting.

An important business meeting is typically reserved for discussing strategic initiatives, project updates, or other pressing business matters. It’s crucial to maintain professionalism and focus on the agenda at hand to ensure a productive and efficient meeting.

IOUs issued by businesses are often used as a temporary measure to bridge a gap in cash flow or to record a transaction that cannot be settled immediately. IOUs issued by governments, on the other hand, are typically used to finance government spending or to cover budget deficits.

Legal Implications of IOUs: An Iou From A Business Or Government

The legal enforceability of IOUs varies depending on the jurisdiction and the specific terms of the IOU. In general, however, IOUs are considered to be legally binding contracts.

An IOU from a business or government is a serious matter that can have ethical implications. If you’re interested in learning more about business ethics, I highly recommend checking out an introduction to business ethics joseph desjardins 6th edition . This book provides a comprehensive overview of the ethical issues that businesses face, and it can help you develop the skills you need to make ethical decisions in your own career.

IOUs from businesses or governments can be a complex issue, but understanding the ethical implications can help you make the right decision.

To be valid, an IOU must typically include the following essential elements:

- The amount of the debt

- The date it is due

- The names of the debtor and creditor

- A signature of the debtor

There are some potential legal risks associated with IOUs, such as the possibility of fraud or forgery. It is important to carefully review an IOU before signing it and to keep a copy for your records.

An IOU from a business or government can be a valuable asset, but it’s important to understand the ethical implications of such a document. An Introduction to Business Ethics by Joseph Desjardins (5th Edition) provides a comprehensive overview of the ethical issues surrounding business practices, including the responsible use of IOUs.

By understanding the ethical principles involved, individuals and organizations can ensure that IOUs are used fairly and responsibly.

Accounting Treatment of IOUs

IOUs are recorded in financial statements as either liabilities (if the IOU is owed to a creditor) or assets (if the IOU is owed to the business). The amount of the IOU is typically recorded at its face value.

IOUs can have a significant impact on a company’s financial ratios. For example, a large amount of IOUs can increase a company’s debt-to-equity ratio and reduce its liquidity.

IOUs are a great way to document a debt owed by a business or government. However, it’s important to understand the ethical implications of such agreements. An Introduction to Business Ethics, 4th Edition provides a comprehensive overview of the ethical principles that should guide business conduct, including the issuance of IOUs.

IOUs can also affect a company’s cash flow. For example, if a company has a large number of IOUs that are due in the short term, it may have difficulty meeting its financial obligations.

Practical Considerations for IOUs

There are both advantages and disadvantages to using IOUs.

- Advantages:

- IOUs can be a quick and easy way to borrow money.

- IOUs can be used to record transactions that cannot be settled immediately.

- IOUs can be used to build trust between parties.

- Disadvantages:

- IOUs can be difficult to enforce if the debtor does not pay.

- IOUs can damage the relationship between the debtor and creditor if the debt is not repaid.

- IOUs can be lost or stolen.

IOUs should only be used in situations where there is a high level of trust between the parties involved. It is important to carefully consider the advantages and disadvantages of using IOUs before entering into an agreement.

Case Studies and Examples

There are many real-world examples of IOUs being issued by businesses and governments.

One example is the IOUs that were issued by the US government during the Civil War. These IOUs were used to finance the war effort and were eventually repaid with interest.

Another example is the IOUs that were issued by the Greek government during the 2010 Greek debt crisis. These IOUs were used to cover budget deficits and were eventually exchanged for new bonds.

IOUs can have a significant impact on the issuing entities and the recipients. It is important to carefully consider the implications of issuing or receiving an IOU before entering into an agreement.

The increase in business taxes causes an iou from a business or government when the business is unable to pay its taxes. This can lead to a number of problems, including the business being unable to operate, the government being unable to provide services, and the economy being weakened.

For this reason, it is important to consider the consequences of increasing business taxes before doing so. An increase in business taxes causes a number of problems, including the business being unable to operate, the government being unable to provide services, and the economy being weakened.

Final Wrap-Up

Throughout this discussion, we’ve explored the multifaceted nature of IOUs from businesses and governments. We’ve delved into their legal implications, accounting treatment, practical considerations, and real-world applications. By grasping these concepts, you’re now equipped to navigate the world of IOUs with confidence.

Remember, IOUs are not mere pieces of paper; they carry legal obligations and financial consequences. Understanding their intricacies is paramount for businesses, governments, and individuals alike. As you encounter IOUs in your personal or professional life, may this guide serve as a valuable resource, empowering you to make informed decisions.

An IOU from a business or government can be a valuable asset, especially if the issuer is an international business with a strong reputation. These firms often have a global reach and are able to generate revenue from a variety of sources.

As a result, their IOUs can be seen as a relatively safe investment.

Q&A

What is the difference between a business IOU and a government IOU?

Business IOUs are issued by private companies, while government IOUs are issued by government entities. Business IOUs are typically used for short-term financing, while government IOUs can be used for both short-term and long-term financing.

Are IOUs legally enforceable?

Yes, IOUs are legally enforceable contracts. However, the enforceability of an IOU depends on factors such as its validity, consideration, and the jurisdiction in which it is issued.

How are IOUs recorded in financial statements?

IOUs are typically recorded as accounts receivable or accounts payable, depending on the perspective of the issuer and the recipient.

What are the advantages of using IOUs?

IOUs can provide a flexible and convenient way to finance short-term obligations. They can also help to build trust and goodwill between parties.