An example of working capital is a crucial element in business operations, providing a snapshot of a company’s financial health and its ability to meet short-term obligations. Understanding working capital and its components is essential for businesses looking to optimize their financial performance and maintain long-term success.

An example of working capital is the difference between current assets and current liabilities. If you’re wondering am i authorized to work as an independent contractor , the answer may depend on your specific circumstances. Ultimately, an example of working capital is a measure of a company’s short-term financial health.

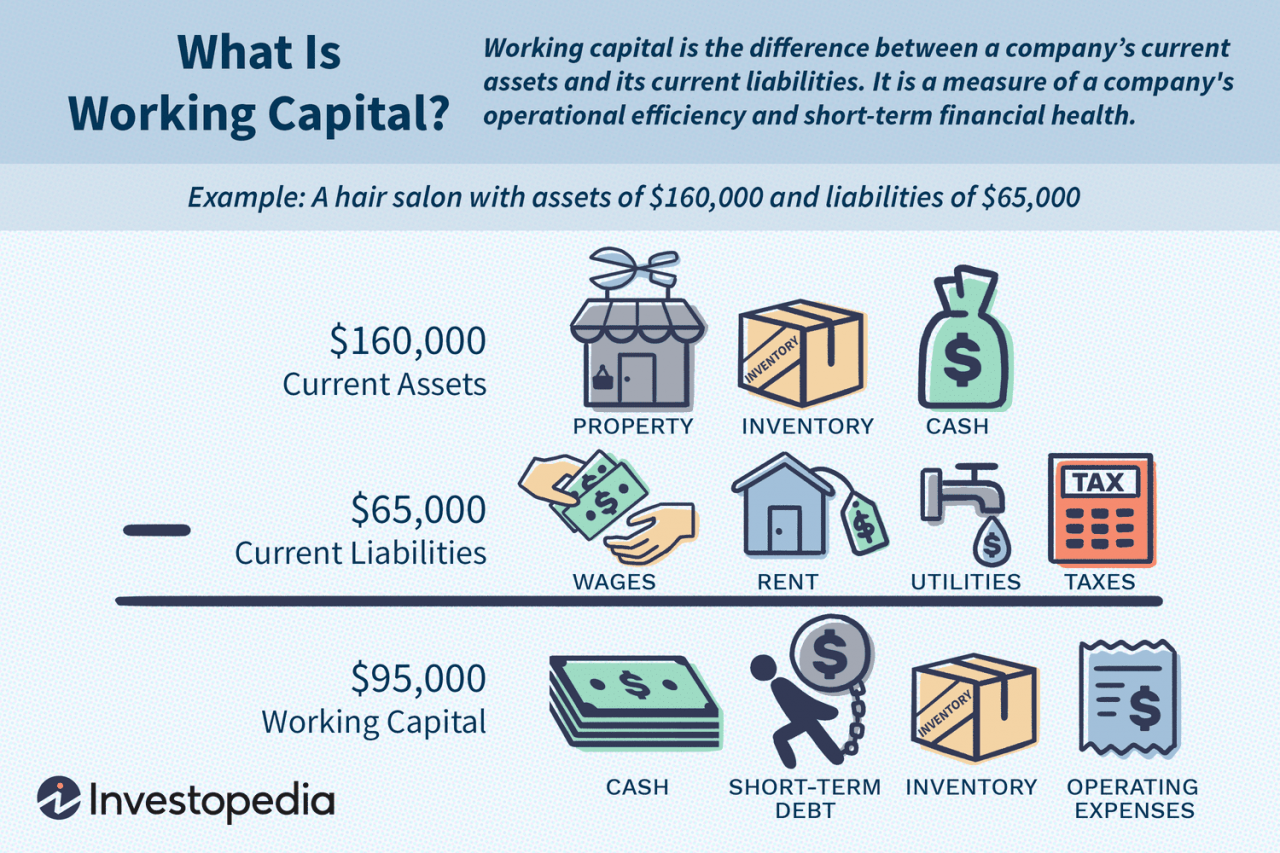

Working capital represents the difference between a company’s current assets and its current liabilities, giving insights into its liquidity and solvency. By analyzing working capital, businesses can assess their ability to cover short-term expenses, make informed investment decisions, and maintain a healthy cash flow.

An example of working capital is inventory. It’s the difference between your current assets and current liabilities. A safe work environment with adequate safeguards promotes an increase in productivity , which can lead to higher profits. This, in turn, can increase your working capital and make your business more financially stable.

Working Capital: The Lifeblood of Business Operations

In the fast-paced world of business, working capital is the oxygen that keeps companies breathing. It’s the lifeblood that fuels operations, allows for growth, and ensures financial stability. Working capital represents the difference between a company’s current assets and its current liabilities.

One way to boost working capital is to reduce inventory costs. As the epigram goes , “The harder you work, the luckier you get.” The same applies to managing working capital. By putting in the effort to optimize inventory levels, businesses can free up cash flow and improve their financial position.

It’s a measure of the company’s short-term liquidity and ability to meet its immediate financial obligations.

Think of working capital like the money you have in your pocket or bank account that you can use to pay your bills, buy groceries, or invest in your future. For businesses, working capital is what they need to keep the lights on, pay their employees, and purchase inventory.

Working capital, like the cash you have in your wallet, is essential for any business. For instance, a counselor working in an AIDS-related case may need working capital to cover expenses such as travel, supplies, and rent.

It’s the foundation upon which all other financial decisions are made.

An example of working capital is the money a company has on hand to pay its bills. This is important for any business, but it’s especially critical for startups and small businesses. Just like a student is working in an optics lab needs a certain amount of money to buy equipment and supplies, a business needs working capital to cover its day-to-day expenses.

Without working capital, a business can’t operate smoothly and may even be forced to close its doors.

Components of Working Capital, An example of working capital is

Working capital is made up of three main components:

- Current Assets:These are assets that can be easily converted into cash within one year. They include cash, accounts receivable (money owed by customers), and inventory.

- Current Liabilities:These are debts that must be paid within one year. They include accounts payable (money owed to suppliers), short-term loans, and accrued expenses.

- Working Capital:This is the difference between current assets and current liabilities. A positive working capital indicates that the company has enough liquidity to meet its short-term obligations, while a negative working capital suggests financial strain.

Conclusive Thoughts: An Example Of Working Capital Is

In conclusion, an example of working capital is a valuable tool for businesses to monitor their financial well-being. Effective working capital management enables companies to maintain liquidity, optimize profitability, and position themselves for long-term growth. By understanding the concept of working capital and implementing strategies to manage it effectively, businesses can navigate the complexities of financial management and achieve sustainable success.

Quick FAQs

What is an example of working capital?

An example of working capital is the difference between a company’s current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable, short-term debt, and accrued expenses).

An example of working capital is the cash used to cover the day-to-day operating expenses of a business. Like a charge nurse working with an assistive personnel , the business needs to have enough working capital to cover its expenses and keep the business running smoothly.

Without sufficient working capital, a business may not be able to pay its employees, suppliers, or other creditors.

Why is working capital important?

An example of working capital is the difference between a company’s current assets and current liabilities. This can be used to measure a company’s financial health and liquidity. An agile supply chain strategy works best with a focus on customer demand and flexibility.

This can help companies to respond quickly to changes in the market and to improve their overall efficiency.

Working capital is important because it provides insights into a company’s liquidity and solvency. A positive working capital indicates that the company has sufficient resources to meet its short-term obligations, while a negative working capital may indicate financial distress.

How can I improve my working capital?

There are several strategies to improve working capital, such as optimizing inventory management, managing accounts receivable effectively, and negotiating favorable payment terms with suppliers.