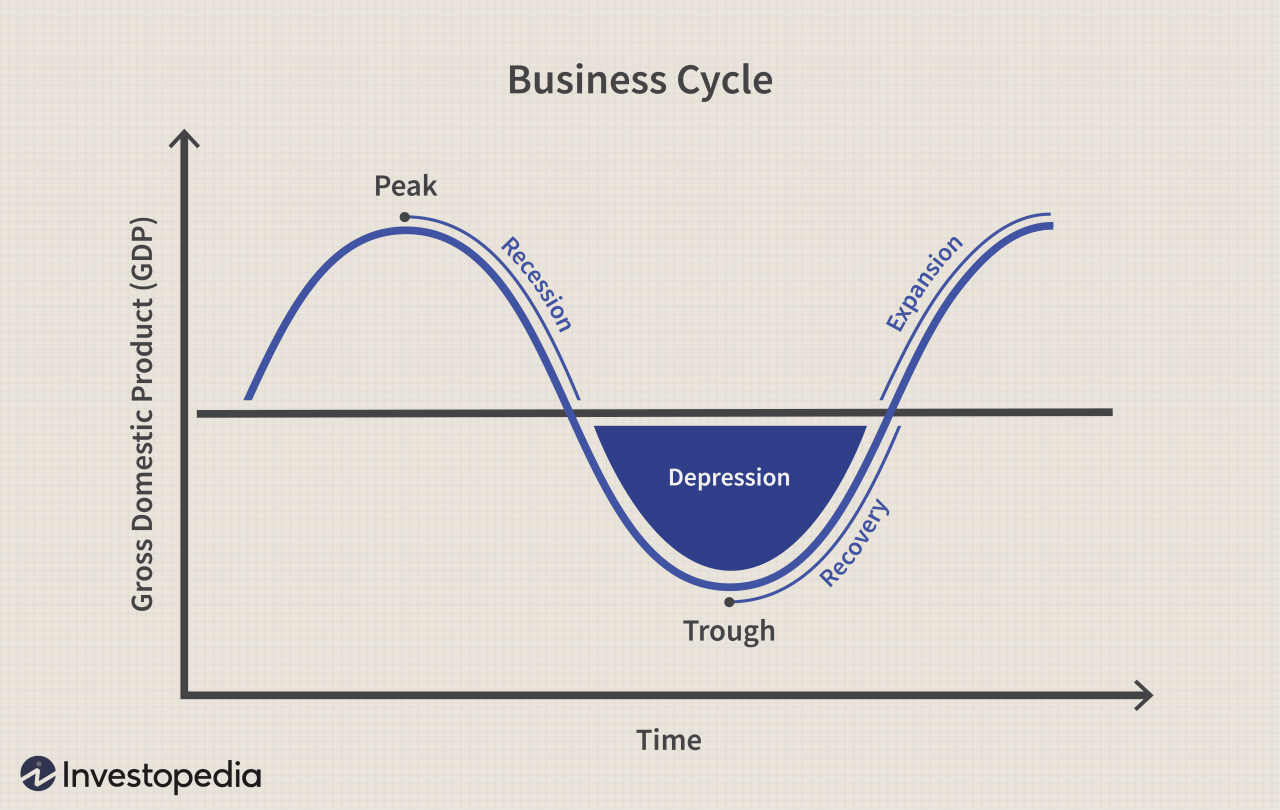

Imagine the economy as a rollercoaster, with its ups and downs, twists and turns. An equilibrium model of the business cycle is like a blueprint that helps us understand why this rollercoaster ride happens and how to navigate it. Get ready to dive into the fascinating world of economic cycles!

An equilibrium model assumes that the economy tends to balance itself out over time, like a seesaw finding its equilibrium point. These models capture the dynamic interactions between different parts of the economy, like investment, consumption, and government spending, to explain how they influence economic fluctuations.

Introduction

An equilibrium model of the business cycle is a theoretical framework that attempts to explain the fluctuations in economic activity around its long-run trend. These models assume that the economy will eventually return to its equilibrium state after being shocked away from it.Equilibrium

models of the business cycle typically focus on the interaction between aggregate demand and aggregate supply. Aggregate demand is the total demand for goods and services in an economy, while aggregate supply is the total supply of goods and services.

When aggregate demand is greater than aggregate supply, the economy will experience inflation. When aggregate demand is less than aggregate supply, the economy will experience recession.There are a number of different equilibrium models of the business cycle. One common type of model is the real business cycle model.

Real business cycle models assume that fluctuations in economic activity are caused by changes in technology or productivity. Another common type of model is the monetary business cycle model. Monetary business cycle models assume that fluctuations in economic activity are caused by changes in the money supply.

Key Assumptions

Equilibrium models of the business cycle make several simplifying assumptions in order to make the analysis of the business cycle more tractable. These assumptions include:

- Perfect competition:All firms and consumers are assumed to be price takers, meaning that they have no market power to influence prices.

- Rational expectations:Economic agents are assumed to form rational expectations about the future, meaning that they use all available information to make decisions that maximize their expected utility.

- Complete information:Economic agents are assumed to have perfect information about the economy, meaning that they know all of the relevant economic variables and their relationships.

- Constant returns to scale:Firms are assumed to experience constant returns to scale, meaning that their output is proportional to their inputs.

These assumptions simplify the analysis of the business cycle by reducing the number of variables that need to be considered and by eliminating the possibility of irrational behavior by economic agents.

Perfect Competition

The assumption of perfect competition is important because it implies that firms cannot influence prices. This means that the price of a good or service is determined by the interaction of supply and demand, and that firms cannot make profits by charging a higher price than the market price.

The equilibrium model of the business cycle is a useful tool for understanding the dynamics of the economy. The model suggests that the economy will fluctuate around an equilibrium point, and that these fluctuations will be driven by exogenous shocks.

In addition, the model predicts that the economy will return to equilibrium after a shock, although it may take some time. For example, can you video chat between an iphone and an android ? The equilibrium model of the business cycle can help us to understand how the economy will respond to such shocks, and how long it will take for the economy to recover.

Dynamic Equations

Dynamic equations are the mathematical equations that govern the behavior of an equilibrium model of the business cycle. These equations describe how the economy evolves over time and capture the cyclical behavior of output, employment, and other macroeconomic variables.

The dynamic equations of an equilibrium model of the business cycle typically include:

- An equation describing the evolution of the capital stock.

- An equation describing the evolution of the labor force.

- An equation describing the evolution of technology.

- An equation describing the evolution of the price level.

- An equation describing the evolution of the interest rate.

These equations are solved simultaneously to determine the equilibrium values of the endogenous variables of the model. The equilibrium values of these variables determine the cyclical behavior of the economy.

Capital Accumulation

The capital accumulation equation describes how the capital stock evolves over time. This equation typically takes the following form:

$$K_t+1 = (1-\delta)K_t + I_t$$

where:

- $K_t$ is the capital stock at time t.

- $\delta$ is the depreciation rate of capital.

- $I_t$ is investment at time t.

This equation states that the capital stock at time t+1 is equal to the capital stock at time t minus the depreciation of capital plus investment at time t.

An equilibrium model of the business cycle considers the dynamic interactions between economic variables over time. For example, an e-commerce company is currently celebrating ten years in business , highlighting the cyclical nature of economic activity. Equilibrium models aim to capture the underlying mechanisms driving these fluctuations, providing insights into economic policy and forecasting.

Equilibrium Conditions

In an equilibrium model of the business cycle, the equilibrium conditions ensure that the model is consistent and that the economy is in a state of balance. These conditions are:

- The demand for goods and services equals the supply of goods and services.

- The demand for labor equals the supply of labor.

- The demand for capital equals the supply of capital.

- The demand for money equals the supply of money.

These conditions ensure that the model is consistent and that the economy is in a state of balance. If any of these conditions are not met, the economy will not be in equilibrium and will experience fluctuations in output, employment, and prices.

The Demand for Goods and Services Equals the Supply of Goods and Services

The demand for goods and services is determined by the preferences of consumers and the prices of goods and services. The supply of goods and services is determined by the production function and the prices of inputs. In equilibrium, the quantity of goods and services demanded equals the quantity of goods and services supplied.

This condition ensures that there is no excess demand or supply in the market for goods and services.

The Demand for Labor Equals the Supply of Labor

The demand for labor is determined by the demand for goods and services and the production function. The supply of labor is determined by the preferences of workers and the wage rate. In equilibrium, the quantity of labor demanded equals the quantity of labor supplied.

This condition ensures that there is no excess demand or supply in the market for labor.

An equilibrium model of the business cycle captures the cyclical fluctuations in economic activity around a long-run equilibrium. For further insights into business cycles, consider checking out an awfully beastly business books , which provides a unique perspective on business dynamics.

This comprehensive guide explores various business cycle theories, offering valuable insights into the underlying mechanisms of economic fluctuations and the role of equilibrium in shaping them.

The Demand for Capital Equals the Supply of Capital

The demand for capital is determined by the production function and the interest rate. The supply of capital is determined by the savings of households and firms. In equilibrium, the quantity of capital demanded equals the quantity of capital supplied.

This condition ensures that there is no excess demand or supply in the market for capital.

An equilibrium model of the business cycle considers how economic factors interact to create fluctuations in output and employment. For example, can you video chat on snapchat with an android ? The answer is yes, but only if both users have the Snapchat app installed.

However, this interaction can affect the overall economic equilibrium, as changes in consumer spending and investment can lead to changes in output and employment.

The Demand for Money Equals the Supply of Money

The demand for money is determined by the transactions demand for money, the precautionary demand for money, and the speculative demand for money. The supply of money is determined by the monetary authority. In equilibrium, the quantity of money demanded equals the quantity of money supplied.

An equilibrium model of the business cycle can be used to analyze the behavior of the economy over time. The model can be used to explain how the economy moves from one equilibrium to another. For example, if there is a recession, the model can be used to explain how the economy will eventually recover.

This model can also be used to answer questions such as can you recover deleted pictures from an android phone . In an equilibrium model of the business cycle, the economy is assumed to be in a state of equilibrium, where all markets are in balance.

This means that the quantity of goods and services supplied is equal to the quantity demanded, and the price level is stable. The model can be used to analyze the effects of shocks to the economy, such as a change in government spending or a change in the money supply.

This condition ensures that there is no excess demand or supply in the market for money.

Comparative Statics

Comparative statics is a technique used to analyze the effects of changes in exogenous variables on the equilibrium of a model. In an equilibrium model of the business cycle, exogenous variables are those that are not determined within the model itself but are instead assumed to be given from outside.

An equilibrium model of the business cycle is a theoretical framework that attempts to explain the cyclical fluctuations in economic activity. While equilibrium models can provide insights into the causes of business cycles, they often rely on simplifying assumptions that may not fully capture the complexity of real-world economies.

For example, can you take screenshots on an android ? Equilibrium models typically assume that agents have perfect information and make rational decisions, which may not always be the case in practice. Despite these limitations, equilibrium models can still be useful for understanding the broad patterns of economic fluctuations and for guiding policy decisions.

Examples of exogenous variables include government spending, monetary policy, and technological shocks.By analyzing the effects of changes in exogenous variables, comparative statics can be used to understand the impact of policy changes. For example, a government that wants to stimulate the economy might consider increasing its spending.

Comparative statics can be used to predict the effects of this policy change on output, employment, and other macroeconomic variables.

Impact of Monetary Policy

One of the most important exogenous variables in an equilibrium model of the business cycle is monetary policy. Monetary policy is the set of actions taken by a central bank to control the money supply and interest rates.An expansionary monetary policy, which involves increasing the money supply or lowering interest rates, can lead to an increase in output and employment.

This is because lower interest rates make it cheaper for businesses to borrow money and invest, and for consumers to borrow money and spend.A contractionary monetary policy, which involves decreasing the money supply or raising interest rates, can lead to a decrease in output and employment.

This is because higher interest rates make it more expensive for businesses to borrow money and invest, and for consumers to borrow money and spend.

Stochastic Equilibrium

The equilibrium model of the business cycle can be extended to include stochastic shocks. Stochastic shocks are random events that can affect the economy, such as changes in technology, consumer preferences, or government policy. These shocks can generate business cycles by causing the economy to fluctuate around its equilibrium.

One way that stochastic shocks can generate business cycles is by affecting the aggregate supply curve. For example, a positive technology shock can shift the aggregate supply curve to the right, leading to an increase in output and a decrease in prices.

This can lead to a period of economic expansion.

Stochastic shocks can also affect the aggregate demand curve. For example, a negative consumer confidence shock can shift the aggregate demand curve to the left, leading to a decrease in output and an increase in prices. This can lead to a period of economic recession.

Impact of Stochastic Shocks on Business Cycles, An equilibrium model of the business cycle

- Stochastic shocks can generate business cycles by causing the economy to fluctuate around its equilibrium.

- Positive technology shocks can shift the aggregate supply curve to the right, leading to an increase in output and a decrease in prices.

- Negative consumer confidence shocks can shift the aggregate demand curve to the left, leading to a decrease in output and an increase in prices.

Policy Implications

Equilibrium models of the business cycle can provide valuable insights for policymakers seeking to stabilize the economy. These models can help policymakers understand the underlying causes of economic fluctuations and design policies that mitigate their effects.

One important implication of equilibrium models is that economic fluctuations are often caused by exogenous shocks, such as changes in technology or government policy. These shocks can lead to fluctuations in output, employment, and inflation. Policymakers can use equilibrium models to identify the sources of these shocks and design policies that offset their effects.

Fiscal Policy

Equilibrium models can also be used to evaluate the effectiveness of different fiscal policies. Fiscal policy refers to the use of government spending and taxation to influence the economy. Equilibrium models can help policymakers understand how fiscal policy affects aggregate demand and output.

This information can be used to design fiscal policies that stabilize the economy and promote economic growth.

Monetary Policy

Equilibrium models can also be used to evaluate the effectiveness of different monetary policies. Monetary policy refers to the use of interest rates and other tools by the central bank to influence the economy. Equilibrium models can help policymakers understand how monetary policy affects aggregate demand and output.

This information can be used to design monetary policies that stabilize the economy and promote economic growth.

Empirical Applications

Equilibrium models of the business cycle have been used in a variety of empirical applications to understand the causes and consequences of business cycles.One common application is to use these models to estimate the structural parameters that govern the behavior of the economy.

These parameters can then be used to simulate the model and generate artificial time series data that can be compared to actual economic data. This comparison can help to assess the model’s ability to capture the key features of the business cycle.Another

common application is to use equilibrium models to evaluate the effects of different economic policies. For example, a model can be used to simulate the effects of a fiscal stimulus package or a change in monetary policy. This can help policymakers to understand the potential consequences of their decisions before they are implemented.Empirical

applications of equilibrium models of the business cycle have helped to improve our understanding of the causes and consequences of business cycles. These models have also been used to evaluate the effects of different economic policies.

Example

One example of an empirical application of an equilibrium model of the business cycle is the work of Kydland and Prescott (1982). They used a real business cycle model to simulate the effects of different monetary policies on the economy.

An equilibrium model of the business cycle suggests that economic fluctuations are caused by exogenous shocks that shift the economy away from its long-run equilibrium. These shocks can be positive, such as an increase in consumer spending, or negative, such as a decline in investment.

In the case of an amazon seller celebrating ten years in business , the positive shock could be attributed to the growth of e-commerce and the increasing popularity of online shopping. The equilibrium model of the business cycle can help us understand how the economy responds to these shocks and how it eventually returns to its long-run equilibrium.

They found that a contractionary monetary policy can lead to a recession, while an expansionary monetary policy can lead to an economic boom.

Limitations

Equilibrium models of the business cycle, despite their ability to provide insights into economic fluctuations, are not without limitations. These models face challenges in capturing the complexities of real-world economies, leading to potential inaccuracies in their predictions.

One major limitation lies in the simplifying assumptions made by these models. To make the models tractable, they often assume perfect competition, rational expectations, and constant returns to scale. However, these assumptions may not hold in real-world economies, where market imperfections, irrational behavior, and increasing returns to scale are prevalent.

Challenges in Application

- Data Limitations:Equilibrium models require extensive data on economic variables to estimate their parameters. However, obtaining accurate and timely data can be challenging, especially for developing countries or for variables that are not directly observable.

- Model Complexity:Equilibrium models can become highly complex, making it difficult to interpret their results and assess their reliability. The complexity arises from the need to incorporate multiple sectors, agents, and interactions, which can lead to computational challenges and potential errors.

- Policy Implementation:Even if equilibrium models provide accurate predictions, implementing policies based on their recommendations can be difficult. Policymakers may face political constraints, time lags, and unintended consequences that can hinder the effective implementation of model-based policies.

Final Summary

Equilibrium models of the business cycle are powerful tools that have shed light on the causes and consequences of economic ups and downs. They help policymakers design strategies to stabilize the economy, like adjusting interest rates or fiscal policies. While these models have limitations, they continue to provide valuable insights into the complex world of economic cycles.

Popular Questions: An Equilibrium Model Of The Business Cycle

What is an equilibrium model of the business cycle?

It’s a simplified representation of the economy that assumes it tends to balance itself out over time, explaining how different factors interact to create economic cycles.

How do these models help us understand the economy?

They capture the dynamic relationships between investment, consumption, government spending, and other factors, showing how they influence economic ups and downs.

What are the limitations of these models?

They are simplified representations and may not fully capture all the complexities of the real-world economy.