In the realm of expense management, an accountable expense reimbursement plan emerges as a game-changer, offering a seamless and transparent way for businesses to empower their employees while ensuring compliance with tax regulations. Join us as we delve into the nuances of this essential plan, uncovering its benefits, requirements, and best practices.

To maintain accountability and transparency, an accountable expense reimbursement plan is crucial. Just like how effective classroom lesson plans have seven key components as outlined here , expense reimbursement plans also require clear guidelines and documentation to ensure proper tracking and approval of employee expenses.

This comprehensive guide will equip you with the knowledge to design, implement, and maintain an accountable expense reimbursement plan that meets the needs of your organization and ensures the well-being of your employees.

Introduction

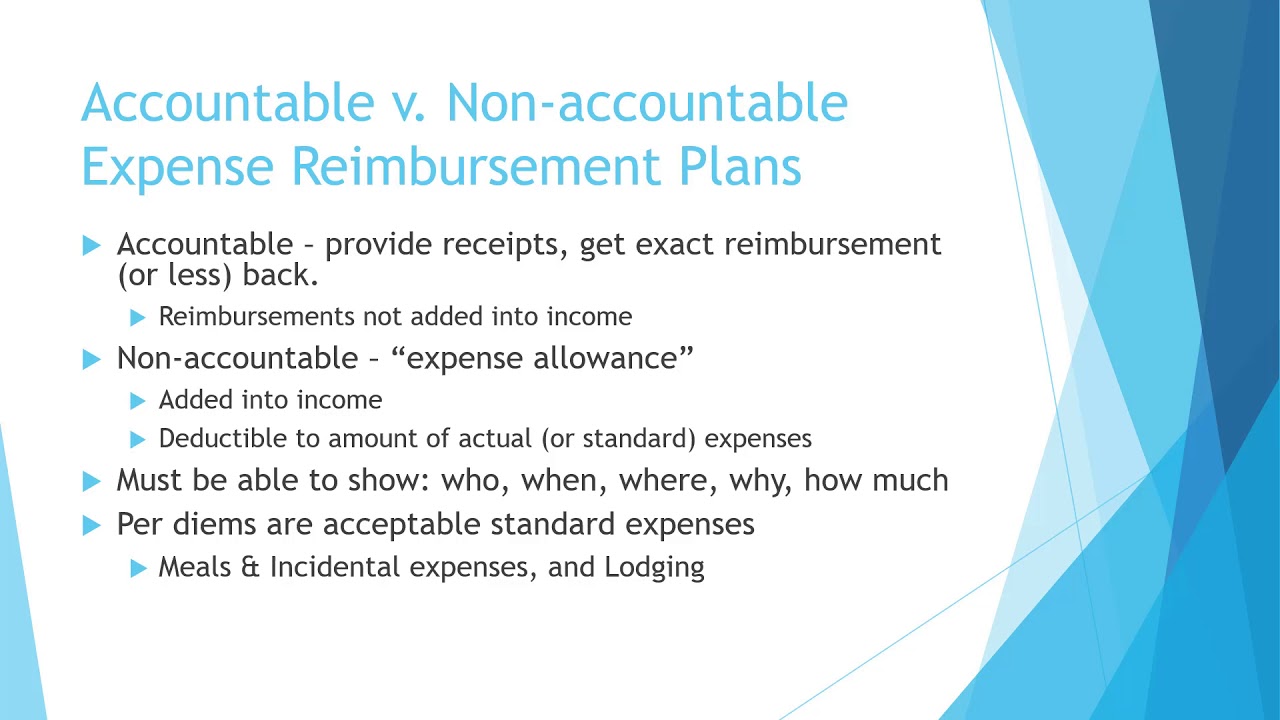

An accountable expense reimbursement plan is a system that allows employees to be reimbursed for business-related expenses they incur on behalf of their employer. These plans offer several benefits, including the ability to deduct certain expenses from taxes and the convenience of not having to pay for expenses out of pocket.

To qualify as an accountable plan under IRS regulations, the plan must meet the following requirements:

- The expenses must be ordinary and necessary for the employee’s job.

- The employee must adequately account for the expenses, including providing receipts or other documentation.

- The employee must return any excess reimbursement within a reasonable period of time.

Eligibility

All employees who incur business-related expenses on behalf of their employer are eligible to participate in an accountable expense reimbursement plan. This includes employees who work full-time, part-time, or on a contract basis.

An accountable expense reimbursement plan ensures that employees are reimbursed for legitimate business expenses, which is crucial for maintaining a budget, as a budget is an informal plan for future business activities . By following specific guidelines and providing proper documentation, employees can be reimbursed for their expenses, ensuring that they are not personally liable for business costs.

To substantiate expenses, employees must provide documentation such as receipts, invoices, or credit card statements. The documentation must show the date, amount, and purpose of the expense.

Reimbursement Procedures

The process for submitting and reimbursing expenses varies from company to company. Typically, employees submit an expense report to their supervisor or manager for approval. The expense report should include a list of the expenses, the amounts, and the supporting documentation.

Once the expense report is approved, the employee is reimbursed for the expenses. The reimbursement can be made by check, direct deposit, or credit card.

There are typically timelines and limitations for reimbursement. For example, employees may be required to submit their expense reports within a certain number of days after incurring the expenses. Additionally, there may be a limit on the amount of expenses that can be reimbursed.

Accountability

Employees are responsible for accounting for the expenses they incur on behalf of their employer. This means providing documentation to support the expenses and returning any excess reimbursement within a reasonable period of time.

Failure to meet the accountability requirements can result in the employee being taxed on the reimbursed expenses. Additionally, the employer may be subject to penalties.

Examples of acceptable expenses include travel expenses, meals and entertainment expenses, and office supplies.

Examples of unacceptable expenses include personal expenses, such as groceries or clothing, and expenses that are not ordinary and necessary for the employee’s job.

Tax Implications

Reimbursed expenses are not taxable to the employee if the plan meets the IRS requirements for an accountable plan. However, if the plan does not meet the requirements, the reimbursed expenses are taxable to the employee.

The accountable plan does not affect the employee’s Social Security or Medicare taxes.

Examples of taxable reimbursements include reimbursements for personal expenses and reimbursements for expenses that are not ordinary and necessary for the employee’s job.

An accountable expense reimbursement plan is a great way to track your expenses and get reimbursed for them. If you’re self-employed, you may also be interested in a retirement plan offered for the self-employers . An accountable expense reimbursement plan can help you save money for retirement, and it can also help you reduce your taxes.

Be sure to keep track of your expenses and receipts so that you can get reimbursed for them. An accountable expense reimbursement plan is a great way to manage your finances and get the most out of your money.

Examples of non-taxable reimbursements include reimbursements for travel expenses, meals and entertainment expenses, and office supplies.

An accountable expense reimbursement plan is a way to get your employer to pay for certain expenses that you incur while working. For example, if you have to travel for work, you can submit an expense report to your employer and they will reimburse you for the cost of your travel.

A retirement plan offered by an employer is a defined contribution plan , meaning that the employer contributes a set amount of money to the plan each year. An accountable expense reimbursement plan is a great way to save money on your taxes, and it can also help you to save for retirement.

Design and Implementation

When designing and implementing an accountable expense reimbursement plan, it is important to have clear policies and procedures.

The policies and procedures should include the following:

- The eligibility requirements for participation in the plan.

- The documentation requirements for substantiating expenses.

- The process for submitting and reimbursing expenses.

- The timelines and limitations for reimbursement.

- The consequences of failing to meet the accountability requirements.

It is also important to communicate the policies and procedures to employees.

Compliance and Audit: An Accountable Expense Reimbursement Plan

It is important to comply with IRS regulations when administering an accountable expense reimbursement plan. Failure to comply can result in the plan being disqualified and the employees being taxed on the reimbursed expenses.

The IRS may audit an accountable expense reimbursement plan to ensure that it is compliant with the regulations.

To minimize audit risk, employers should do the following:

- Have a written plan document that meets the IRS requirements.

- Communicate the plan to employees.

- Train employees on the plan’s requirements.

- Monitor the plan to ensure that it is being administered properly.

Final Review

In conclusion, an accountable expense reimbursement plan is not just a policy; it’s a strategic tool that fosters trust, accountability, and compliance within your organization. By embracing its principles, you can empower your employees, streamline expense management, and stay on the right side of tax regulations.

Remember, the success of any plan lies in its implementation and adherence. Stay vigilant in reviewing and updating your plan to ensure it remains effective and compliant. Invest in employee education and communication to foster a culture of accountability and transparency.

Frequently Asked Questions

What is the primary benefit of an accountable expense reimbursement plan?

An accountable expense reimbursement plan allows employees to be reimbursed for business-related expenses without being taxed on the reimbursement.

With an accountable expense reimbursement plan, employees can be reimbursed for business-related expenses without the hassle of tracking every little receipt. This can save both time and money for businesses, and it can also help to improve employee morale. A marketing plan for an end user involves developing a strategy to reach and engage with your target audience.

This can include creating content, running ads, and building relationships with influencers.

Who is eligible to participate in an accountable expense reimbursement plan?

All employees who incur eligible business expenses are generally eligible to participate in an accountable expense reimbursement plan.

What documentation is required to substantiate expenses under an accountable expense reimbursement plan?

Employees must provide receipts, invoices, or other documentation to support the expenses they claim for reimbursement.

What are the consequences of failing to meet accountability requirements under an accountable expense reimbursement plan?

Failing to meet accountability requirements can result in the employee being taxed on the reimbursed expenses and the employer facing penalties.