An affiliated business arrangement disclosure is due. It’s a crucial step that ensures transparency and compliance in business dealings. Dive into this comprehensive guide to grasp the significance, requirements, and best practices of affiliated business arrangement disclosures.

Understanding the concept, identifying affiliated parties, and adhering to disclosure deadlines are essential aspects that we’ll explore in detail.

Disclosure Overview

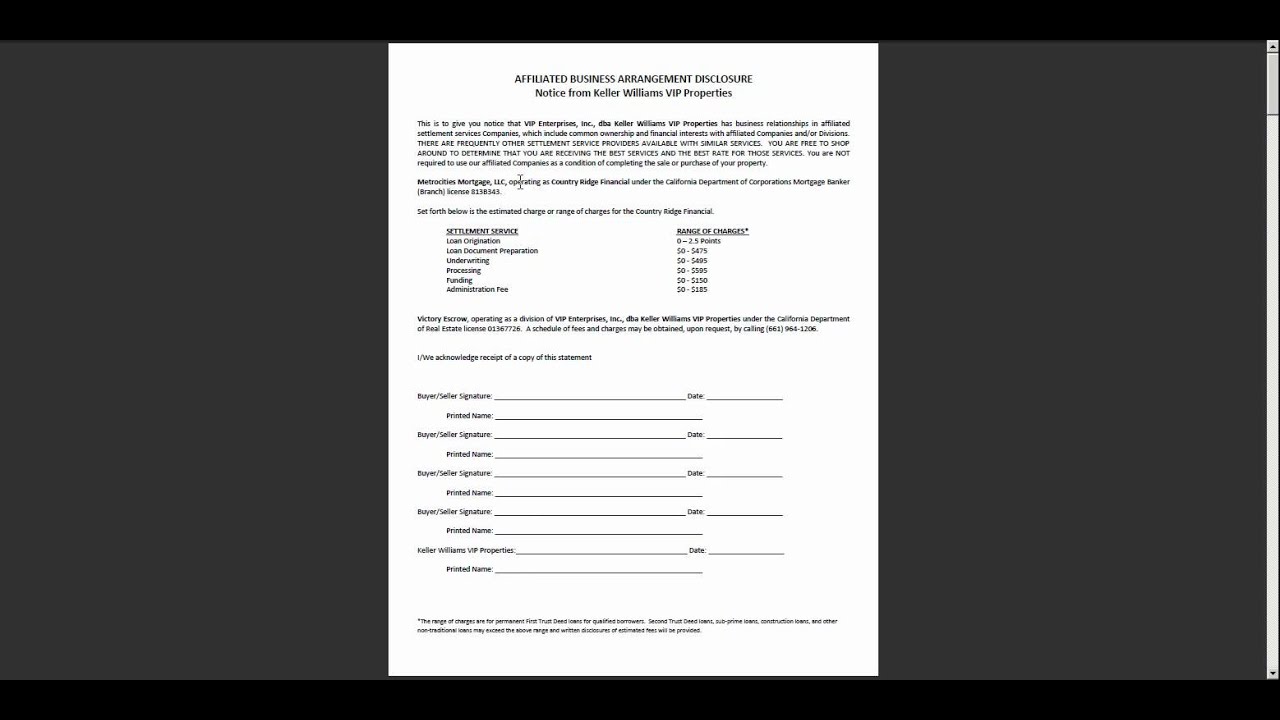

Affiliated business arrangement disclosures are crucial for providing transparency and protecting consumers. They reveal relationships between businesses that may influence transactions or recommendations.

Legally, such disclosures are mandated to ensure that consumers are fully informed about potential conflicts of interest and can make informed decisions. Failure to disclose affiliated business arrangements can result in legal consequences.

Legal Requirements

- The Federal Trade Commission (FTC) requires businesses to disclose any material connections they have with other entities that could affect their recommendations or actions.

- The Securities and Exchange Commission (SEC) mandates disclosure of affiliated business relationships in financial reporting.

- Various state laws also impose disclosure obligations for affiliated business arrangements.

Identifying Affiliated Parties

In the context of business arrangements, affiliated parties refer to individuals or entities that have a close relationship or common interest that could potentially influence their business dealings.

Common types of affiliated relationships include:

Related Parties

- Family members, including spouses, siblings, and children

- Business partners or joint venture participants

- Companies with common ownership or control

Financial Relationships

- Companies with significant investments in each other

- Companies that share common lenders or investors

- Companies that provide or receive substantial financial support to each other

Management Relationships, An affiliated business arrangement disclosure is due

- Companies with interlocking boards of directors

- Companies with shared management personnel

- Companies that have entered into management contracts with each other

Disclosure Timing and Content

Submitting affiliated business arrangement disclosures is crucial for transparency and ethical conduct. These disclosures provide clear information about potential conflicts of interest, allowing for informed decision-making by stakeholders.

Deadlines for submitting disclosures vary depending on the industry and regulatory requirements. It’s essential to adhere to these deadlines to ensure compliance and avoid any potential penalties or reputational damage.

Remember that an affiliated business arrangement disclosure is due soon. As you work on that, consider that many businesses are shifting to outsourced IT help desks for better efficiency and cost-effectiveness. Learn more about the 5 reasons businesses shift to an outsourced it help desk and see if it’s a good fit for your business.

Don’t forget to complete your affiliated business arrangement disclosure on time.

Key Information in Disclosures

- Identification of all affiliated parties involved in the business arrangement.

- Nature and extent of the affiliation, including any financial or ownership relationships.

- Potential conflicts of interest that may arise from the affiliation.

- Steps taken to manage or mitigate these conflicts of interest.

- Any other relevant information that may assist stakeholders in understanding the nature of the affiliated business arrangement.

Disclosure Methods

There are several methods available for disclosing affiliated business arrangements. The most appropriate method depends on the specific circumstances, such as the size and complexity of the arrangement, the number of parties involved, and the regulatory requirements applicable to the parties.

Common methods of disclosure include:

- Written disclosures:These disclosures are typically provided in the form of a written contract or agreement between the parties. The disclosure should clearly and concisely describe the nature of the affiliated business arrangement, including the identity of the affiliated parties, the services to be provided, and the compensation to be paid.

Heads up, folks! An affiliated business arrangement disclosure is due, but hold that thought for a sec. Have you ever wondered if you can record TV shows on an Android box? It’s a thing, you know! Check out this for the scoop.

Now, back to that disclosure…

- Oral disclosures:These disclosures are made verbally, typically in a meeting or phone call. Oral disclosures should be clear and concise, and should include the same information as written disclosures. However, oral disclosures are not as reliable as written disclosures, as they can be difficult to remember and may be subject to misinterpretation.

- Electronic disclosures:These disclosures are made electronically, typically through email or a website. Electronic disclosures should be clear and concise, and should include the same information as written disclosures. However, electronic disclosures may not be as reliable as written disclosures, as they can be difficult to access and may be subject to technical problems.

In addition to these methods, there are a number of other ways to disclose affiliated business arrangements. The most important thing is to choose a method that is clear, concise, and reliable, and that meets the specific requirements of the parties involved.

Consequences of Non-Disclosure

Failing to make timely and accurate affiliated business arrangement disclosures can have serious legal and financial consequences for individuals and businesses. These consequences can include:

Legal Consequences

* Lawsuits filed by regulators or consumers

- Fines and penalties imposed by regulatory agencies

- Damage to reputation and loss of trust

- Loss of business licenses or permits

Financial Consequences

* Loss of revenue due to decreased consumer confidence

- Increased costs of compliance and legal defense

- Loss of business opportunities

- Inability to secure financing or insurance

It is important to note that the specific consequences of non-disclosure can vary depending on the jurisdiction and the specific circumstances of the case. However, it is always advisable to comply with all applicable disclosure requirements to avoid potential legal and financial risks.

Since an affiliated business arrangement disclosure is due, we’re unable to go into detail about the specifics of the agreement. However, we can provide some general information that may be helpful. For example, if you’re wondering can you use an android tablet without a data plan , the answer is yes, you can.

You can use Wi-Fi to connect to the internet and access all of your favorite apps and websites. And when you’re not near a Wi-Fi hotspot, you can still use your tablet to play games, read books, or watch movies.

We hope this information is helpful. Please let us know if you have any other questions.

Best Practices for Disclosure: An Affiliated Business Arrangement Disclosure Is Due

To ensure the effectiveness and transparency of affiliated business arrangement disclosures, industry best practices recommend adhering to specific guidelines and avoiding common pitfalls. These practices help organizations maintain ethical standards, build trust with stakeholders, and comply with regulatory requirements.

By following these best practices, organizations can enhance the clarity and accessibility of their disclosures, enabling stakeholders to make informed decisions and maintain confidence in the integrity of business relationships.

Clear and Concise Language

- Use plain and straightforward language that is easily understood by a wide range of stakeholders.

- Avoid technical jargon and legalistic terms that may obscure the meaning of the disclosure.

- Present information in a logical and organized manner, with clear headings and subheadings.

Transparency and Completeness

- Provide full and accurate information about the nature and extent of the affiliated business arrangement.

- Disclose all potential conflicts of interest, including financial relationships, family ties, or other connections.

- Avoid using vague or ambiguous language that could mislead stakeholders.

Timeliness and Accessibility

- Make disclosures promptly and in a timely manner, before any potential conflicts of interest arise.

- Ensure that disclosures are easily accessible to all relevant stakeholders, including investors, customers, and regulators.

- Consider using multiple channels for disclosure, such as websites, annual reports, and press releases.

Regular Review and Updates

- Review disclosures regularly to ensure they remain accurate and up-to-date.

- Update disclosures as necessary to reflect changes in the affiliated business arrangement or any new potential conflicts of interest.

- Seek legal counsel to ensure compliance with regulatory requirements and industry best practices.

Avoiding Common Pitfalls

- Lack of Clarity:Avoid using vague or ambiguous language that could mislead stakeholders.

- Incomplete Disclosure:Ensure that all material information about the affiliated business arrangement is disclosed.

- Untimely Disclosure:Make disclosures promptly and in a timely manner, before any potential conflicts of interest arise.

- Inaccessible Disclosure:Ensure that disclosures are easily accessible to all relevant stakeholders.

- Lack of Regular Review:Review disclosures regularly to ensure they remain accurate and up-to-date.

Case Studies and Examples

To illustrate the effectiveness of affiliated business arrangement disclosures, we present case studies and real-world examples that showcase successful implementations.

These examples highlight key factors that contributed to their effectiveness, providing valuable insights for businesses seeking to enhance their own disclosure practices.

Case Study: XYZ Corporation

XYZ Corporation, a publicly traded company, implemented a comprehensive disclosure policy for affiliated business arrangements. The policy required all material transactions with affiliated parties to be disclosed in a timely and transparent manner.

The disclosure included details such as the nature of the transaction, the parties involved, the value of the transaction, and any potential conflicts of interest. This information was presented in a clear and concise format, ensuring accessibility and understanding for investors and stakeholders.

An affiliated business arrangement disclosure is due today. Have you considered how you’ll track progress on the associated initiatives? For instance, can you track an iPhone from an Android phone ? I’m curious to know if that’s possible. Anyway, getting back to the topic, we need to finalize the disclosure for the affiliated business arrangement.

As a result of its robust disclosure practices, XYZ Corporation gained credibility and trust among investors, who appreciated the transparency and accountability demonstrated by the company. The company also experienced increased investor confidence, leading to a positive impact on its stock price and overall financial performance.

Case Study: ABC Mutual Fund

ABC Mutual Fund, a leading investment firm, adopted a proactive approach to affiliated business arrangement disclosure. The fund implemented a policy that required all portfolio managers to disclose any potential conflicts of interest, including any relationships with affiliated companies or individuals.

The fund also established a dedicated compliance team to review and monitor all affiliated business arrangements, ensuring compliance with regulatory requirements and internal policies. This proactive approach fostered trust among investors and helped the fund maintain a strong reputation for ethical and responsible investing.

Regulatory Considerations

Regulatory agencies play a crucial role in enforcing affiliated business arrangement disclosure requirements. They ensure transparency and protect consumers from conflicts of interest.

Relevant Laws and Regulations

Numerous laws and regulations govern affiliated business arrangement disclosures. These include:

- Securities and Exchange Commission (SEC) Rule 206(4)-2

- Financial Industry Regulatory Authority (FINRA) Rule 2210

- Investment Advisers Act of 1940

- Sarbanes-Oxley Act of 2002

These regulations mandate that affiliated parties disclose their relationships and potential conflicts of interest to investors and clients.

Ethical Considerations

Affiliated business arrangements raise ethical considerations regarding transparency and potential conflicts of interest. Understanding these ethical implications is crucial for maintaining trust and integrity in business dealings.

Transparency is essential to ensure that all parties involved in an affiliated business arrangement are fully aware of the nature of the relationship and any potential conflicts of interest. This allows informed decision-making and helps prevent situations where one party may take advantage of the other.

Disclosure of Conflicts of Interest

Disclosure of conflicts of interest is a key ethical obligation. By disclosing potential conflicts, parties can demonstrate their commitment to fairness and transparency. This disclosure should be made in a timely and comprehensive manner, allowing all parties to assess the potential impact of the conflict on the transaction or relationship.

Hey guys, just a heads up that an affiliated business arrangement disclosure is due soon. If you’re wondering if you can use an Android TV with an iPhone, check out this article: can you use an android tv with an iphone . It’s got all the info you need.

Anyway, back to the disclosure…

Impact on Financial Reporting

Affiliated business arrangement disclosures have a significant impact on financial reporting practices. These disclosures provide essential information to users of financial statements, allowing them to understand the nature and extent of relationships between the reporting entity and its affiliated parties.

Before I forget, I need to get that affiliated business arrangement disclosure out of the way. Speaking of which, I’ve been curious about the life of an agile business analyst lately. So, I decided to check out a day in the life of an agile business analyst . After reading about their daily tasks and responsibilities, I’m now back to the present, with the affiliated business arrangement disclosure still on my to-do list.

The disclosures also help to ensure that the financial statements are presented fairly and accurately.

The accounting standards and principles that apply to affiliated business arrangement disclosures are set forth in the International Financial Reporting Standard (IFRS) 10, Consolidated Financial Statements. IFRS 10 requires that entities disclose all material relationships with affiliated parties, including the nature of the relationship, the transactions between the entities, and the effects of the transactions on the financial statements.

Materiality

The materiality of an affiliated business arrangement is determined by its potential to affect the financial statements. A relationship is considered material if it could reasonably be expected to influence the economic decisions of users of the financial statements.

Disclosure Requirements

The specific disclosure requirements for affiliated business arrangement disclosures vary depending on the nature of the relationship. However, the following general requirements apply to all material relationships:

- The nature of the relationship

- The transactions between the entities

- The effects of the transactions on the financial statements

Impact on Financial Statements

The disclosures required by IFRS 10 can have a significant impact on the financial statements. For example, the disclosure of a material related-party transaction may result in the adjustment of the financial statements to eliminate any related-party gains or losses.

Hey there! Just a quick reminder that an affiliated business arrangement disclosure is due soon. While you’re getting that sorted, have you ever wondered can you skype on an android ? It’s a pretty handy feature if you need to video call someone who doesn’t have a Skype account.

Just make sure to double-check that affiliated business arrangement disclosure before the deadline!

Additionally, the disclosure of a material affiliated business arrangement may result in the consolidation of the financial statements of the affiliated entities.

Emerging Trends and Future Considerations

The landscape of affiliated business arrangement disclosures is constantly evolving, driven by technological advancements, regulatory changes, and evolving stakeholder expectations. Several emerging trends and potential future developments are shaping the disclosure landscape.

One notable trend is the increasing adoption of digital disclosure platforms. These platforms enable companies to disclose information in a more accessible and user-friendly format, making it easier for stakeholders to understand and engage with the disclosures.

Data Analytics and Artificial Intelligence

Data analytics and artificial intelligence (AI) are also playing a significant role in enhancing disclosure practices. These technologies can be used to analyze large volumes of data and identify patterns and trends that may not be apparent through manual review.

This can help companies improve the accuracy and completeness of their disclosures.

Focus on Sustainability and ESG

In recent years, there has been a growing focus on sustainability and environmental, social, and governance (ESG) factors. This has led to increased demand for disclosures that provide information about a company’s sustainability performance and its impact on stakeholders.

Regulatory Developments

Regulatory bodies are also continuing to review and update their disclosure requirements. These changes aim to enhance the transparency and comparability of disclosures and ensure that investors and other stakeholders have access to the information they need to make informed decisions.

End of Discussion

Mastering affiliated business arrangement disclosures empowers you to navigate complex business relationships with clarity and integrity. Remember, transparency fosters trust and mitigates risks, making this disclosure a cornerstone of ethical and compliant business practices.

Detailed FAQs

What is an affiliated business arrangement?

An affiliated business arrangement exists when two or more entities share a common ownership or control structure.

Why are affiliated business arrangement disclosures important?

Disclosures provide transparency, prevent conflicts of interest, and ensure compliance with legal and regulatory requirements.

When are affiliated business arrangement disclosures due?

Deadlines vary depending on the specific regulations and circumstances, but it’s typically within a reasonable time frame after the arrangement is established.

What are the consequences of non-disclosure?

Failure to disclose can result in legal penalties, reputational damage, and loss of trust.

How can I ensure effective affiliated business arrangement disclosures?

Follow best practices such as providing clear and accurate information, using appropriate disclosure methods, and seeking professional guidance when needed.