A corporation that has an automatic reinvestment plan (ARP) offers a convenient and effective way to invest for the long term. ARPs allow investors to automatically reinvest their dividends and capital gains back into the same or a different investment, potentially boosting their returns over time.

In this comprehensive guide, we will delve into the ins and outs of ARPs, exploring their benefits, drawbacks, and how to optimize their performance.

Whether you’re a seasoned investor or just starting out, understanding ARPs can help you make informed decisions about your financial future. So, buckle up and let’s dive into the world of automatic reinvestment plans!

A corporation that has an automatic reinvestment plan can take advantage of compounding interest to grow their wealth over time. Just like a company needs to design an AWS disaster recovery plan to protect its data and applications, a corporation should also have a plan in place to protect its financial investments.

By automatically reinvesting dividends and capital gains, a corporation can ensure that its wealth continues to grow, even during market downturns. This can help the corporation to achieve its long-term financial goals, such as funding new projects or providing for employee retirement.

Overview of Automatic Reinvestment Plans (ARPs)

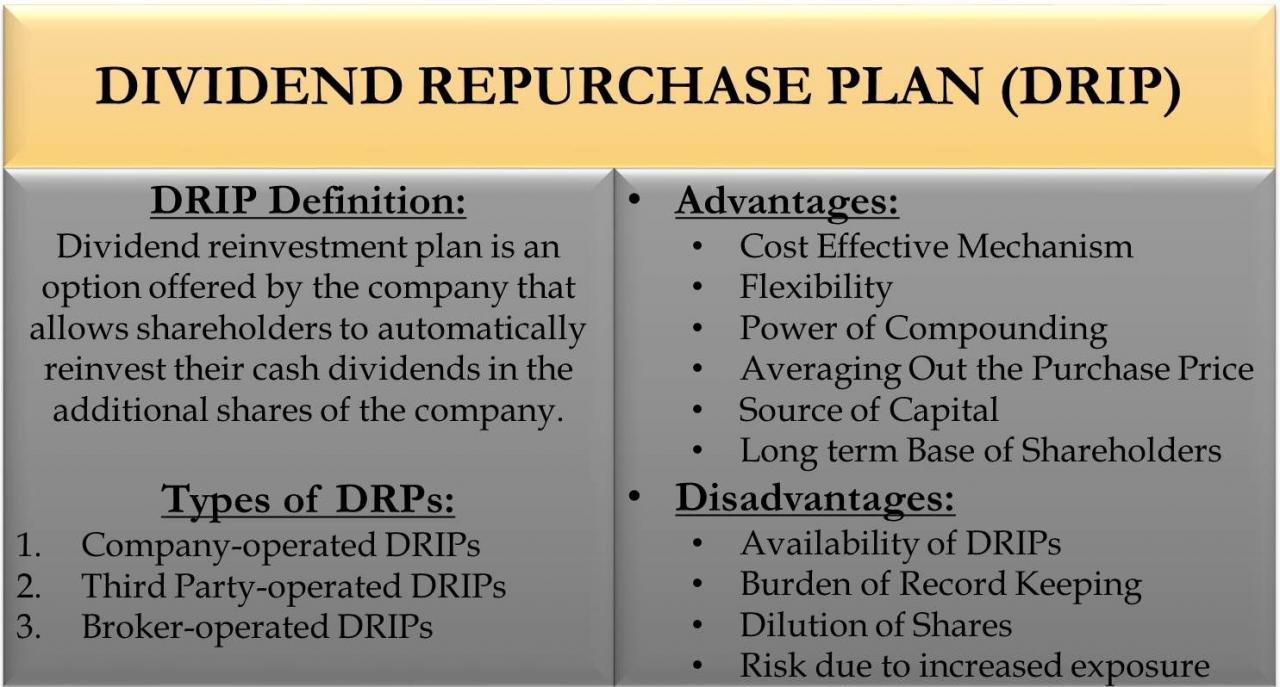

Automatic Reinvestment Plans (ARPs) are investment programs that allow investors to automatically reinvest their dividends and capital gains into additional shares of the same investment. These plans are popular among investors who want to grow their wealth over time without having to manually reinvest their earnings.

A corporation with an automatic reinvestment plan can benefit from regular monitoring to ensure its effectiveness. There are various ways to do this, including setting clear goals, establishing regular reporting intervals, conducting performance reviews, and tracking key performance indicators (KPIs).

Here are four ways to monitor an action plan that can help a corporation with an automatic reinvestment plan stay on track and achieve its objectives.

ARPs work by automatically purchasing additional shares of the investment whenever the investor receives a dividend or capital gain. This means that investors can benefit from compound interest, as the earnings from their investments are reinvested and grow over time.

Benefits of ARPs

- Convenience: ARPs automate the reinvestment process, saving investors time and effort.

- Compound interest: ARPs allow investors to benefit from compound interest, as their earnings are automatically reinvested and grow over time.

- Dollar-cost averaging: ARPs help investors dollar-cost average their investments, which can reduce risk and improve returns over time.

Drawbacks of ARPs

- Taxes: ARPs can trigger capital gains taxes when dividends and capital gains are reinvested.

- Fees: Some ARPs may charge fees for enrollment or ongoing management.

- Lack of flexibility: ARPs are typically inflexible, and investors may not be able to withdraw their funds without paying penalties.

Eligibility and Implementation of ARPs: A Corporation That Has An Automatic Reinvestment Plan

Most investment accounts are eligible for ARPs, including brokerage accounts, mutual funds, and exchange-traded funds (ETFs). To enroll in an ARP, investors typically need to contact their investment provider and provide instructions on how they want their dividends and capital gains to be reinvested.

There are different types of investments that can be included in ARPs, including stocks, bonds, and mutual funds. Some ARPs allow investors to choose which investments they want to reinvest their earnings in, while others automatically reinvest earnings into the same investment.

Corporations with automatic reinvestment plans are like 5G for your money: they keep growing and growing. Just like the 5G for Europe action plan aims to boost the European economy, these plans can help you boost your financial future. So, if you’re looking for a way to make your money work harder, consider a corporation with an automatic reinvestment plan.

Tax Implications of ARPs

ARPs can have tax implications for investors. Dividends and capital gains that are reinvested through an ARP are typically subject to capital gains taxes. However, there are some exceptions to this rule, such as qualified dividends and long-term capital gains.

Like a corporation with an automatic reinvestment plan, unmarried couples should consider creating an estate plan to ensure their assets are distributed according to their wishes. Check out 4 tips why unmarried couples need an estate plan to learn why it’s crucial to have a plan in place, even if you’re not married.

Doing so can help protect your assets and provide peace of mind, much like an automatic reinvestment plan safeguards a corporation’s financial future.

Investors should consult with a tax professional to determine how ARPs will affect their tax liability.

Yo, check this out! A corporation that’s got an automatic reinvestment plan is like a boss on autopilot, always making your money work harder. But if you’re not killing it on social media, you’re missing out big time. So, hit up this guide on 7 steps for an effective social media marketing plan . It’s like the cheat code to crushing it online.

With these steps, you’ll be a social media ninja in no time, boosting your brand and making that reinvestment plan work even harder for you!

Tax Advantages of ARPs

- Qualified dividends: Dividends that meet certain requirements are taxed at a lower rate than ordinary income.

- Long-term capital gains: Capital gains that are held for more than one year are taxed at a lower rate than ordinary income.

Tax Disadvantages of ARPs

- Short-term capital gains: Capital gains that are held for less than one year are taxed at the same rate as ordinary income.

- State taxes: Some states may impose additional taxes on dividends and capital gains.

Performance and Monitoring of ARPs

The performance of ARPs is affected by a number of factors, including the performance of the underlying investment, the frequency of dividend payments, and the capital gains tax rate.

Investors should monitor the performance of their ARPs regularly to ensure that they are meeting their investment goals. This can be done by tracking the value of the investment, the amount of dividends and capital gains that are reinvested, and the tax implications of the ARP.

Tips for Optimizing the Performance of ARPs

- Invest in high-quality investments: ARPs are most effective when they are used to invest in high-quality investments that are expected to grow in value over time.

- Reinvest dividends and capital gains regularly: The more frequently dividends and capital gains are reinvested, the greater the potential for compound interest.

- Minimize taxes: Investors should consult with a tax professional to minimize the tax implications of their ARPs.

Comparison of ARPs with Other Investment Strategies

ARPs are one of many investment strategies that investors can use to grow their wealth. Other popular investment strategies include mutual funds, exchange-traded funds (ETFs), and individual stocks and bonds.

Advantages of ARPs over Other Strategies, A corporation that has an automatic reinvestment plan

- Convenience: ARPs automate the reinvestment process, saving investors time and effort.

- Dollar-cost averaging: ARPs help investors dollar-cost average their investments, which can reduce risk and improve returns over time.

- Tax advantages: ARPs can provide tax advantages for investors who are investing in qualified dividends and long-term capital gains.

Disadvantages of ARPs over Other Strategies

- Fees: Some ARPs may charge fees for enrollment or ongoing management.

- Lack of flexibility: ARPs are typically inflexible, and investors may not be able to withdraw their funds without paying penalties.

- Limited investment options: Some ARPs may only allow investors to invest in a limited number of investments.

Conclusive Thoughts

In conclusion, ARPs can be a valuable tool for investors looking to simplify their investment strategy and potentially enhance their returns. By understanding the mechanics, tax implications, and performance factors associated with ARPs, you can make informed decisions about whether this investment strategy is right for you.

Remember to consult with a financial advisor to determine the best investment plan for your individual needs and goals.

So, embrace the power of automatic reinvestment plans and watch your investments grow over time. Happy investing!

Answers to Common Questions

What is the minimum investment required to participate in an ARP?

The minimum investment required varies depending on the corporation and the specific ARP. Some ARPs may have no minimum investment, while others may require a minimum of $100 or more.

Can I withdraw my investments from an ARP at any time?

Yes, you can typically withdraw your investments from an ARP at any time. However, there may be fees or penalties associated with early withdrawals.

How are taxes applied to ARPs?

ARPs are taxed as dividends. This means that you will pay taxes on the dividends you receive, even if you reinvest them. However, you may be able to defer paying taxes on the capital gains until you sell your investments.