Adding a partner to an existing business uk – Considering adding a partner to your existing UK business? This guide provides a comprehensive overview of the legal, financial, and practical considerations involved in this important decision. From legal requirements to conflict resolution, we’ll cover everything you need to know to navigate this process successfully.

Legal Considerations

In the United Kingdom, adding a partner to an existing business involves various legal considerations. Understanding these requirements and potential implications is crucial for business owners.

If you’re thinking about adding a partner to your existing business in the UK, it’s important to do your research. You’ll need to make sure that you’re compatible with each other and that you have a clear understanding of your roles and responsibilities.

You should also consider how you will handle disputes and how you will divide the profits. Once you’ve done your research, you can start the process of adding a partner to your business. This can be a complex process, so it’s important to have a lawyer help you draft the necessary paperwork.

If you’re looking for more information on adding a partner to your business, you can check out this article . It provides a step-by-step guide to the process and includes helpful tips and advice. Once you’ve added a partner to your business, you’ll need to work together to build a successful future.

It is essential to ensure that the partnership agreement clearly Artikels the roles, responsibilities, and profit-sharing arrangements of each partner. This document should also address dispute resolution mechanisms and the process for adding or removing partners in the future.

Legal Documents

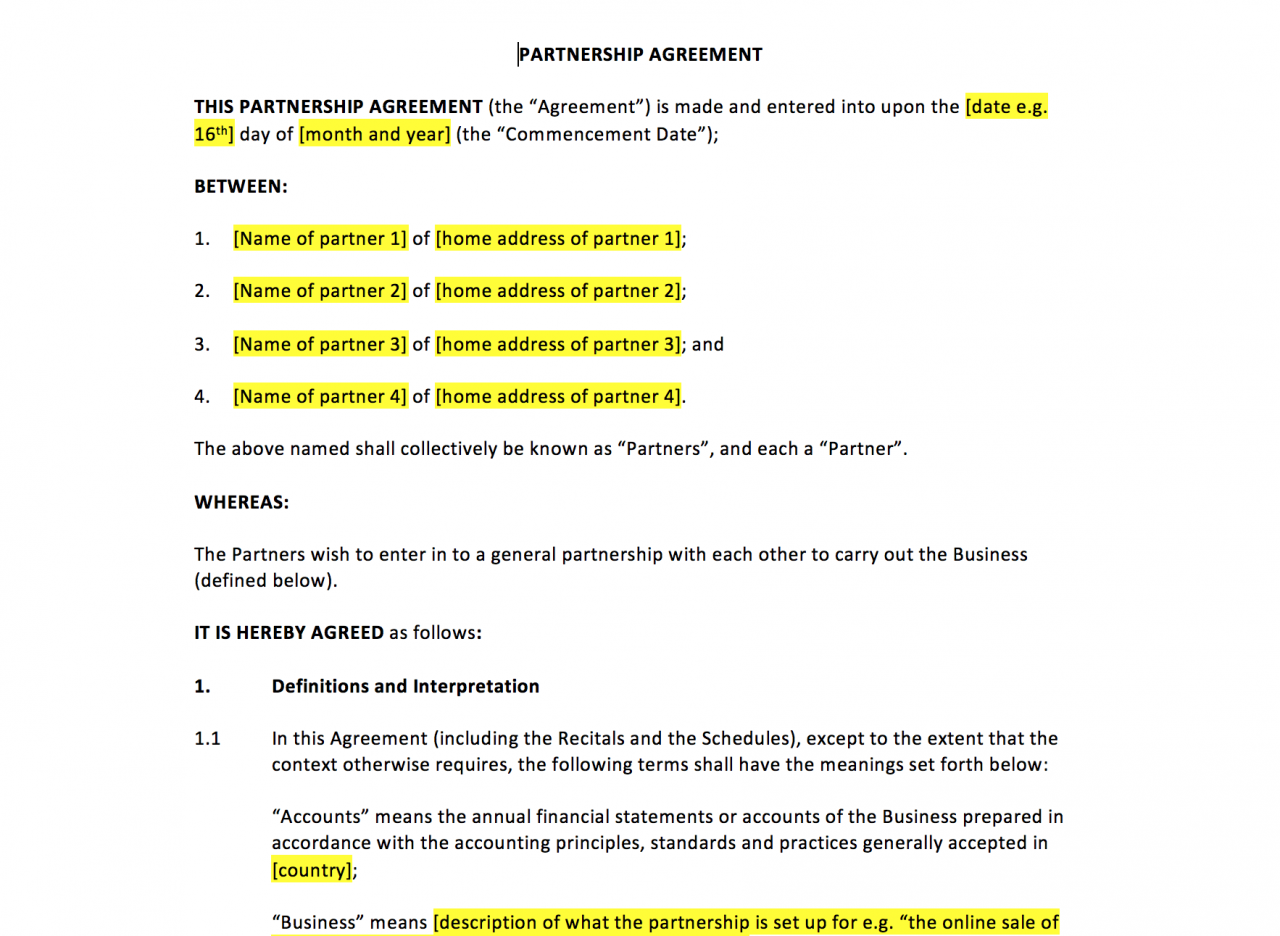

- Partnership Agreement: A comprehensive document outlining the terms and conditions of the partnership, including profit-sharing, decision-making, and dispute resolution.

- Business License: If the business structure changes, it may require obtaining a new business license.

- Tax Registration: The addition of a partner may necessitate updating tax registrations and filings.

Potential Legal Implications

Adding a partner can have several legal implications, including:

- Liability: Partners are jointly and severally liable for the debts and obligations of the partnership.

- Decision-Making: The partnership agreement should clearly define the decision-making process and the level of authority each partner possesses.

- Dispute Resolution: A well-drafted partnership agreement should include mechanisms for resolving disputes among partners.

Conflict Resolution

Conflict is an inherent part of any business partnership. To ensure the smooth functioning and longevity of the partnership, it is crucial to establish a framework for resolving conflicts effectively.

Effective conflict management involves open and honest communication, active listening, and a willingness to compromise. It also requires a clear understanding of each partner’s roles and responsibilities, as well as their individual goals and interests.

Before adding a partner to your existing UK business, consider researching and discussing the potential benefits of utilizing technology to enhance your operations. For instance, you might want to explore whether can you track an android phone without an app . This knowledge can help you make informed decisions about how to improve efficiency and optimize your business strategy.

Strategies for Effective Conflict Management

- Establish clear communication channels:Encourage open and honest communication between partners, both verbally and in writing.

- Practice active listening:Pay attention to what your partner is saying, both verbally and nonverbally, and strive to understand their perspective.

- Identify the root cause:Get to the heart of the conflict by exploring the underlying issues and motivations.

- Seek common ground:Focus on finding areas of agreement and shared interests to build a foundation for compromise.

- Be willing to compromise:Be prepared to negotiate and find solutions that meet the needs of both partners.

- Document agreements:Put any agreements reached in writing to avoid misunderstandings and ensure accountability.

Mediation and Dispute Resolution Mechanisms

In cases where conflicts cannot be resolved through direct negotiation, it may be necessary to seek external assistance.

- Mediation:A neutral third party facilitates a discussion between the partners to help them reach a mutually acceptable solution.

- Arbitration:A binding decision is made by an impartial arbitrator after hearing both sides of the conflict.

- Litigation:As a last resort, partners may choose to resolve their conflict through the court system.

The choice of dispute resolution mechanism depends on the nature of the conflict, the willingness of the partners to compromise, and the potential costs involved.

Business Plan Revision

When a partner joins an existing business, it’s crucial to revise the business plan to reflect the new structure and responsibilities. This ensures alignment and clarity for all parties involved.

The revised business plan should address key elements, including:

Roles and Responsibilities

- Clearly define the roles and responsibilities of each partner, including their areas of expertise and decision-making authority.

- Establish a clear chain of command to avoid confusion and ensure efficient decision-making.

Financial Structure

- Update the financial projections to reflect the additional capital and expenses associated with the new partner.

- Determine how profits and losses will be distributed among the partners.

Exit Strategy

- Review and update the exit strategy to account for the addition of a new partner.

- Consider factors such as the valuation of the business, the distribution of assets, and the potential for future disputes.

Template for Revised Business Plan

A revised business plan should typically include the following sections:

- Executive Summary

- Market Analysis

- Company Description

- Products and Services

- Marketing and Sales

- Operations

- Management Team

- Financial Projections

- Exit Strategy

Communication Strategy

Effective communication is paramount when adding a new partner to an existing business. A well-defined communication strategy ensures that all parties are on the same page, reducing misunderstandings and fostering a cohesive working environment.

When you’re considering adding a partner to your existing business in the UK, it’s important to do your research. Just like you can’t connect an android phone to apple tv , not all partnerships are a good fit. Make sure you take the time to find a partner who shares your vision and values, and who has the skills and experience to help you grow your business.

Establish clear channels of communication, such as regular meetings, email, and instant messaging, to facilitate open and transparent dialogue. Encourage active listening, respectful communication, and regular check-ins to address any concerns or questions promptly.

Regular Check-ins

Schedule regular check-ins, such as weekly or bi-weekly meetings, to discuss progress, address issues, and make decisions collectively. These meetings provide a structured platform for open communication and ensure that all partners are kept informed.

Open and Transparent Communication

Foster an environment of open and transparent communication where all partners feel comfortable sharing their ideas, concerns, and suggestions. Encourage active participation in discussions and decision-making processes to promote a sense of ownership and accountability.

When you’re adding a partner to an existing business in the UK, there are a lot of things to consider. From the legal implications to the tax consequences, it’s important to make sure you do your research before you take the plunge.

If you’re not sure where to start, there are plenty of resources available online, including this helpful guide on can’t download an app on android . Once you’ve done your research, you’ll be able to make an informed decision about whether or not adding a partner is the right move for your business.

Tax Implications

Adding a partner to an existing business can have significant tax implications. It’s crucial to understand these implications to make informed decisions and avoid potential tax liabilities.

There are several tax structures available to partnerships, each with its own advantages and disadvantages. The most common types include:

General Partnerships

- Partnerships are not recognized as separate legal entities for tax purposes.

- Income and losses are passed through to the individual partners and reported on their personal tax returns.

- Partnerships are not subject to corporate income tax, but partners may be liable for self-employment taxes.

Limited Partnerships

- Limited partnerships have two types of partners: general partners and limited partners.

- General partners have unlimited liability and are responsible for managing the partnership.

- Limited partners have limited liability and are only responsible for the amount of capital they invest.

- Limited partnerships are taxed as pass-through entities, with income and losses passed through to the individual partners.

Limited Liability Partnerships

- Limited liability partnerships (LLPs) offer the same liability protection as limited partnerships.

- However, LLPs are taxed as partnerships, with income and losses passed through to the individual partners.

- LLPs are often used by professionals such as lawyers and accountants.

The choice of tax structure depends on several factors, including the number of partners, the level of liability desired, and the business’s income and expenses.

In addition to choosing a tax structure, it’s also important to be aware of the tax reporting requirements for partnerships. Partnerships are required to file an annual partnership return (Form 1065) with the IRS.

The Form 1065 reports the partnership’s income, deductions, and losses. The partners then use this information to prepare their individual tax returns.

Understanding the tax implications of adding a partner to an existing business is crucial for making informed decisions and avoiding potential tax liabilities. It’s recommended to consult with a tax professional to determine the best tax structure and reporting requirements for your specific situation.

Risk Assessment

Introducing a partner to an existing business involves evaluating potential risks. A comprehensive risk assessment helps identify and address these risks proactively.

The risk assessment should consider factors such as the partner’s experience, financial stability, compatibility with the existing team, and potential conflicts of interest.

Before you add a partner to your existing business in the UK, make sure you have all your ducks in a row. It’s important to have a clear understanding of your business goals, as well as the roles and responsibilities of each partner.

You may also want to consider recording phone calls with potential partners to document your conversations. Once you’ve done your due diligence, you can move forward with confidence, knowing that you’ve taken the necessary steps to protect your business.

Risk Mitigation Strategies

- Background Checks:Conducting thorough background checks on potential partners can provide insights into their financial history, legal compliance, and overall reliability.

- Partnership Agreement:A well-drafted partnership agreement clearly Artikels the roles, responsibilities, and profit-sharing arrangements, reducing the likelihood of future disputes.

- Communication and Transparency:Establishing open communication channels and promoting transparency can help prevent misunderstandings and foster trust among partners.

Importance of Ongoing Risk Management, Adding a partner to an existing business uk

Risk management is an ongoing process that should be continuously reviewed and updated. Regularly monitoring risks allows businesses to identify and address emerging threats or changes in circumstances.

By conducting a thorough risk assessment and implementing effective mitigation strategies, businesses can minimize potential risks and enhance the chances of a successful partnership.

Adding a partner to an existing business in the UK can be a great way to bring in new skills and perspectives. Before you do, though, it’s important to make sure that you’re on the same page about everything from your business goals to your communication styles.

If you’re not sure how to start the conversation, can you video chat between an iPhone and an Android ? That could be a great way to get to know each other better and start building a strong foundation for your partnership.

Exit Strategy

An exit strategy Artikels the procedures for a partner to leave the partnership. It’s crucial to establish this plan early on to avoid disputes and ensure a smooth transition in case of unforeseen circumstances.

Legal and financial considerations include determining the value of the partner’s share, addressing tax implications, and ensuring compliance with partnership agreements.

Bringing on a new partner in a UK business can be a major decision. It’s important to consider the potential benefits and risks, as well as the legal and financial implications. If you’re looking for more information on this topic, you can check out this article: Can you listen to podcasts on an Android phone . Additionally, it’s worth consulting with an accountant or lawyer to ensure that you’re making the best decision for your business.

Negotiating and Documenting an Exit Strategy

- Clearly define the conditions for a partner’s exit, such as retirement, disability, or breach of contract.

- Establish a formula or process for determining the value of the partner’s share, considering factors like assets, liabilities, and goodwill.

- Specify the payment terms and timeline for the buyout.

- Include provisions for non-compete agreements and post-exit obligations.

- Document the exit strategy in a written agreement that is signed by all partners.

Case Studies

To provide concrete examples of successful partnerships that have added a partner, let’s examine a few case studies and analyze the factors that contributed to their success.

Case Study: Apple Inc.

- Factor: Complementary Skills:Steve Jobs and Steve Wozniak brought different but complementary skills to the partnership, with Jobs focusing on marketing and Wozniak on engineering.

- Factor: Shared Vision:Both partners shared a common vision for creating innovative technology products.

- Factor: Trust and Respect:Jobs and Wozniak had a strong bond built on trust and respect, which allowed them to navigate challenges together.

Case Study: Nike Inc.

- Factor: Shared Values:Phil Knight and Bill Bowerman shared a passion for running and a belief in the power of sports.

- Factor: Clear Roles and Responsibilities:Knight focused on marketing and sales, while Bowerman specialized in product development.

- Factor: Open Communication:Knight and Bowerman maintained open and honest communication, which fostered a collaborative and supportive environment.

Lessons Learned

- Identify and leverage complementary skills to create a balanced partnership.

- Ensure a shared vision and common goals to align efforts and avoid conflicts.

- Build a foundation of trust, respect, and open communication to foster collaboration and resilience.

Closing Notes: Adding A Partner To An Existing Business Uk

Adding a partner to an existing business can be a transformative decision, but it’s crucial to approach it with a clear understanding of the legal, financial, and operational implications. By carefully considering the factors Artikeld in this guide, you can increase your chances of a successful partnership that drives your business to new heights.

Q&A

What are the legal requirements for adding a partner to an existing business in the UK?

You’ll need to register the partnership with Companies House, create a partnership agreement, and obtain any necessary licenses or permits.

How do I determine the appropriate equity split between partners?

Consider factors such as each partner’s capital contribution, experience, and role in the business.

What are the tax implications of adding a partner?

Partnerships are taxed as pass-through entities, meaning that the profits and losses are passed through to the individual partners and reported on their personal tax returns.